Now we have a uniformly speculative thought with a conservative touch: take stock of industrial company Nordson (Nasdaq: NDSN), to earn income on the growth of his orders.

Growth potential and duration : eleven percent for 13 Months; nine percent a year for ten years. All excluding dividends.

Why stocks can go up: there is a demand for the company's products.

How do we act: we take at the moment 238,6 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

The company designs and manufactures coating equipment. According to the report, revenue is divided into two sectors:

- Clear solutions for the industry - fifty-five percent. Packaging equipment, paint application, lamination. The main users of the sector's products work in the industry, also in the production of consumer products - as a long shelf life, as well as perishable. The sector's operating margin is 18,2 % from its proceeds.

- Difficult technological decisions - forty-five percent. Electronic coating systems, liquid control devices and equipment for testing high-tech products. The main users of the sector's products are manufacturers of hard electronics. The sector's operating margin is 19,6 % from its proceeds.

According to the presentation of the company, by industry, its revenue is distributed as follows:

- Electronics - twenty-seven percent.

- Consumer products - twenty-six percent.

- Medicine - twenty-two percent.

- Industry - fourteen percent.

- Other Markets - 11%. Car manufacturing, long life products, delivery systems and veterinary products.

Revenue by product type:

- Consumables and spare parts — 57%.

- Equipment - 43%.

This is an important point, because it turns out, that more than half of the company's revenue is renewable revenue: let there be no subscription, but it comes out, that customers more or less regularly return to Nordson for the components they need to get the job done.

According to the report, geographically, the revenue is distributed as follows:

- USA - 35,62%.

- Other countries in the Americas — 6,66%.

- Europe - 25,29%.

- Japan - 5,73%.

- Other countries in the Asia-Pacific region - 26,7%.

Arguments in favor of the company

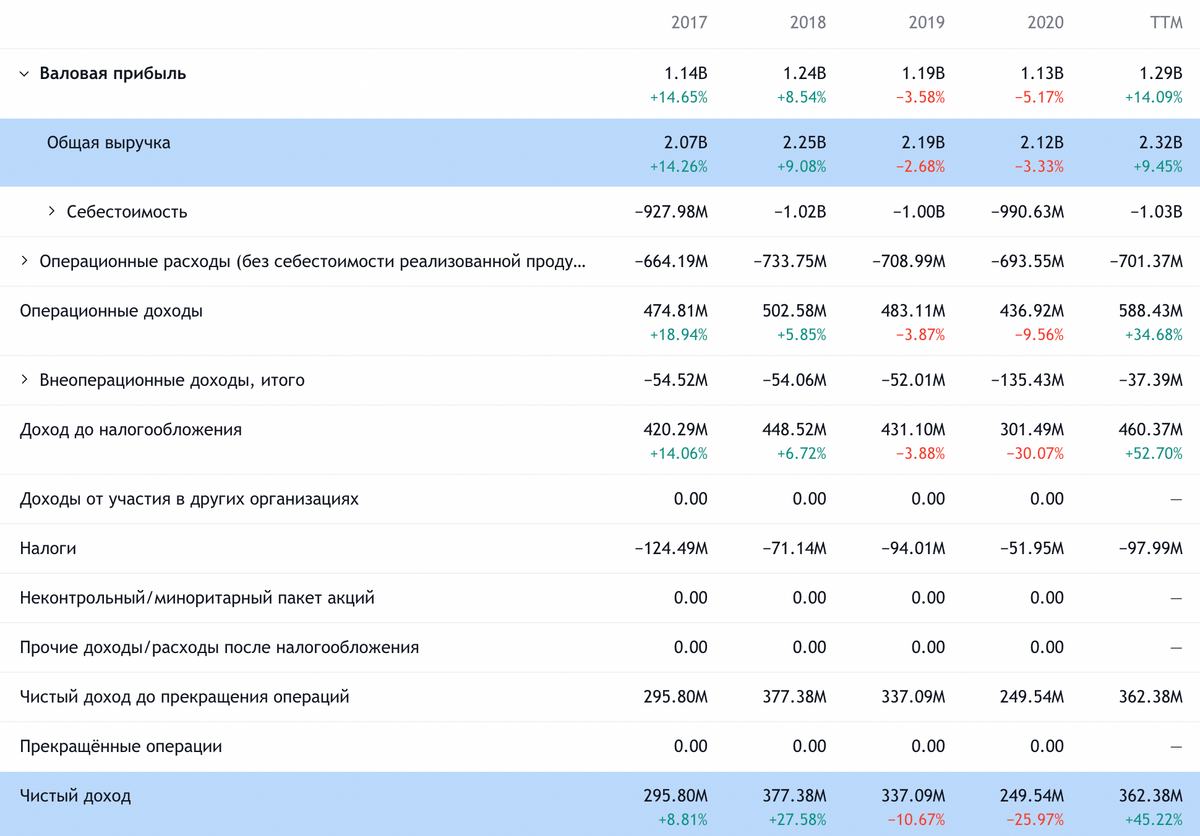

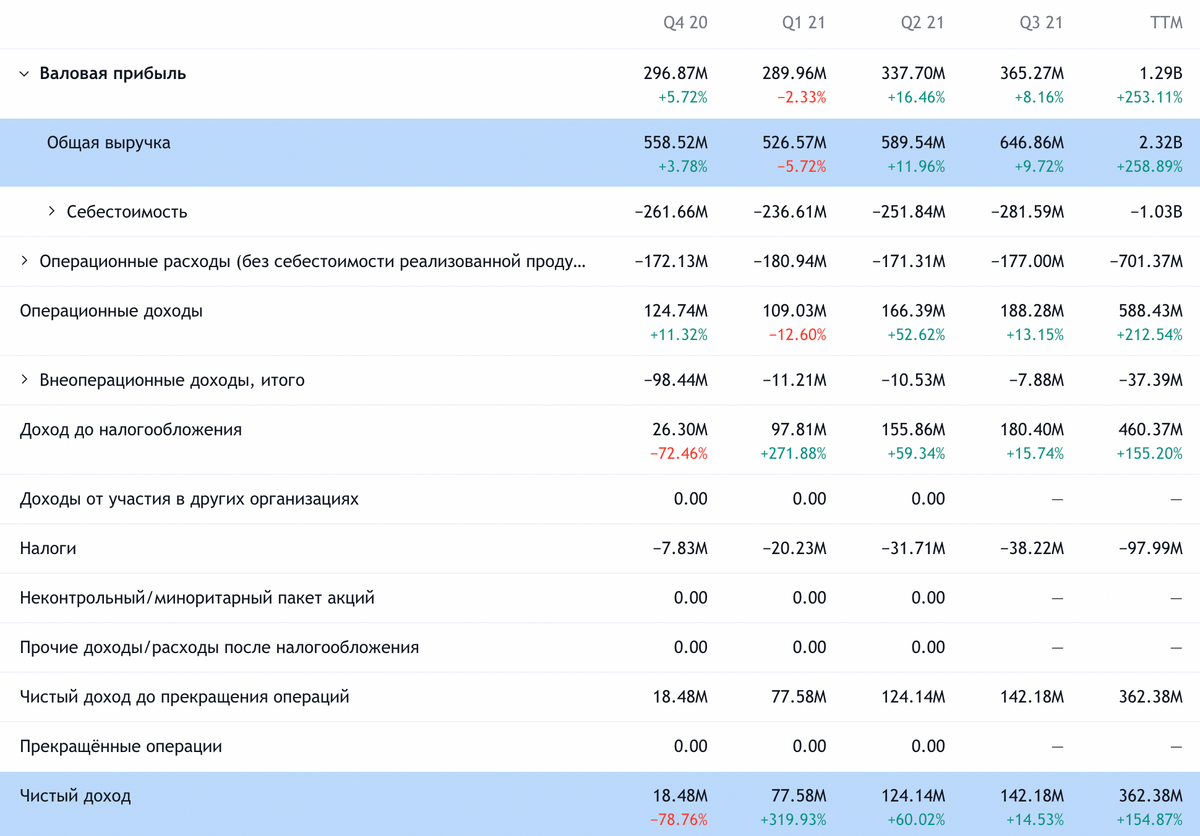

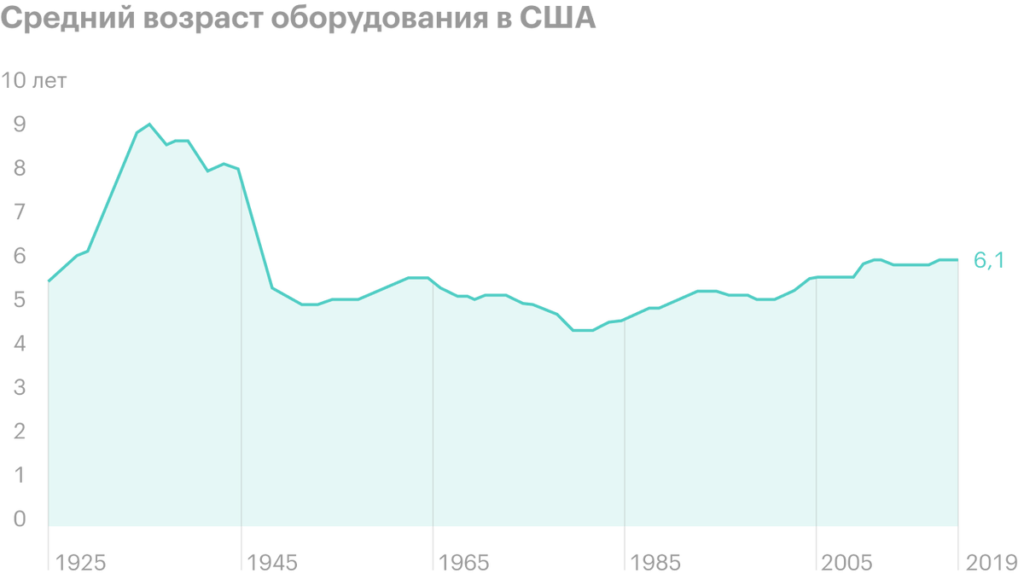

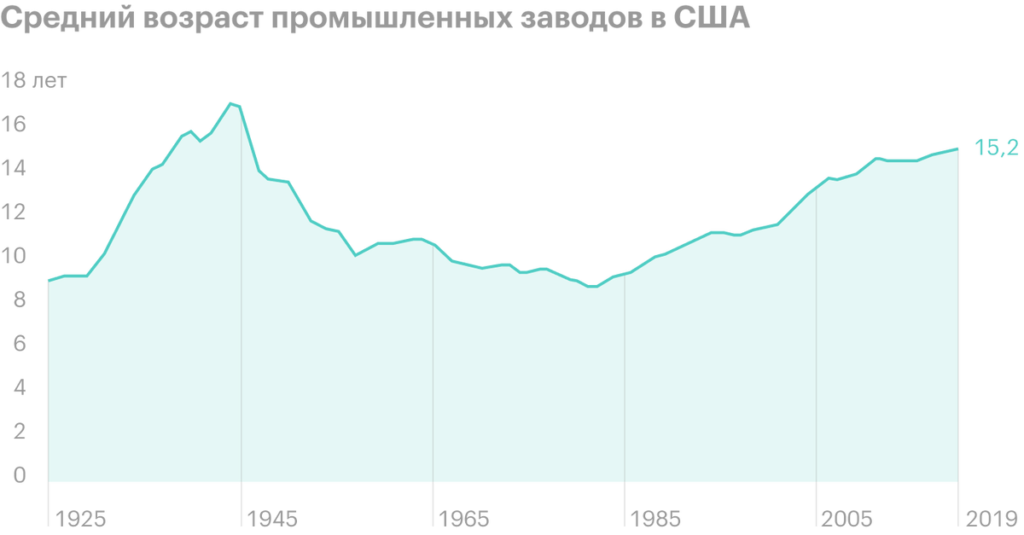

Memories of the future. In the idea for Keysight, we talked about the growth of industrial production in the world, as well as the plans of companies to increase investment in the renewal of fixed assets. Nordson should also be the beneficiary of this process.. Moreover, it is from companies that it is necessary to expect the greatest growth., which are spent on the modernization of enterprises. The average age of equipment and factories in the US is now at a very high level., so that investments in the renewal of production facilities will be fully justified. A direct confirmation of our correctness can be considered the recent good report of the company and the improvement of its forecasts for this year.

A little bit of everything for everyone. The company has a fairly diverse set of clients., what protects its business from the devastating effects of a decline in production in one of the segments. This is definitely a positive point., which will attract a lot of investors into the shares, seeking stability.

What can get in the way

Price. Company P / E 38,65, and its quotes rose by 73% over the past two years, but the company did not demonstrate commensurate progress in revenue and profit - therefore, it can be accused of overvaluation. The company survived the corona crisis without terrible losses, but quarantine does not bring anything good for her. If new strains lead to plant closures and this affects Nordson's reporting, then stocks may fall disproportionately due to investor hysteria.

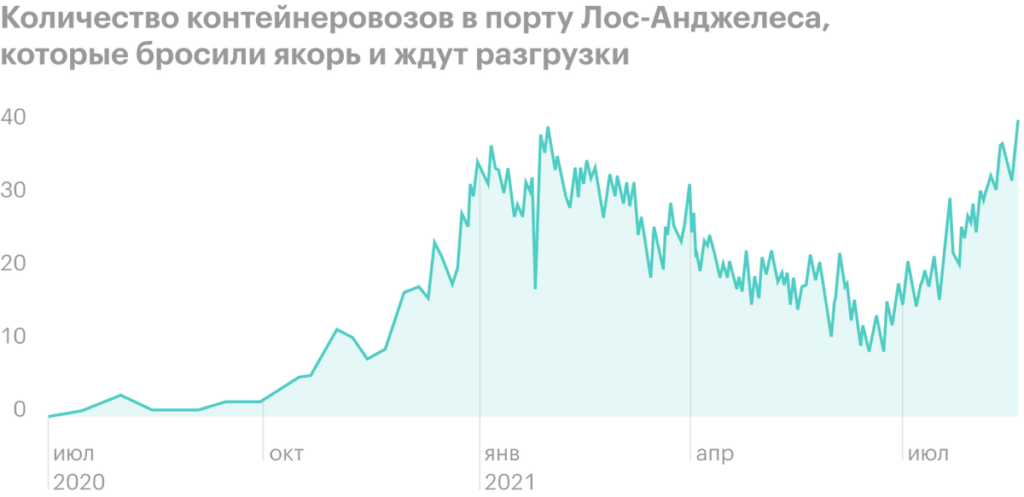

Logistics. Problems with logistics in the world in general and in the US in particular can have a very negative impact on the company's reporting: it is highly dependent on the speed of movement of its goods and their timely delivery. The same applies to components., which she uses in production. Their increased cost and late delivery can negatively affect the margins of Nordson's business..

Accounting. The company pays 2,04 $ dividends per share per year is about 0,85% per annum. It takes her 120,36 million dollars a year - about a third of its profits over the past 12 Months. According to the latest report, the company has approximately 1,5 billion dollars in arrears, out of which 420,822 million needs to be repaid within a year.

Basically, there is enough money at Nordson's disposal to cover urgent debts, and to pay dividends: 174,235 million in accounts and 516,685 mln of counterparties' debts. But still, the large amount of debt cannot but worry in the light of raising rates.. Yes, and payments can be cut due to some force majeure circumstances, and stocks may fall. On the other hand, I don't think, that investors will be very worried about the reduction of such dividends.

What's the bottom line?

We take shares now by 238,6 $. And then there are two options.:

- wait, when stocks exceed historic highs and are worth 265 $. Think, that we will wait for this level for the next 13 Months;

- keep shares next 10 years in sorrow and joy, To view, how the company will become the beneficiary of the renewal of fixed assets by American manufacturing enterprises.