Today we have a moderately speculative idea.: take shares of MKS Instruments (NASDAQ: MKSI), to capitalize on the industrial boom in the US and the world.

Growth potential and validity: 12% behind 12 months excluding dividends; 10% per year for 7 years including dividends.

Why stocks can go up: the world needs semiconductors, and in the US and other countries there is a demand for the company's products.

How do we act: we take shares now by 186,82 $.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

What the company makes money on

MKS Instruments makes goods and provides services in the industrial field. According to company report, its revenue structure is as follows.

Companies, working in the field of semiconductors, give 59% revenue MKS Instruments. This and those, who produces equipment for them, and they, who directly manufactures devices from semiconductors.

"Developed markets" give 41% company revenue. This is how the company calls customers from the field of industrial technology: printed circuit boards, glass coatings, laser marking, Research, as well as the defense sector.

The company has a good presentation, which shows, what kind of products it produces. More information can be found on the company's website..

By types of goods and services, revenue is distributed as follows.

Vacuum and analysis — 60,33%. These are pipe pressure control solutions, nutrition, operation of microwave radiation. 84,5% segment revenue comes from semiconductor companies, 15,5% — to developed markets. 86,4% segment revenues come from goods, 13,6% - services. Segment gross margin — 45,1% from its proceeds.

Light and movement — 29,98%. This is all, related to lasers and photonics, - here the company competes with II-VI. 24,4% segment revenue comes from semiconductor companies, 75,6% — to developed markets. 90,18% segment revenues come from goods, 9,82% - services. Segment gross margin — 44,9% from its proceeds.

Equipment and solutions — 9,69%. This segment includes all, what you need for the production of complex electronics. 12,6% segment revenue comes from semiconductor companies, 87,4% — to developed markets. 72,7% segment revenues come from goods, 27,3% - services. Segment gross margin — 45,2% from its proceeds.

Company sales by region

| USA | 45% |

| South Korea | 11,96% |

| China | 11,73% |

| European countries | 8,54% |

| Asian countries | 22,77% |

USA

45%

South Korea

11,96%

China

11,73%

European countries

8,54%

Asian countries

22,77%

Arguments in favor of the company

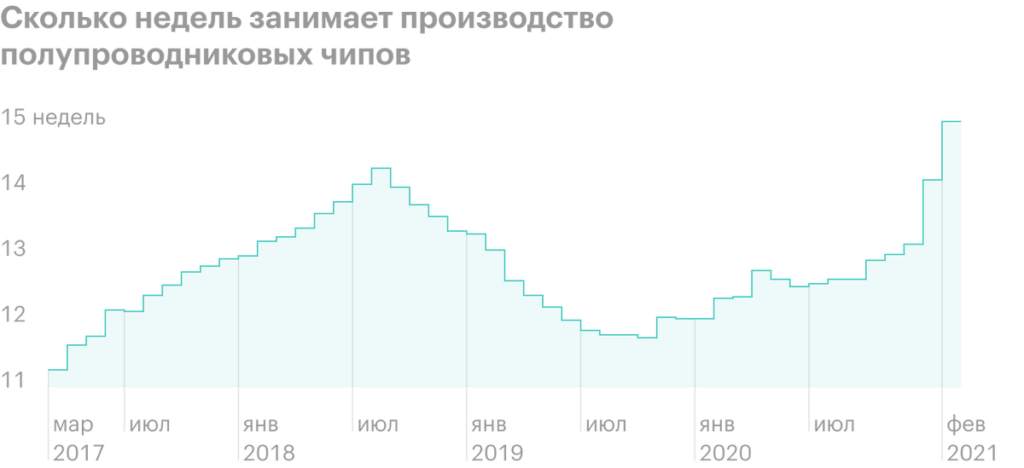

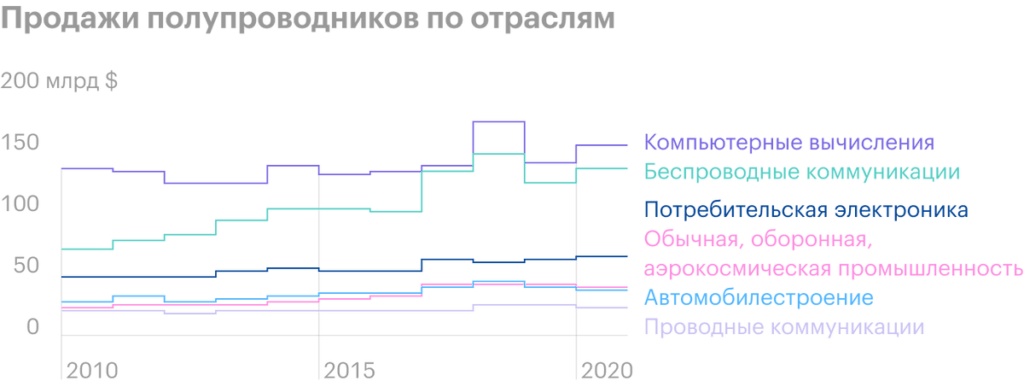

Semiconductors. Today there is a large shortage of semiconductors in the world, and because it is an important resource for the modern economy, we can expect MKS revenue growth in this segment.

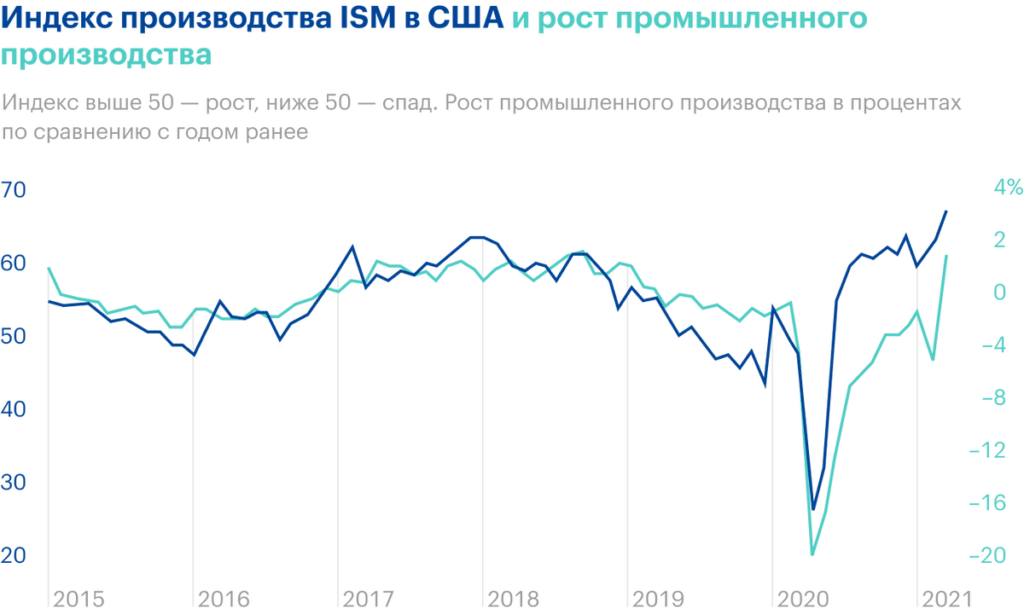

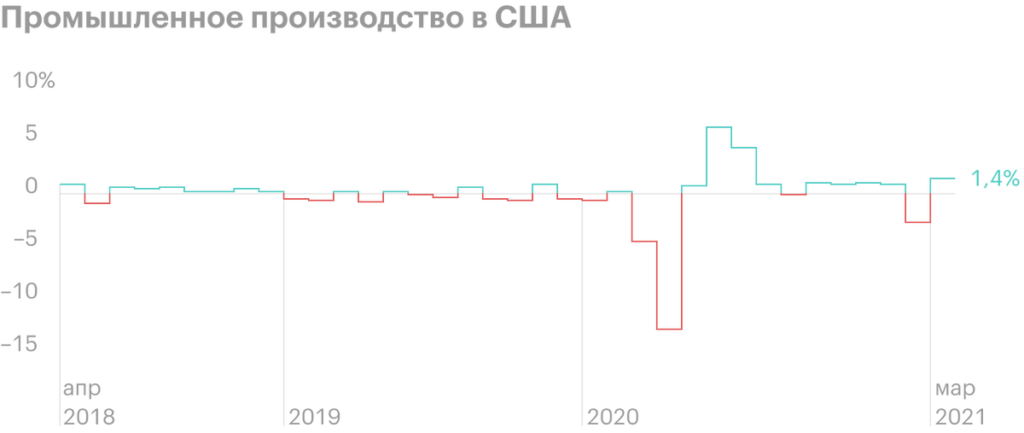

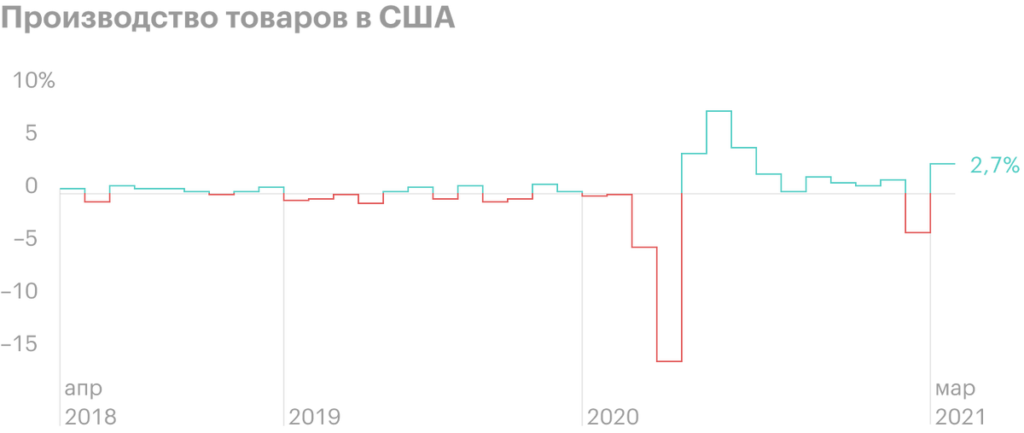

Industry is growing. Except semiconductors in the USA, and not only in the USA, growing industry, so we have every reason to hope, that MKS will have sales growth not only due to semiconductor companies, but also in a purely industrial direction.

Export orientation. Considering, that the company is an exporter: over half of sales are made outside the US, - the relative cheapness of the dollar is a plus for MKS.

Good farm. According to the main parameters, MKS is a successful, efficient and profitable business. The company does not have a very large P / E — 29,51, so, I think, There will still be a lot of investors in stocks, looking for "good", working businesses».

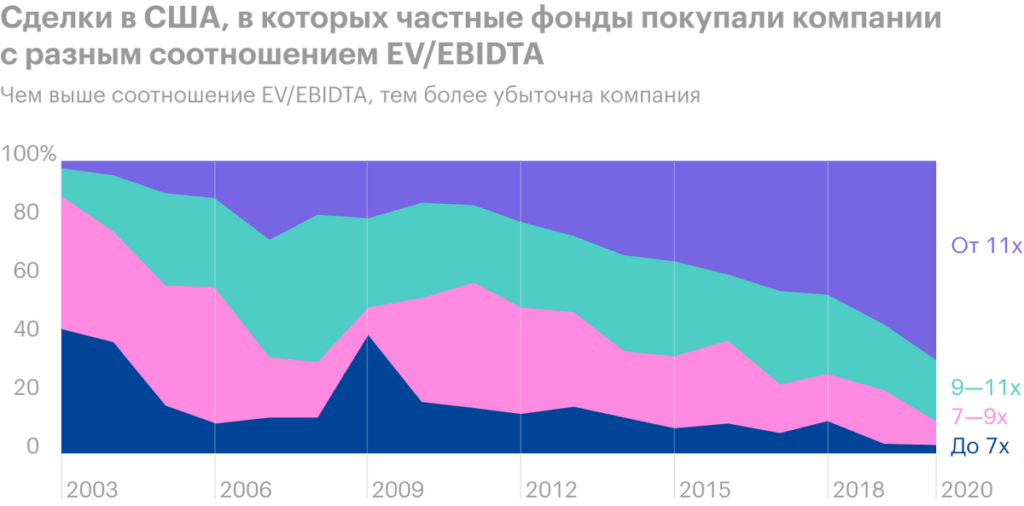

According to the same logic, a company can be bought - it may well be some kind of large private fund. In absolute terms, MKS is not so expensive: capitalization less than 10.4 billion dollars. Considering, that in the United States every year, funds buy hundreds of billions of dollars of companies at an inflated price, the chances of someone buying MKS are very high.

What can get in the way

Everything can go a little wrong. U.S. production figures for March were quite decent, but they were slightly below expectations: among other things, frosts affected. There is a small possibility, that MKS reporting for this period will not be so cool, as we would like.

This risk is very small, but it should be considered. For the past year, MKS has outperformed analysts in earnings per share., so it could turn out that way., that investors will be disappointed, why the shares will fall. Up to this point, MKS shares have been given a large credit of confidence.: quotes increased by 120%.

Customer concentration. According to the report, two largest customers account for too much revenue: 13,5% — of Lam Research and 10,6% — на Applied Materials. A change in relationship with one of them may adversely affect reporting.

Greedy people don't have enough. The company pays dividends 80 cents per share, which costs 44 million dollars a year, it is approximately 12,57% from the company's annual profit. The yield is very small 0,42% per annum, but there are definitely a lot of investors in stocks, who cling to these pennies.

If MKS cuts dividends for the noble purposes of investing in business expansion, then investors will start selling shares. Although, maybe, I overestimate their greed: The dividend yield on these stocks is very low., it is unlikely that people will be so worried about these pennies. But you should still keep this option in mind..

Earnings per share MKS

| Reality | Expectation | |

|---|---|---|

| 1 neighborhood 2020 | 1,54 $ | 1,24 $ |

| 2 neighborhood 2020 | 1,62 $ | 1,18 $ |

| 3 neighborhood 2020 | 1,93 $ | 1,78 $ |

| 4 neighborhood 2020 | 2,34 $ | 2,02 $ |

| 1 neighborhood 2021 | — | 2,21 $ |

Reality

1 neighborhood 2020

1,54 $

2 neighborhood 2020

1,62 $

3 neighborhood 2020

1,93 $

4 neighborhood 2020

2,34 $

1 neighborhood 2021

—

Expectation

1 neighborhood 2020

1,24 $

2 neighborhood 2020

1,18 $

3 neighborhood 2020

1,78 $

4 neighborhood 2020

2,02 $

1 neighborhood 2021

2,21 $

What's the bottom line?

26 April the company publishes a report for the quarter. In anticipation of this, I believe, that we can take shares now on 186,82 $, and then there are two options:

- wait, when stocks will overcome historical highs and will cost 210 $. Given all the strengths of the company and favorable market conditions, I would expect, that we will achieve what we want 12 Months;

- keep shares next 7 years. You can't be sure about this 100%, but it seems very likely, that the company during this period will be acquired by the previously mentioned II-VI, which grows due to the purchase of competitors. MKS is a good industrial asset, which will also allow II-VI to somewhat diversify their line of solutions.