Now we have a uniformly speculative thought: take stock of food manufacturer Lancaster Colony (Nasdaq: LANC), to earn income on their growth.

Growth potential and duration : eleven percent for 14 months excluding dividends; eight percent per annum for ten years, including dividends.

Why stocks can go up: the company's business is stable and pays above average returns on securities.

How do we act: we take at the moment 175,06 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

The name of the company sets up unnecessary associations with medieval England and imperialism, but in reality LANC is engaged in the creation and sale of food under its own brands. In accordance with the annual report, the company's revenue is divided into subsequent segments.

Retail - fifty-seven percent of the company's revenue. Products and services, which the company sells through retail chains. Distribution by types of goods as a percentage of the total revenue of the company:

- frozen bread - twenty-one percent;

- refueling, sauces and croutons - twenty-one percent;

- frozen dressings, sauces and other - fifteen percent.

The sector's operating margin is 22,7 % from its proceeds.

Catering - forty three percent. Products and services, which LANC sells to restaurants, also cafeterias at different companies. Distribution by type of product as a percentage of the total revenue of the company:

- dressings and sauces 32%;

- frozen bread and more 11%.

Segment operating margin — 14% from its proceeds.

The USA is doing 95% company revenue, the rest comes from unnamed other countries.

Arguments for Lancaster Colony

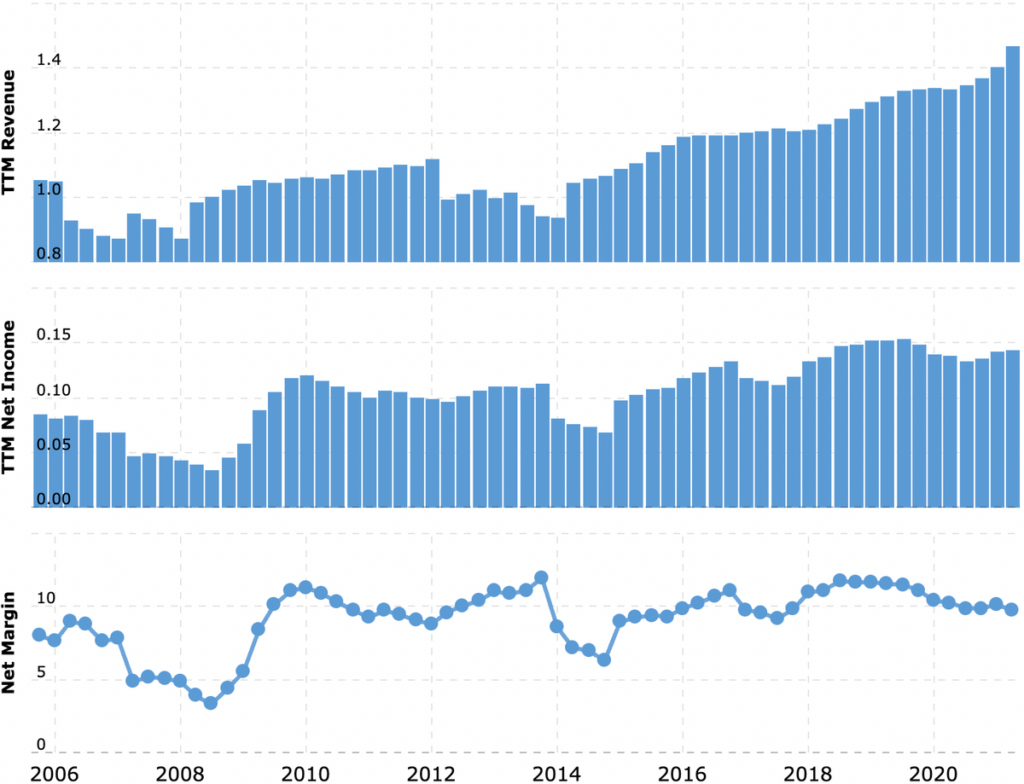

Sustainability. The flotilla is sailing so fast, how fast her slowest ship sails. Similarly, all company reporting may depend on the state of affairs in its most vulnerable segment.. In a terrible 2020 year, when catering establishments suffered more than all other types of establishments, sales of this LANC segment fell only by 5%, and operating profit by 7%. In general, the company's revenue even increased during the pandemic. And this is a good argument in favor of buying its shares..

In ideas about Flowers Foods and Hostess Brands, we wrote, that in conditions of constant instability, investors will look for reliable companies, to "sit out the bad times in them". LANC is great for this purpose.. Moreover, the company does not have a very large capitalization in 4,2 billion dollars, so the effect of the influx of investors will be significant.

This situation can also be projected into the future.: these shares can be held with an eye on the long term. The further, the more American stock market will be in a fever due to the influx of retail investors, and because of the greed of large institutional investors. In particular, this can happen due to pension funds, who may not fulfill their obligations, if they no longer take risks and speculate. Over the long haul, some investors will value shares of issuers like LANC more., showing stable business development. Increasing investment in stocks like LANC will somewhat offset the popularity of high-growth, but unprofitable technology companies.

Relatively not overrated. Since the start of the pandemic, stocks have risen by only 7%. Taking into account the merits of the company, it can be assumed, that there is still room to grow: as it turned out in the time of trials, LANC is a strong and profitable business.

Money should work! The company pays 3 $ dividends per share per year - approximately 1,71% per annum. It's bigger, than average in 1,32% on S&P 500. I do not think, what kind of profitability are people willing to commit crimes, but in combination with the evenness and stability of this business, dividends above the "hospital average" are an additional argument for investing in LANC. Especially from institutional investors, who are looking for assets in order to "park" their money in shares of a reliable business - so that the yield is acceptable, and there were prospects for growth in the value of the asset itself.

Gobsek likes it. According to the latest report, The company's total debt is approximately 258 million dollars, out of which 173,923 million needs to be repaid within a year. However, she has enough money at her disposal.: 188 million in accounts and 97,897 mln of counterparties' debts. In anticipation of the rate hike and the resulting increase in the cost of loans, investors will certainly appreciate the prudence of LANC management.

Can buy. LANC is a strong brand with a long history of business growth and strong performance. I think, that against this background, the company may well be bought. Its capitalization is not very large, a P / E is not transcendental - 33,91.

What can get in the way

Concentration. According to the annual report, two clients of the company generate a disproportionate amount of sales: 18% accounts for the Walmart retail network and 13% - to the supply company McLane, which is owned by Berkshire Hathaway.

You should also take into account the concentration of buyers by segments.: in the retail segment, the five largest buyers give 55% segment sales, and in public catering, the five largest customers give 61% selling. Changing relationships with one of the major clients may negatively affect reporting.

Cost growth. Rising costs of labor and agricultural products in the United States could negatively affect the company's bottom line. With agricultural products, the company is slightly helped by the current storm on the US East Coast: export ports closed, products cannot be sold abroad on time and have to be sold inside the United States at lower prices.

But it's not so easy for employees.. Employers' hopes, that the removal of generous additional "pandemic" payments for the unemployed in the United States will increase the supply of the labor market, failed. Employment growth in those states, where payments were canceled, about the same, like in those states, where payments have not been canceled. In other words, applicants have become very demanding and will have to be lured with large salaries and benefits, because, as Alexander II said in an advertisement for Imperial Bank, “You need to feed better - they won’t fly away”. Another challenge for LANC is rising logistics costs..

So LANC shareholders need to prepare mentally, that higher costs will affect reporting.

Harmful pennies. The company spends on paying dividends 84 million per year - 60% from its profits over the past 12 Months. In theory, dividends can cut: in 2022 In 2019, the company plans large investments in the region of 170-190 million dollars. But that's in theory, I think., that in the end the company, probably, will cost with borrowed money. But it will ruin her bookkeeping in the eyes of investors., although it will still be a lesser evil compared to cutting dividends.

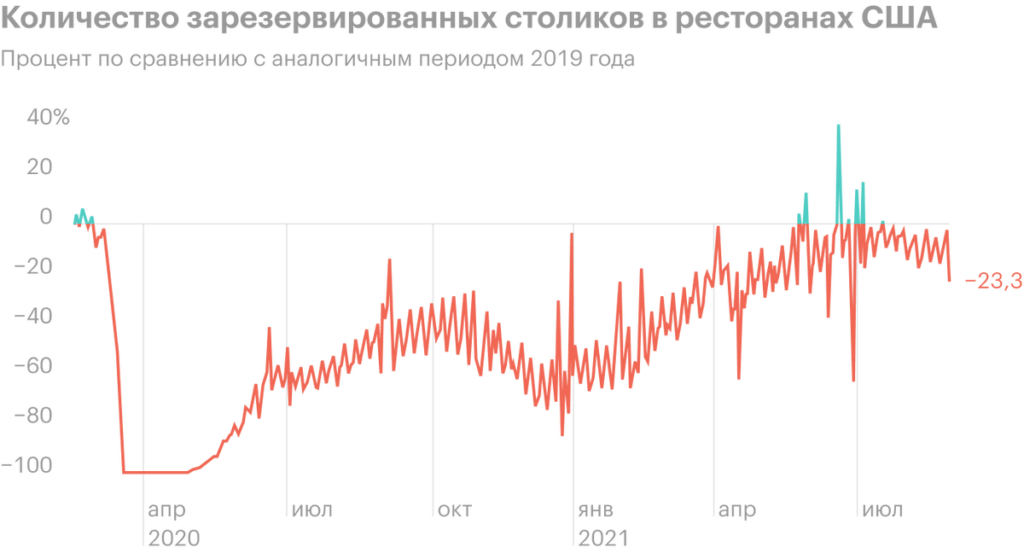

Diner without wheels. I would not hope for a strong improvement in the situation in the catering segment, as U.S. restaurant attendance rates began to fall again. On the other hand, even at such levels, the fullness of restaurants is now still higher, than for the same period 2020.

Relative high cost. P / E the company is still too big, when looking at the US food industry as a whole, where P / E usually in the range 20-22. So stocks can storm.

What's the bottom line?

Shares can be taken now for 175,06 $, and then there are two options:

- wait for the price 195 $ - this is slightly less than their historical maximum in July. Think, that we will reach this level in the next 14 Months;

- hold shares 10 years, watching their slow growth and receiving dividends, which will also grow with the profit of the company. This is for true conservatives..