Today we have a moderately speculative idea.: take shares of the supplier of equipment for the production of semiconductors KLA (NASDAQ: KLAC), to make money on the hype in this area.

Growth potential and validity: 13% behind 12 Months; 25% behind 1,5 of the year. All excluding dividends.

Why stocks can go up: semiconductor shortages won't disappear just like that.

How do we act: we take shares now by 318,92 $.

The idea was proposed by our reader Dmitry Nazimov in the comments to the analysis of Renewable Energy Group. Suggest your ideas in the comments.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

What the company makes money on

The company supplies equipment for the production of semiconductors. She doesn't make it herself.: KLA's job is to design, assembly and testing of equipment, and third-party companies are engaged in the production of components. The company also provides technical support and maintenance services for its customers..

The company's report is full of tedious technical details., but he gives us the main information. The company's revenue is divided into two segments: products - 75% proceeds, services - 25% proceeds.

Types of KLA products by purpose

| Checking the plates | 36% |

| Patterning | 22% |

| PCB Inspection, displays and components | 9% |

| Specialized Processes for Semiconductors | 5% |

| Other | 3% |

Checking the plates

36%

Patterning

22%

PCB Inspection, displays and components

9%

Specialized Processes for Semiconductors

5%

Other

3%

Revenue by country and region

| Taiwan | 27% |

| China | 25% |

| South Korea | 17% |

| Japan | 12% |

| USA | 11% |

| Europe and Israel | 5% |

| Asian countries, except for the above | 3% |

Taiwan

27%

China

25%

South Korea

17%

Japan

12%

USA

11%

Europe and Israel

5%

Asian countries, except for the above

3%

Arguments in favor of the company

Looking for the police, looking for firefighters. Ideas on Avnet and MKS Instruments share almost three months, but the situation with semiconductors has not changed at all. Even so - she got even worse: there are not enough chips for everyone. And what's more, all this should last at least until next year, maybe, and longer: to build a factory and start a workflow for the production of semiconductor components, usually takes several years. That is, in a few months and even in six months or a year, at the current level of demand, the lack of supply in the market cannot be filled.

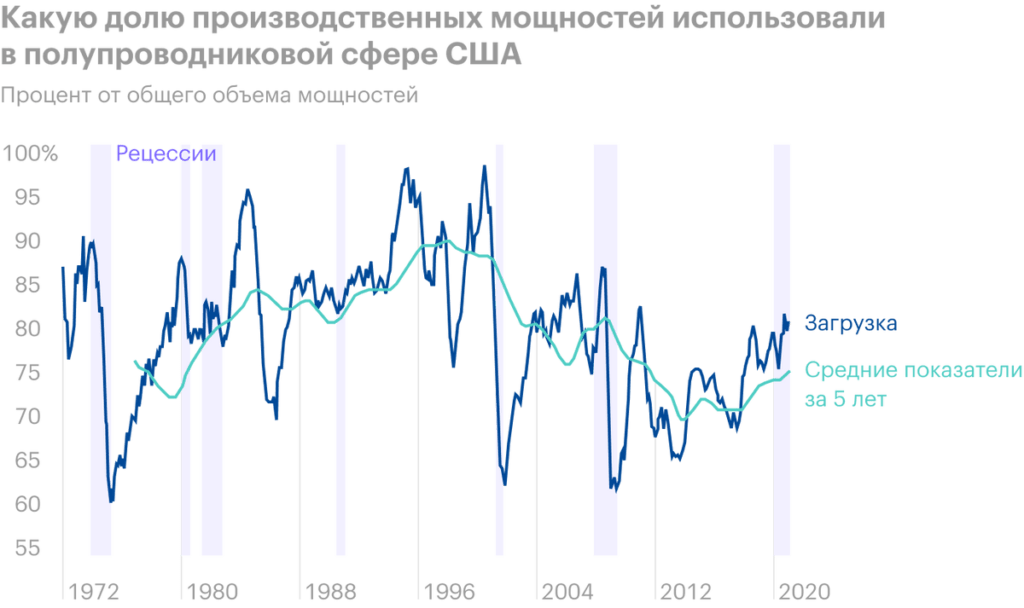

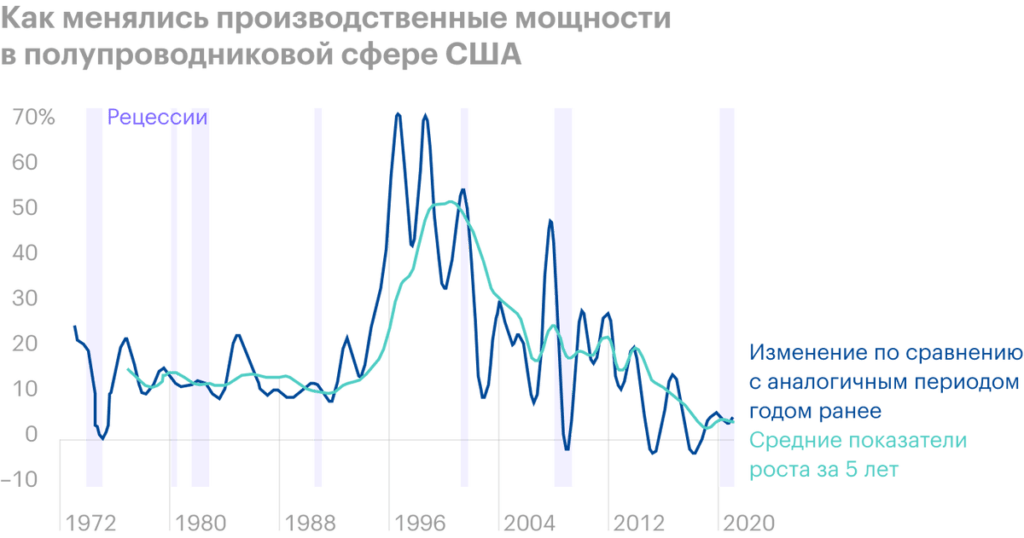

Under these conditions, KLA will be able to make good money, for it is quite obvious, that there is a great demand for its products and services. Still, the capacity utilization in the semiconductor industry tends to multi-year highs., and the semiconductor companies themselves have always been distinguished by a huge level of spending on R&D and updating fixed assets - more 20% from collective revenue for each expense category. Given the high demand for their products, we can expect, that they will plan large investments, and this practically guarantees the growth of KLA revenue.

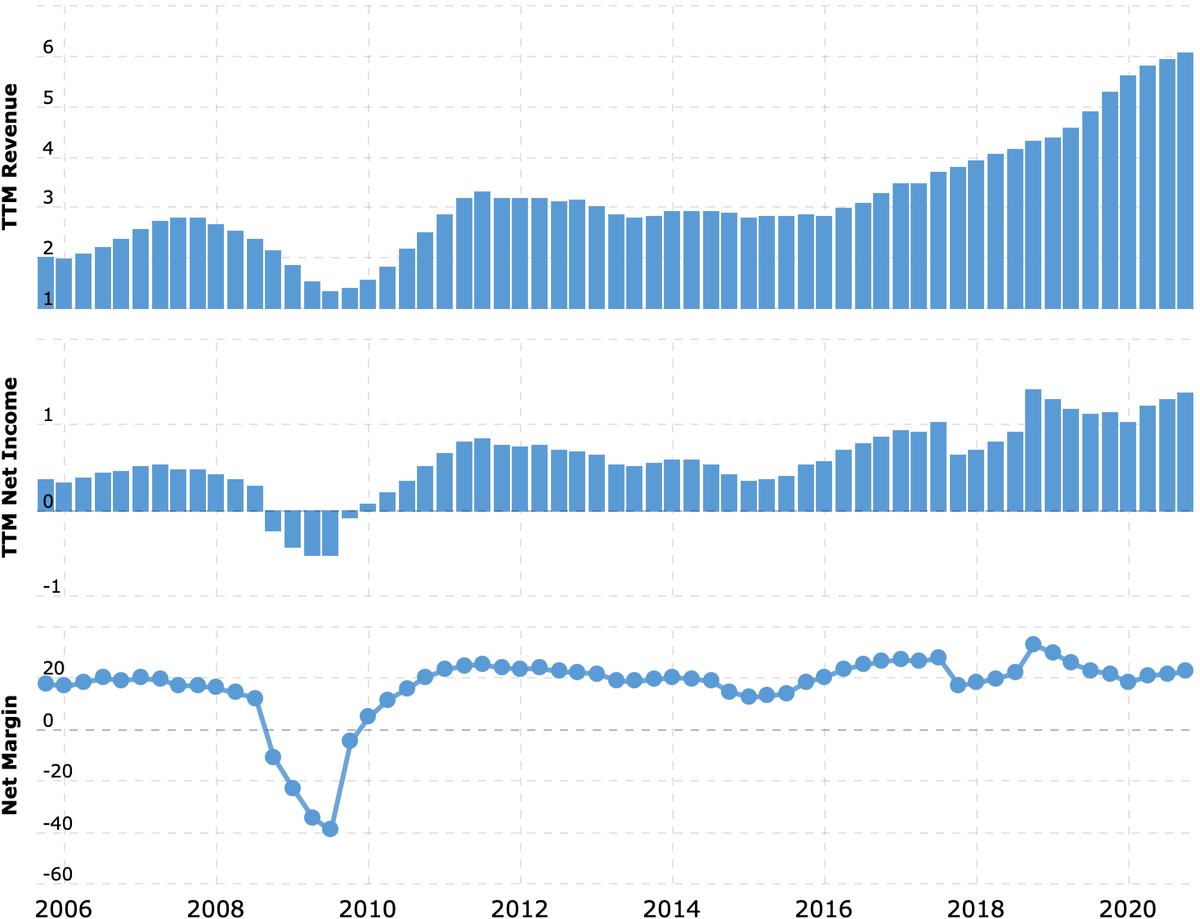

A good buy for everyone. From a business point of view, KLA is a very stable and profitable enterprise.. In the context of growing demand for semiconductors and taking into account an acceptable price - P / E 36,41 - can be counted on, that investors will show increased interest in the company.

Actually, they have already shown interest: shares rose by 115%. But, Considering, that KLA is objectively stronger than many competitors in terms of gross and operating margins, if counted according to non-GAAP, and the problem with the shortage of semiconductors will not be solved soon, we can expect further growth. KLA looks like a leader in its niche.

KLA may well be bought by larger enterprises in order to integrate into their production chains. What makes KLA so attractive is its service segment, with more than 90% clients, renewing service contracts. The company does not just sell pieces of iron to customers, she then also makes a profit from these same customers for a long time. In absolute terms, the capitalization is slightly higher than $49 billion - the company is worth a lot of money, but it's worth the price.

R&D as a percentage of revenue across industries, data 2019

| Semiconductors | 22% |

| Pharmaceuticals and biotech | 21% |

| Software and computer services | 14% |

| Media | 9% |

| Technological equipment | 7% |

Semiconductors

22%

Pharmaceuticals and biotech

21%

Software and computer services

14%

Media

9%

Technological equipment

7%

Capital renewal spending as a percentage of revenue across industries, data 2019

| Semiconductors | 26% |

| Housing and communal services | 25% |

| Energy generation | 21% |

| Television and information services | 19% |

| Cargo transportation | 17% |

Semiconductors

26%

Housing and communal services

25%

Energy generation

21%

Television and information services

19%

Cargo transportation

17%

What can get in the way

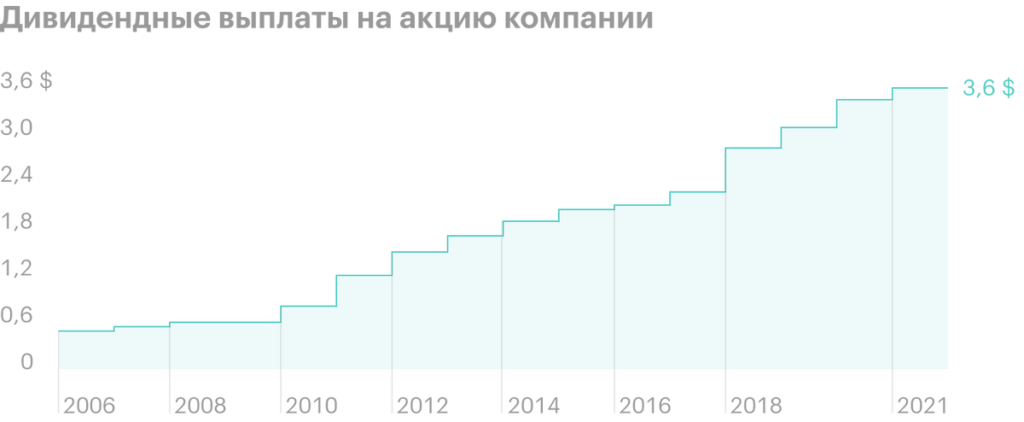

Leeches and bills. The company pays 3,6 $ dividends per share per year - with share price 318,92 $ it's mind blowing 1,12% per annum. It costs her $561.6 million a year to do this—nearly 40,94% from its profits over the past 12 Months. In my opinion, this money can be used much more worthy in the business of the company itself. And also in her accounting: according to the latest report, the total amount of its debts is 6.864 billion dollars, of which 2.09 billion must be repaid within a year.

There is enough money at the disposal of the company to cover debts and pay off: 1,431 billion in accounts and 1.219 billion debts of counterparties. But still there is a possibility, that the dividend will be cut, - and this creates the danger of falling stocks, because over the years of increasing payouts, many investors have crammed into the stock, accustomed to a certain amount of dividends.

Customer concentration. According to the annual report, the company has two clients, each of which gives more 10% from the company's revenue: Taiwan Semiconductor Manufacturing и Samsung. Reconsideration of relations with one of them may negatively affect KLA reporting.

Non sumus filii, in response to the forum. Possible production overlays at the company's customers, which will affect its reporting not in the best way. Basically, there is nothing wrong with that, but, given the stock's strong year-over-year performance and somewhat inflated earnings expectations from analysts, there is a small probability, that the report may slightly disappoint investors and stocks will fall.

Chinese sales. A significant part of the company's products goes to China and, given the high risks of sanctions against China with a ban on the supply of high-tech products, there is a possibility of a decrease in revenue in the indefinite future.

Earnings per share

| Reality | Expectations | |

|---|---|---|

| 3 neighborhood 2020 | 2,47 $ | 2,29 $ |

| 4 neighborhood 2020 | 2,73 $ | 2,41 $ |

| 1 neighborhood 2021 | 3,03 $ | 2,77 $ |

| 2 neighborhood 2021 | 3,24 $ | 3,20 $ |

| 3 neighborhood 2021 | — | 3,59 |

Reality

3 neighborhood 2020

2,47 $

4 neighborhood 2020

2,73 $

1 neighborhood 2021

3,03 $

2 neighborhood 2021

3,24 $

3 neighborhood 2021

—

Expectations

3 neighborhood 2020

2,29 $

4 neighborhood 2020

2,41 $

1 neighborhood 2021

2,77 $

2 neighborhood 2021

3,20 $

3 neighborhood 2021

3,59

What's the bottom line?

29 April the company publishes a report for the quarter. I believe, that we can take the shares of the company now 318,92 $, and then there are two options for the development of events:

- wait, when stocks hit all-time highs again 355 $. With all the positive factors, we will be able to reach this result in the following 12 Months;

- wait a little longer and wait, when stocks will overcome historical highs and will cost 392 $ for pike. Here, I think, will have to wait a year and a half.

The option of buying the company by someone is likely in both cases, but understandable, that this probability increases with the length of time the shares are held.