<img class="aligncenter" src="/wp-content/uploads/2021/08/investideja-keysight-technologies-potomunbspchto-zavody-ne-smolkajut-67d1f66.png" alt="Инвестидея: Keysight Technologies, потому что заводы не смолкают" />

Today we have a moderately speculative idea.: take stock of industrial enterprise Keysight Technologies (NYSE: KEYS), to capitalize on the industrial boom in the world.

Growth potential and validity: 14% behind 14 Months.

Why stocks can go up: there is a great demand for the company's products.

How do we act: we take shares now by 166,95 $.

<h2 class='subheading'>Без гарантий</h2> <p class='paragraph'>Наши размышления основаны на анализе бизнеса компании и личном опыте наших инвесторов, но помните: не факт, что инвестидея сработает так, как мы ожидаем. Все, что мы пишем, — это прогнозы и гипотезы, а не призыв к действию. Полагаться на наши размышления или нет — решать вам.</p><p class='paragraph'>Если хотите первыми узнавать, сработала ли инвестидея, подпишитесь на Т—Ж в «Телеграме»: как только это станет известно, мы сообщим.</p><br /><h2 class='subheading'>И что там с прогнозами автора</h2><p class='paragraph'>Исследования, например вот это и вот это, говорят о том, что точность предсказаний целевых цен невелика. И это нормально: на бирже всегда слишком много неожиданностей и точные прогнозы реализовываются редко. Если бы ситуация была обратная, то фонды на основе компьютерных алгоритмов показывали бы результаты лучше людей, но увы, работают они хуже.</p><p class='paragraph'>Поэтому мы не пытаемся строить сложные модели. Прогноз доходности в статье — это ожидания автора. Этот прогноз мы указываем для ориентира: как и с инвестидеей в целом, читатели решают сами, стоит доверять автору и ориентироваться на прогноз или нет.</p><p class='paragraph'>Любим, ценим,<br />Инвестредакция</p>

What the company makes money on

The company produces equipment and software for testing and measuring electronics, also provides services in this area..

According to the annual report, the company's revenue is divided as follows:

- communications solutions — 74,2%. The company manufactures equipment and provides services to manufacturing enterprises: from design and testing to optimization and production customization;

- electronics solutions for industry — 25,8%. As a matter of fact, same, as above, but for automotive, energy, consumer electronics and semiconductor manufacturing.

Distribution of revenue by areas of application:

- government, aerospace, defense - 21,98%;

- commercial communications — 52,21%;

- industrial electronics - 25,81%.

Also, the revenue can be divided in this way:

- products - 81%. Segment gross margin — 60% from its proceeds;

- services - 19%. Segment gross margin — 60,08% from its proceeds.

Distribution of revenue by regions:

- America - 38,87%;

- Europe - 16%;

- Asian-Pacific area - 45,13%.

Unfortunately, the company does not provide information on sales in specific countries.

<img class="aligncenter" src="/wp-content/uploads/2021/08/investideja-keysight-technologies-potomunbspchto-zavody-ne-smolkajut-df3c30f.png" alt="Инвестидея: Keysight Technologies, потому что заводы не смолкают" /></p>

Arguments in favor of the company

Now and then. Although we do not know the exact share of different countries in the company's sales, but you can roughly determine the main countries - consumers of Keysight products. This can be done based on economic logic.: in the Americas, probably, main sales are USA, in Asia - China or Japan.

And it doesn't even matter, Who exactly: indicators of industrial growth in one of these countries, probably, mean industrial growth in another. This is because, that production chains in Asia are highly integrated. Looking at Regional Purchasing Managers' Indices in Manufacturing, then in the USA, Japan, China and eurozone countries see industrial growth.

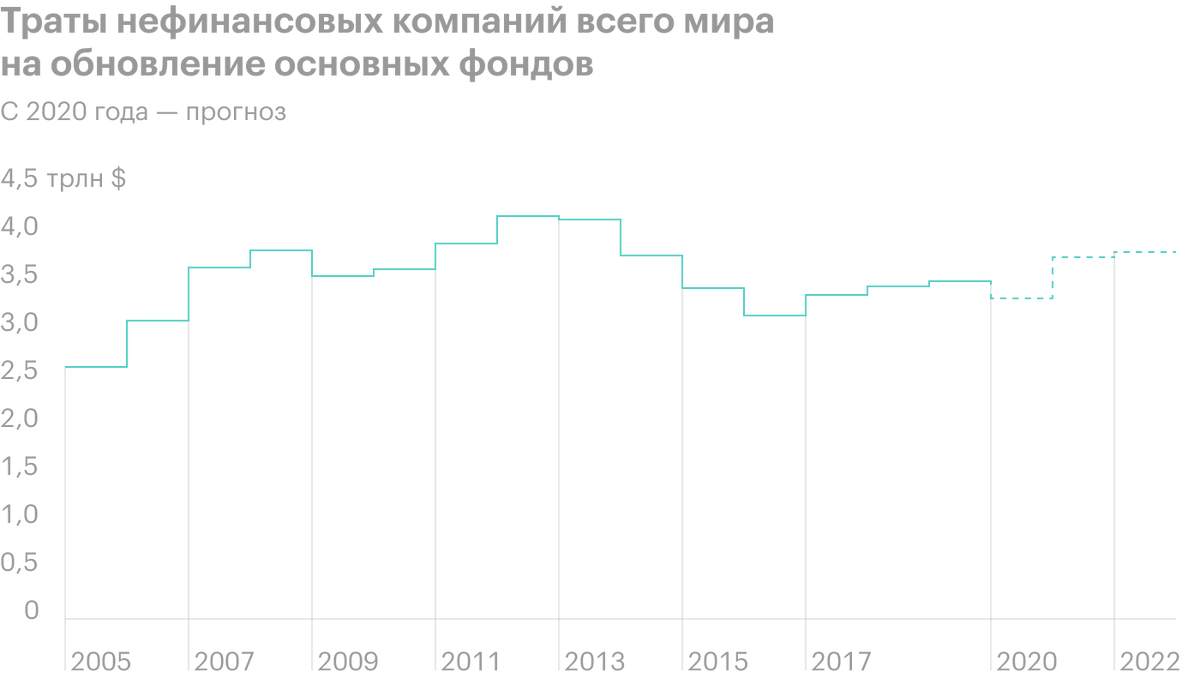

And since the industrial boom in the company's main markets, she may well hope for an increase in sales in the near future. It is also worth considering the volume of companies' investments in the renewal of fixed assets, which will last for at least several years, if nothing gets in the way, - Keysight will also benefit from this.

<p><img class="aligncenter" src="/wp-content/uploads/2021/08/investideja-keysight-technologies-potomunbspchto-zavody-ne-smolkajut-072c2db.png" alt="Инвестидея: Keysight Technologies, потому что заводы не смолкают" /></p>

What can get in the way

<

p class=’paragraph’>Coronavirus. Closing factories and rising costs did not affect the company's financials very well in 2020. It's not noticeable because, that after the quarantine was lifted, the negative effect was leveled by an increase in orders. But the situation with large-scale quarantine may repeat itself - after all, there are still many letters left in the Greek alphabet., so there may well be new, more dangerous strains. So there is a constant threat, that the company's customers will have to adjust equipment investment plans due to plant closures. And then it will be reflected in Keysight reporting.

Price. The company has a big P / E — 41,78, and its shares are now trading at all-time highs, so in case of correction they can drop significantly. But not much: Still, the foundation of this business is quite strong..

China. PRC directly or indirectly, but plays a large role in the company's income, and now its industrial performance is not falling, but their growth was worse than expected. This could be a signal, that the demand for the company's products is not growing so much and the growth rate of its sales will not be so steep, as we would like. Basically, against the background of other problems, it's not a problem at all, but just a small hurdle.

Accounting. According to the latest report, the amount of debts of the company is $ 4.141 billion, of which 1.288 billion must be repaid within a year. The company has enough money to cover the most urgent debts: she has 1.993 billion in accounts and another 676 million she owes counterparties.

But in anticipation of the rate increase, what makes loans more expensive, investors, probably, will take into account large debts, which may not be very good for Keysight quotes. well, at least, the company does not pay dividends - and, means, there is no threat of falling shares from the news about the reduction in payouts.

What's the bottom line?

Shares can be taken now by 166,95 $. Think, that during the next 14 months they reach the mark 191 $, if a, certainly, quarantine won't ruin anything. And then they can be sold.