Now we have a uniformly speculative thought: take stock of the confectionery manufacturer Hostess Brands (Nasdaq: TWNK), to get income from the growth of the popularity of its products and prices.

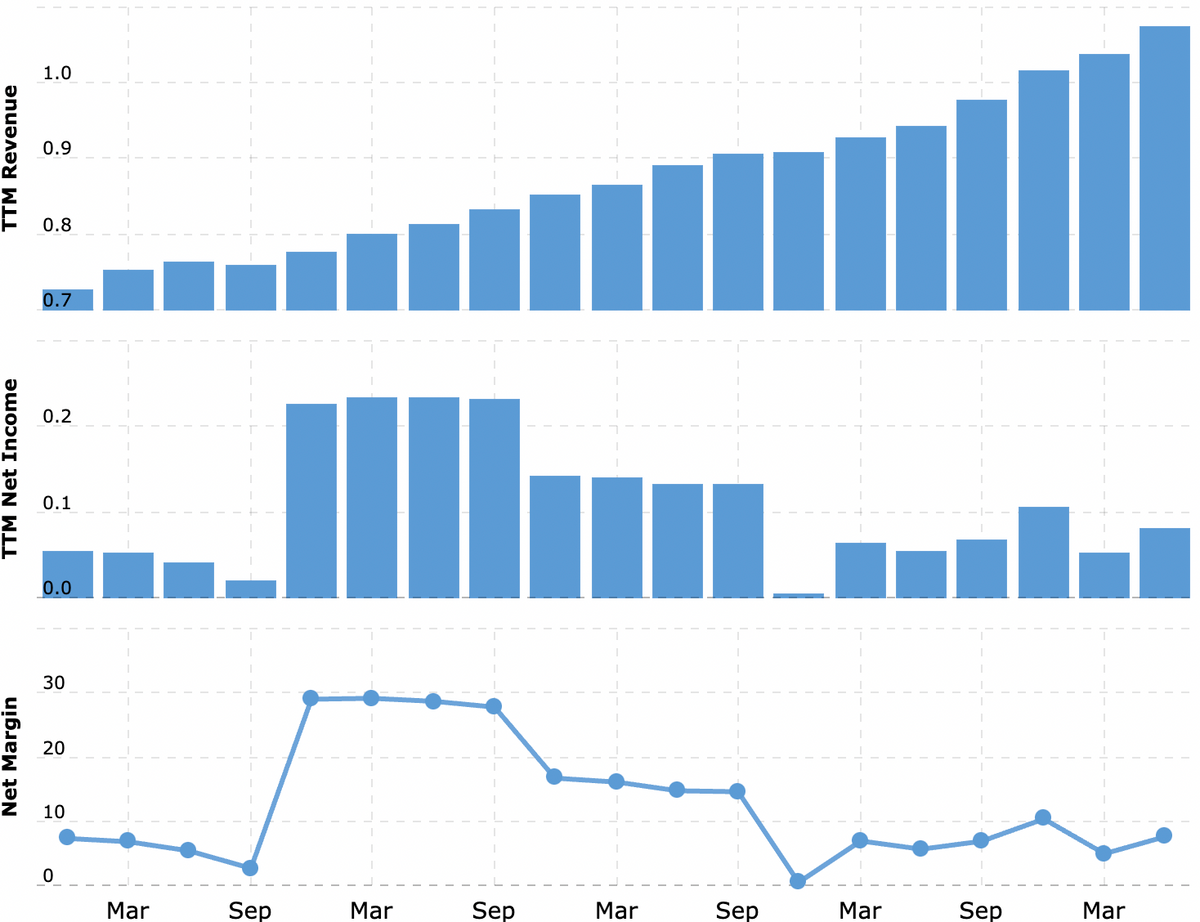

Growth potential and duration : 14,5 % behind 15 Months; ten percent a year for ten years.

Why stocks can go up: the company's business is growing excellently and with a strong epidemic, and without it.

How do we act: take shares at the moment 15,79 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

The company produces various flour cakes, cookies and cakes. However, their Twinkies were extremely adored by Woody Harrelson's character in the "Welcome to Zombieland" dulogy.. According to the report, 90,53 % Hostess proceeds give cakes and pastries, and 9,47 % - cookies.

98,18 % revenue the company makes in the US, 1,82 % - In Canada.

Arguments in favor of the company

Demand conjuncture. The company survived the pandemic well and showed good sales growth even after the quarantine was lifted. In this regard, I consider, that Hostess Brands shares are well suited for “waiting out quarantine” - after all, the company’s sales are growing in such circumstances, - and for life after quarantine. Most likely, the company's sales are driven forward by the primitivization of consumption in America: people began to spend less on travel and more refined food products, preferring to be comforted by familiar pastry brands.

In this regard, you can take shares now with the expectation of both an increase in consumption of the company's products in the United States, so and for that, what's in these stocks, as a kind of defensive asset, investors will be packed, thanks to which quotes will grow. Think, that with a capitalization of $2.05 billion, Hostess Brands stock price does not need too large a crowd of investors to grow.

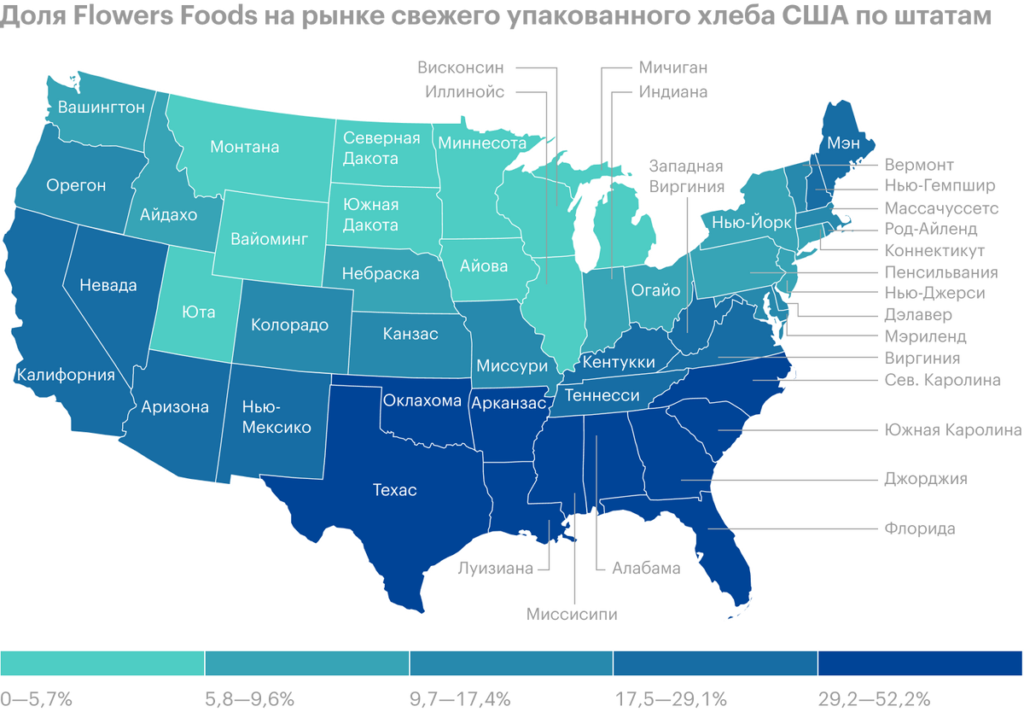

Can buy. Small cap and P / E 20.64 the company looks like a very good option for a takeover by a larger brand. Anyone can be a buyer, but Flowers Foods seems to be the most likely purchaser of Hostess Brands for several reasons..

Firstly, Flowers Foods is one of the largest manufacturers of flour products in the United States..

Secondly, Sales of Flowers Foods after the end of quarantine, albeit not much, but fell, but at Hostess Brands they continue to grow. Hostess Brands in this context would be a very valuable addition to the Flowers Foods business..

However, anyone can become a buyer. Any major food company ranging from Kraft Heinz to Campbell Soup could become the new owner of Hostess Brands.. Because the point about the drop in sales after the end of quarantine is relevant for all of them.. Actually, before the pandemic, sales of most food manufacturers were marking time: the US market did not grow at all, and export was not easy, because outside the US there are popular brands. Hostess Brands stands out from this background as a company, whose products are very popular and without quarantine, and its brand is familiar to all Americans.

What can get in the way

Relative cost. Target market volumes of the company, according to her own estimates, are $ 6.9 billion, and with its capitalization Hostess Brands costs as 29,71% market, but her sales are 15,5% market. In other words, you can find fault, that the company is slightly overvalued.

Concentration. Some unnamed buyer, according to the report, gives the company 20,2% proceeds. A change in relationship with him may adversely affect reporting.

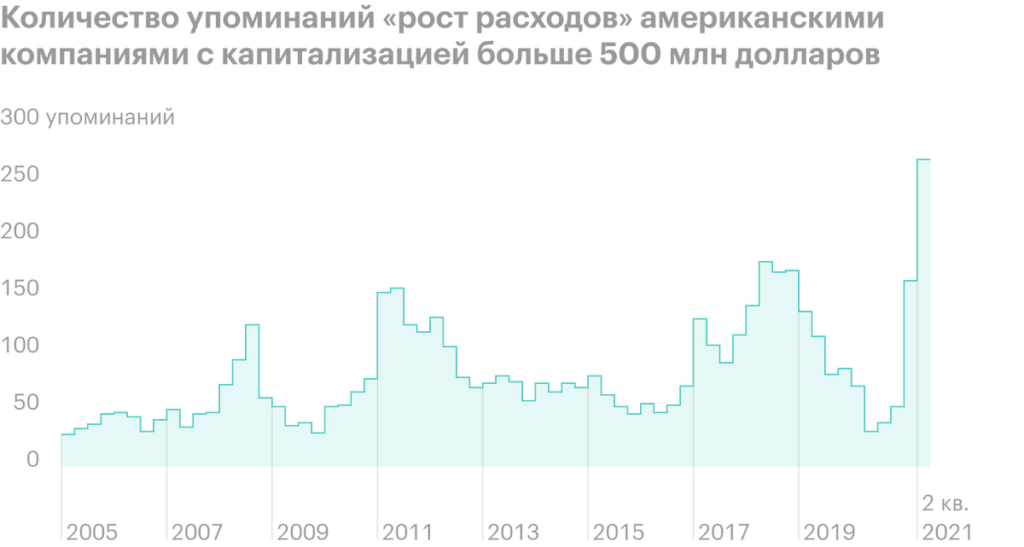

Expenses. During the period, when the entire US corporate sector complains about rising costs, you should be mentally prepared, that Hostess Brands reporting will be negatively impacted by everything from the price of raw materials to the cost of labor. Certainly, the company has invested a lot in improving its production facilities in recent years, but you should still keep in mind the possibility of reducing the margins of Hostess Brands business in the current circumstances.

Accounting. The company has a fairly large amount of debts: 1,742 billion dollars, of which 185.304 million must be repaid during the year. However, there is more than enough money at the disposal of Hostess Brands to cover all urgent debts, so big debt is only a problem for investors, Considering, that in anticipation of raising rates it is better to avoid companies, burdened with unnecessary debt.

In theory, a large debt could also scare away a potential buyer of Hostess Brands, but that's just a hypothesis. As we have already defined above, a fairly large company can become a buyer of Hostess Brands, for which such a debt will not become an insurmountable obstacle.

What's the bottom line?

You can take shares now at a price 15,79 $, then there are two options:

- wait, what are the next 15 months, stocks will rise to 18,1 $. This is above the historical highs of the price of these stocks., but I expect the company's financial performance to grow during this time;

- hold shares 10 years.