Today we have an extremely speculative idea.: take shares in a medical software company Evolent Health (NYSE: EVH), to capitalize on the digitalization of American healthcare.

Growth potential and validity: 22% behind 12 Months; 10% per annum during 15 years.

Why stocks can go up: the company operates in a promising niche.

How do we act: we take shares now by 20,4 $.

How does the company make money Evolent Health

Evolent Health is a company, developing software for managing a medical enterprise. According to the company's annual report, distribution of proceeds is as follows.

Services. This segment is divided into two parts.. Transformation services bring companies 1,17% of total revenue. These are consulting and technical services for the preparation of insurance plans by those, who works in the respective field.

The platform and operating services bring 87,34% of total revenue. These are annually renewed contracts with medical institutions or intermediaries. This software is for the economic, administrative and clinical activities of hospitals..

Health insurance in New Mexico. segment brings 11,49% proceeds. There is not much to say about the segment, as the company is going to sell this division in the first half of this year.

The company is still unprofitable. Only works in the USA.

Arguments for Evolent Health

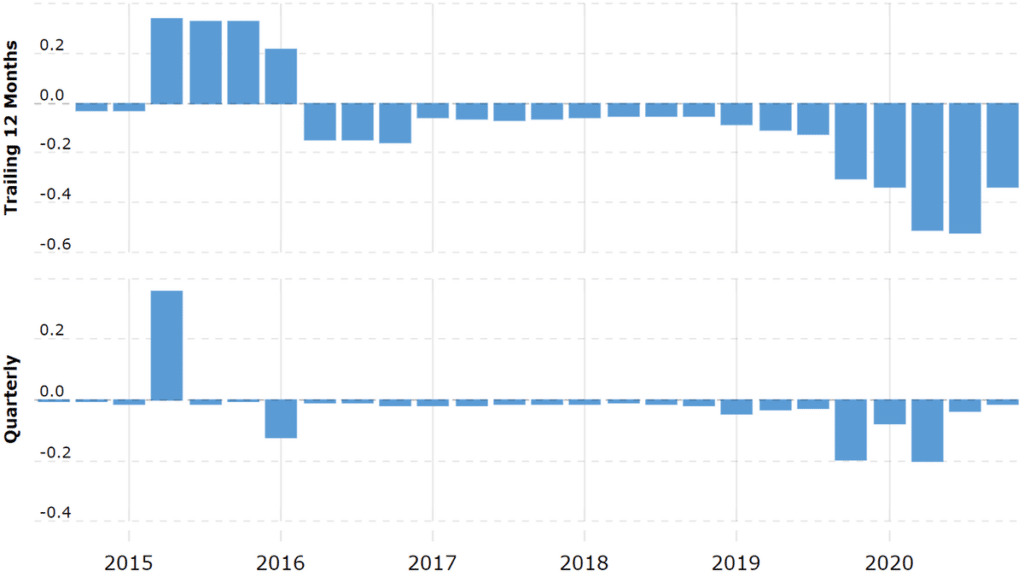

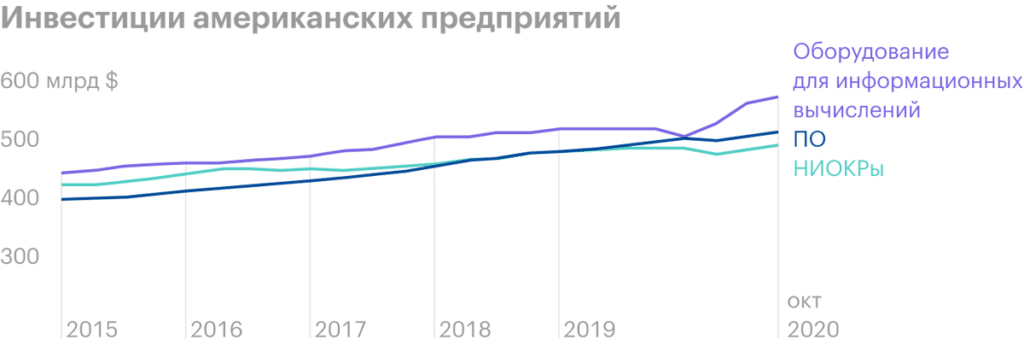

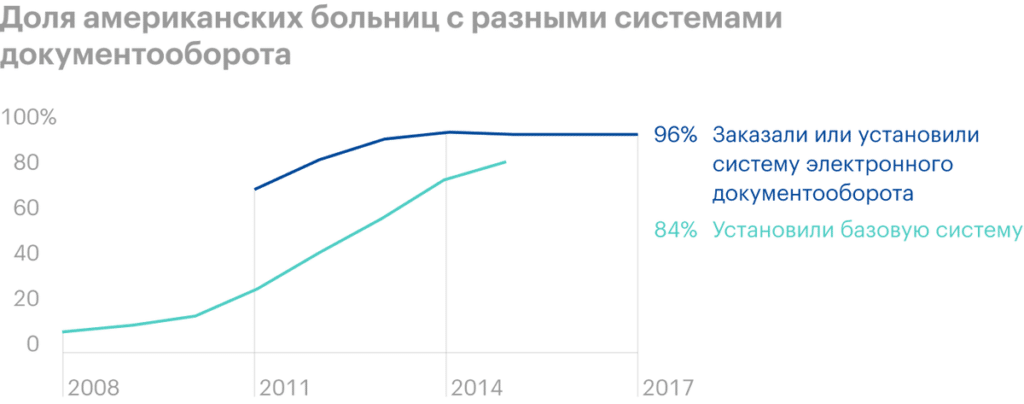

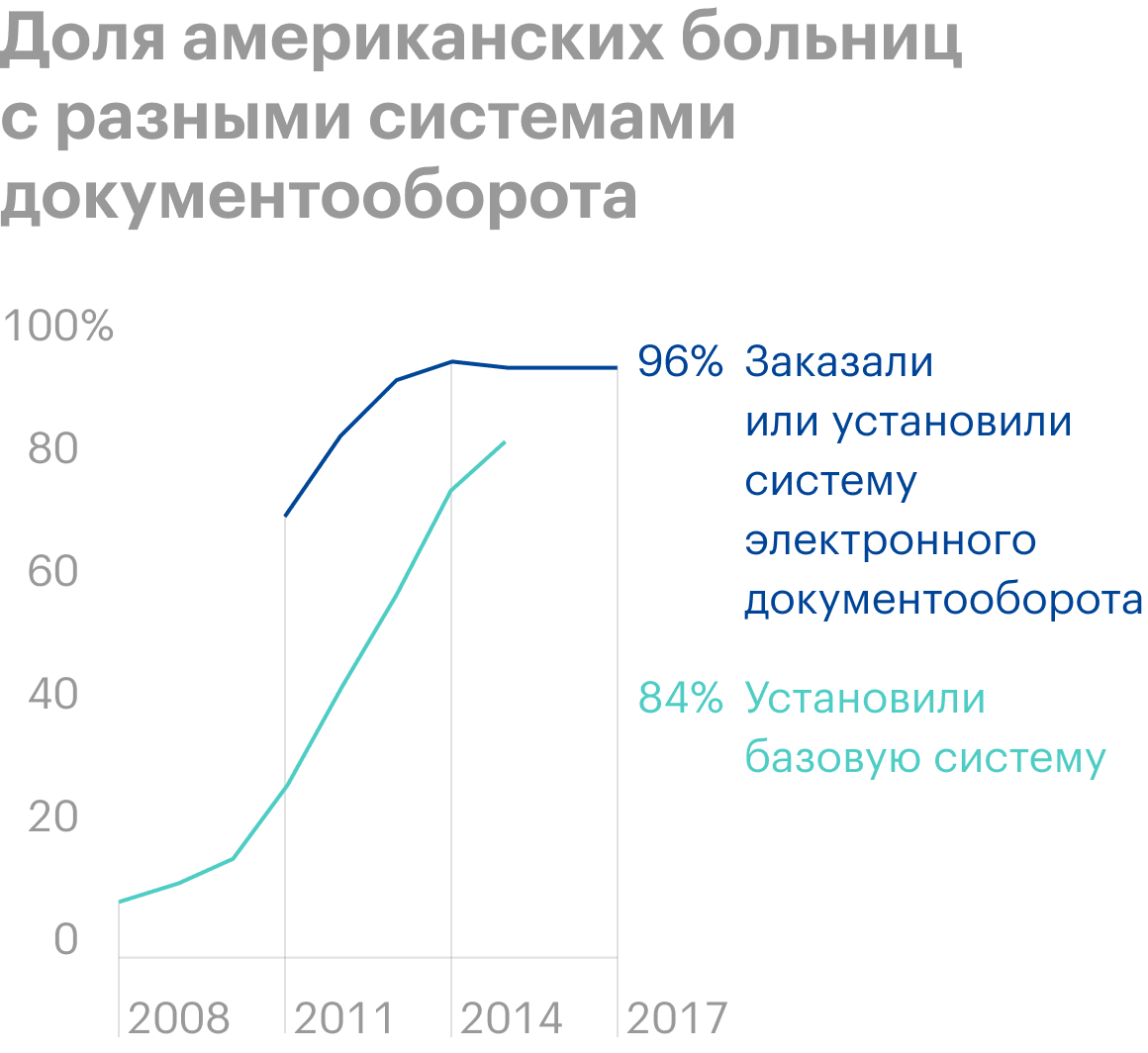

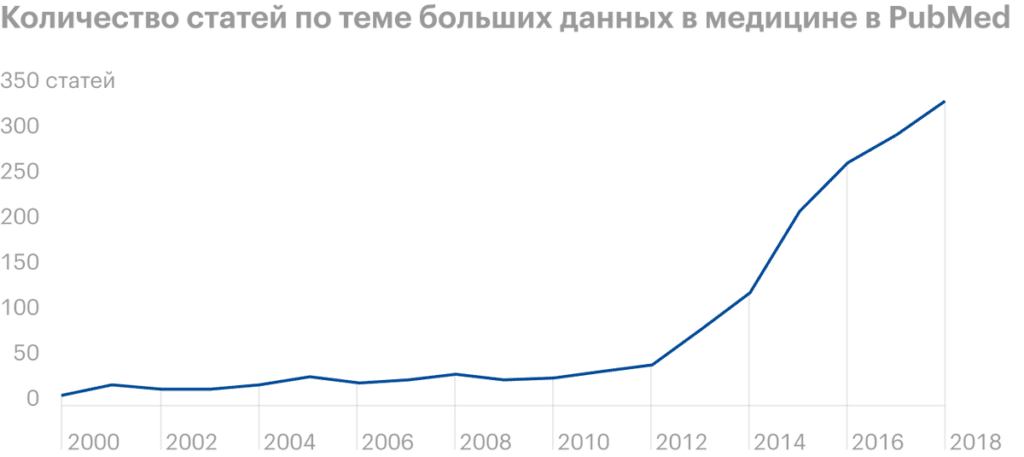

Can jump higher. The pandemic in America has led to an increase in corporate investment in software and other methods of increasing productivity and virtualization of operational processes. American hospitals were actively developing the digitalization of their operations even before the pandemic. An indirect sign of this phenomenon is the increase in the number of articles in medical journals on the topic of big data in medicine..

The pandemic has only accelerated this process., what was reflected in the growth of Evolent Health's revenue. But in terms of pumping money out of the US healthcare system, the company still has a lot of work to do.: spent on treatment in the USA 3,8 trillion dollars a year. Pinch off a small piece of this colossal medical-industrial complex Evolent Health will not be so difficult, and that will be more than enough. That is why we can expect continued growth in the company's revenue.

According to the estimates of Evolent Health itself, its target market is about 60 billion dollars in annual revenue is not the case, when a startup inflates its prospects, to deceive investors. Considering the inflated US healthcare spending and overall inefficiency in the sector, the company will be able to increase revenue well in the near future and, may be, even make a profit.

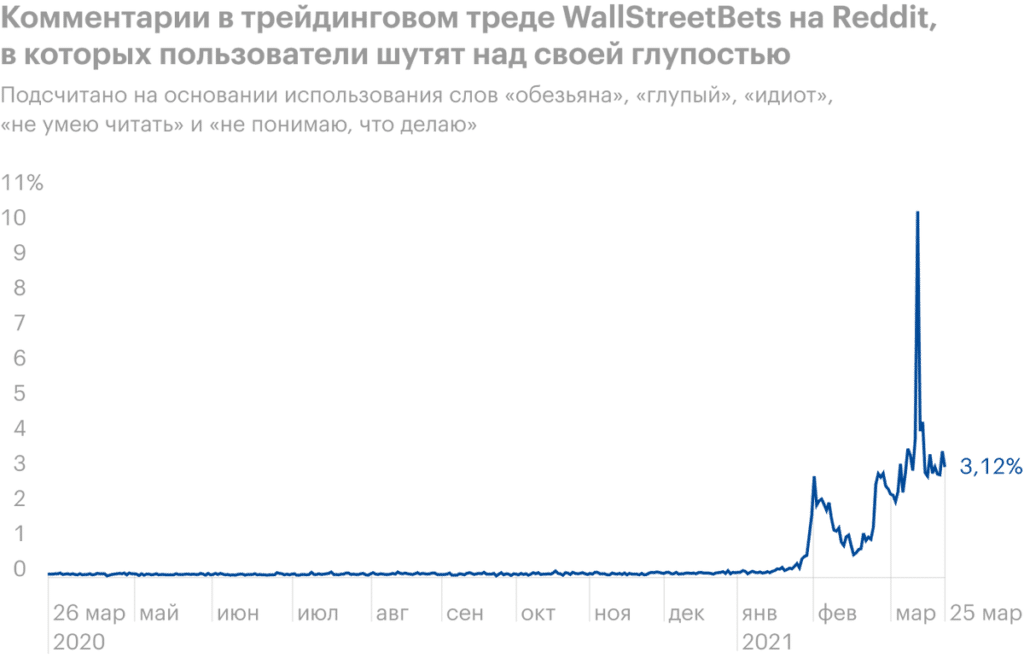

In addition, Evolent Health can be considered "promising": medical software anyway, - and with a small capitalization in 1,76 billion dollars, she will surely be able to attract the attention of the crowd. Many retail investors are aware of their own ignorance and are even proud of it., and possibly, that they will inflate the company's capitalization even more. Only on the energy of such investors, Evolent Health shares can grow strongly, even if the company does not show any outstanding operating results.

US eData consumption in petabytes Evolent Health

| 2016 | 2018 | |

|---|---|---|

| Finance | 1,53 | 16,19 |

| Telecommunications | 2,2 | 13,74 |

| IT | 1,66 | 12,8 |

| healthcare | 0,86 | 8,41 |

| Production of goods | 1,31 | 8,13 |

| Retail sales | 0,96 | 6,81 |

| Scientific research | 1,11 | 6,25 |

| Energy | 1,14 | 5,38 |

| Consulting services | 1,12 | 3,09 |

Worth the money. The company has a very small capitalization, and there is a high probability, that someone will buy it. For example, it could be Google: the company spends hundreds of millions of dollars and a lot of time to gain access to the medical data of patients across America. In this context, the purchase of Evolent Health is a perfectly reasonable move..

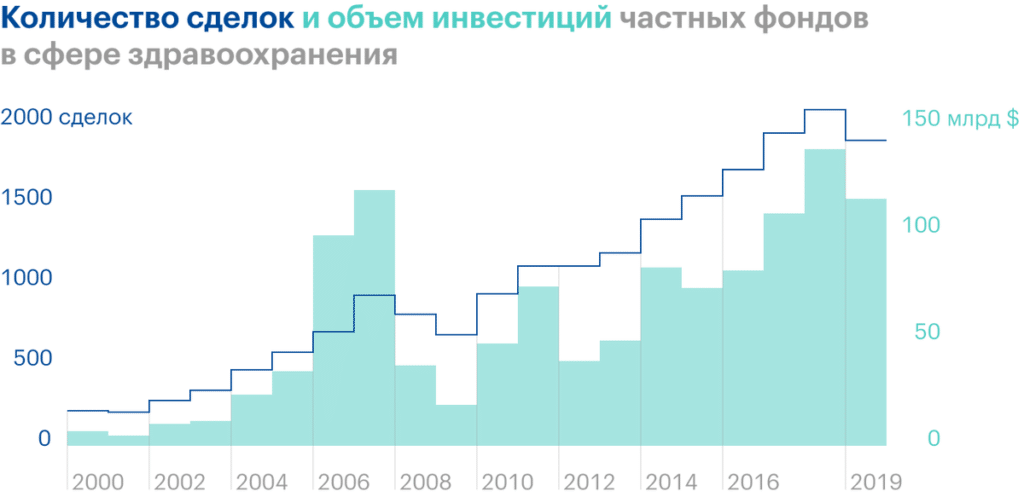

Or Evolent Health can buy some private foundation: these funds spend hundreds of billions of dollars each year to acquire healthcare businesses, and the purchase of Evolent Health will not look like a particularly costly undertaking. IN 2020 year private fund Veritas Capital bought for 5 billion dollars of medical IT company DXC Technology.

We, certainly, can't be 100% sure, what will Evolent Health buy, but its low cost and the halo of the "prospects" of the segment, where she works, can play a positive role here.

What can get in the way of Evolent Health

Customer concentration. According to the annual report, one hospital in Chicago gives the company 20,3% her proceeds. If Evolent Health's relationship with this customer changes in any way, this can affect her reporting in the most dramatic way.

Your tam beautiful, but just weaving in the bay. The company is unprofitable, and her stock will be shaking just because of this.

What's the bottom line?

Take the shares now for 20,4 $, and then two options:

- we wait, when will the stock be worth again 25 $, who asked for them back in November 2018. Given the popularity of the sector and the apparently positive environment for the company, I think, that this share price is reached within the next 12 Months;

- we hold shares 15 years, To view, how a company will benefit from the digitalization of American healthcare. In my opinion, this is the most preferable option, since we are talking, in fact, about yesterday's startup and you need to be prepared, that in short periods stocks can fall sharply. In the long run, it is much more likely that the company will be bought by someone from the outside..