Now we have a very speculative thought: take Dropbox shares (Nasdaq: DBX), in order to receive income from their growth in the event of a successful completion of the campaign of financiers-active participants.

Growth potential and duration : twenty one percent for 17 Months.

Why stocks can go up: participants among the shareholders of the company will force them to grow.

How do we act: we take at the moment 28,5 $.

No guarantees

If you want to be the first to know, did the investment work?, subscribe: how will it become clear, we will inform.

And what is there with the author's forecasts

What the company makes money on

Provides overcast storage. The service has paid and free versions.: 15.48 million people use paid, and free - 700 million. In accordance with the annual report, approximately 500 thousand paying customers of the company are companies.

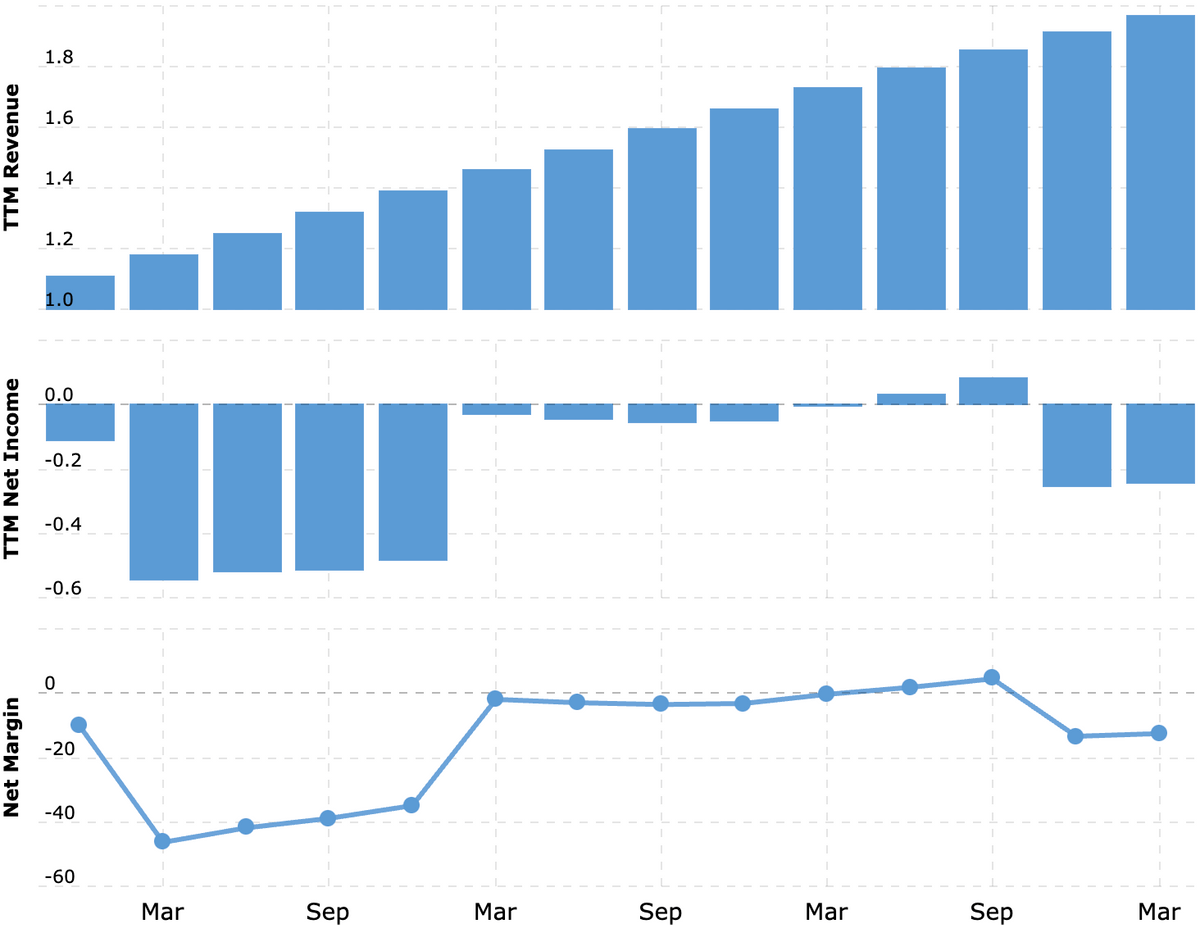

The USA accounts for 52,21 % company revenue, 47,79 % - to other states, none of which gives more 10% from proceeds. The company is unprofitable. Actually, it's all, what you can and should say about your Dropbox business.

Arguments in favor of the company

Elliott will come - he will put things in order. The main argument in favor of Dropbox: recently in it 10% bought Elliott Management fund. The purpose of this fund is, that he finds sick and weak enterprises, buys a stake in them and then campaigns to get management to take action, from which the shares will rise. The offers are very different: from laying off most employees to save on costs to forcing management to sell the company.

I think, that Elliott will force Dropbox to sell, but what exactly will happen, we don't know yet. In any case, Dropbox now looks cheaper than many of its "colleagues" and the stocks really have room to grow here..

Less concentration is sometimes better. According to the company's annual report, none of her clients give more 1% proceeds. This is a good moment: the loss of one of the major clients will not greatly spoil the reporting.

How many times the company is worth more than its future sales

| Snowflake | 55 |

| Cloudflare | 43 |

| Shopify | 38 |

| CrowdStrike | 37 |

| Zscaler | 35 |

| Atlassian | 26 |

| Zoom Video | 23 |

| Twilio | 22 |

| Octa | 21 |

| ServiceNow | 16 |

| Adobe | 15 |

| Workday | 11 |

| Salesforce | 7,8 |

| Dropbox | 5,2 |

| Box | 4,6 |

Snowflake

55

Cloudflare

43

Shopify

38

CrowdStrike

37

Zscaler

35

Atlassian

26

Zoom Video

23

Twilio

22

Octa

21

ServiceNow

16

Adobe

15

Workday

11

Salesforce

7,8

Dropbox

5,2

Box

4,6

What can get in the way

Not interesting without Elliott. Basically, without the participation of activist investors from Elliot, these shares would not be so interesting. Almost all of our hope here is, that the fund will make Dropbox stock go up, - there are no other growth drivers here. But there are a lot of shortcomings, and the main one is the unprofitability of this business, guaranteeing stock volatility.

What's the bottom line?

Take shares on 28,5 $. I think, that Elliott will make them grow up to 34,5 $. This is well below their all-time high in 39,6 $, already achieved in 2018, but achievable goal, given the relative undervaluation of these shares. Yes, and for Elliott it will be good prey.