Today we have a moderately speculative idea.: take shares in software maker Digital Turbine (NASDAQ: APPS) due to the growing attractiveness of the company's business.

Growth potential and validity: 23% behind 14 Months.

Why stocks can go up: it is a growing efficient business in a promising area.

How do we act: we take shares now by 66,17 $.

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

How does Digital Turbine make money?

Digital Turbine (NASDAQ: APPS)Is a service for managing and promoting content on mobile devices. The company's software allows you to manage and monetize mobile applications, collecting fees from clients. You can use it to customize ads. APPS also provides other services in related areas.

Company reporting, Alas, not rich in details: there is no division by segments and applications. The main clients of the company are mobile operators and manufacturers of mobile devices..

Digital Turbine revenue by country and region

| USA and Canada | 65,05% |

| Europe, Middle East and Africa | 25,2% |

| Asia Pacific and China | 8,55% |

| Latin America | 1,2% |

Arguments for Digital Turbine

You can pick up. I have been following this company for a long time., and this year they have noticeably fallen in price - by almost a third. This allows us to capitalize on the rebound.

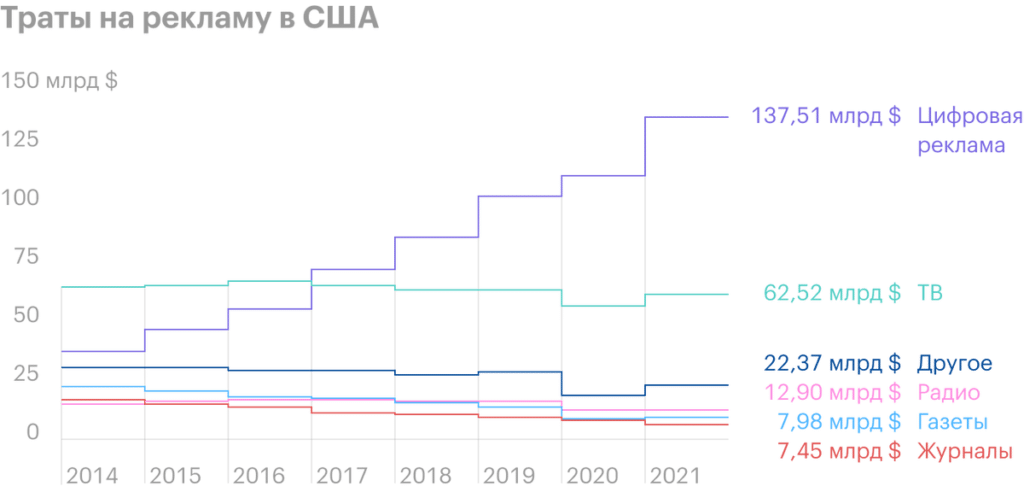

Hey, he touches upon there? Expected, that American advertisers will spend more money on advertising this year, than in 2020. And the most significant increase is expected in the field of digital advertising.: with 112,84 to 137,51 billion dollars. I have little doubt that, that the company will gain something from such generous spending.

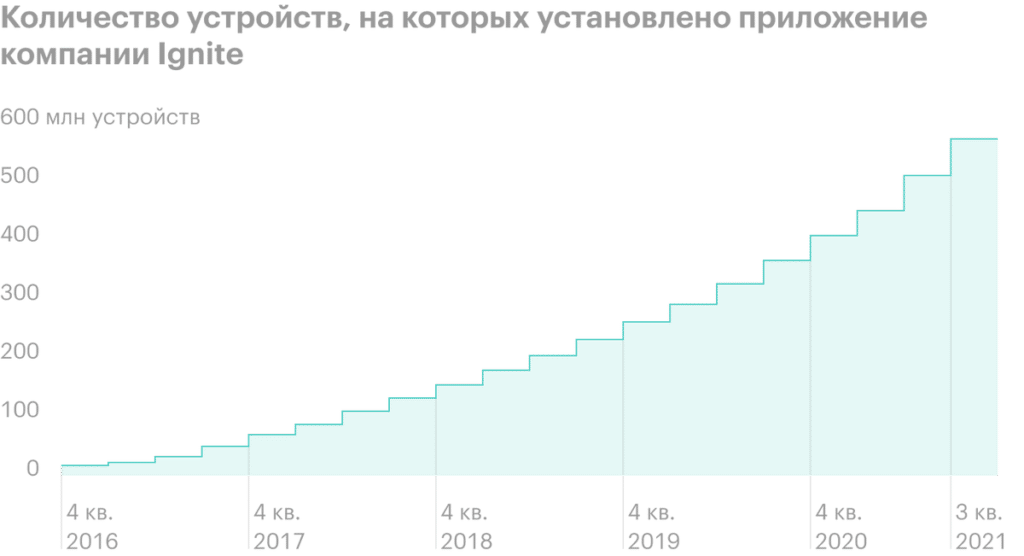

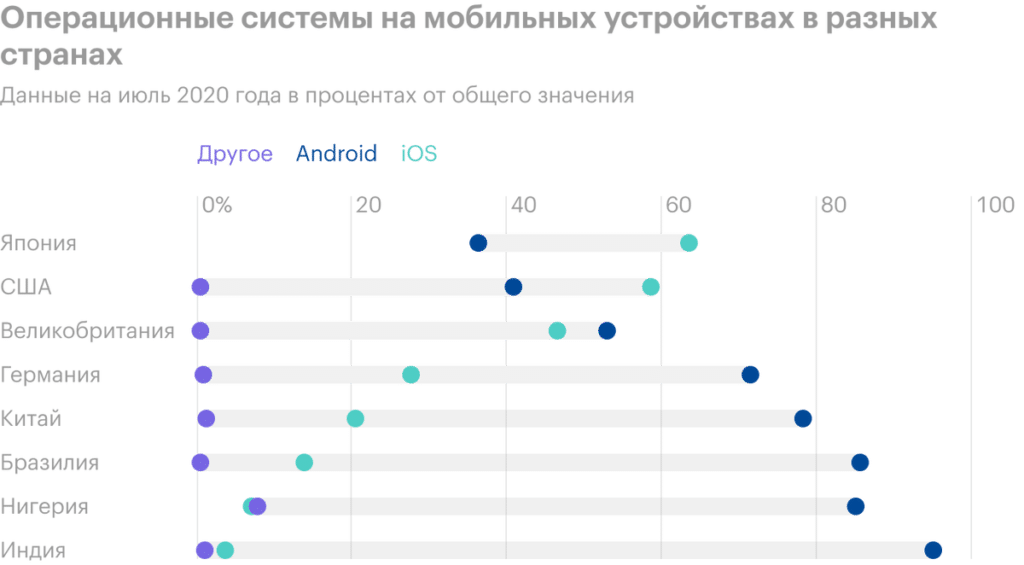

But that's just a bonus, what the company already has: the growing volume of content consumption on mobile devices already creates a rich breeding ground for the company. The company's application was downloaded actively as before, and after the start of the pandemic, so I wouldn't talk about it here., that the company owes its takeoff only to mass digitalization due to quarantine, although this factor played a role. And there's still room to grow: being a company, service-oriented Android devices, APPS is only represented in less than 20% devices, running on this OS.

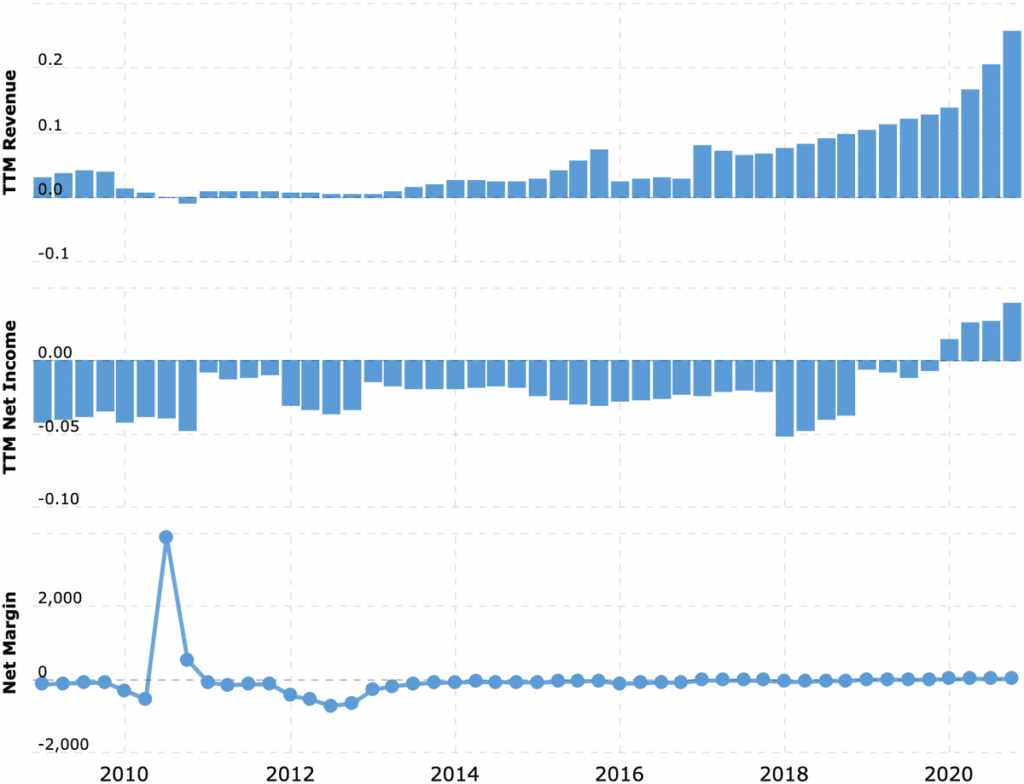

Already quite adults. For some time now, the company has ceased to be unprofitable and has become profitable., what distinguishes it from a host of software manufacturers. Yes, she has a high P / E — 159, but let's face it: not all companies, whose shares are growing, generally there is P / E. APPS combines start-up growth with a working business. Is this not a reason to forgive the company for its cost?

Also, APPS does not have a very large capitalization - about 5,92 billion dollars. This allows us to hope, that stocks can be pumped by a crowd of small investors.

Probability of purchase. Considering the above advantages of APPS, I wouldn't be too surprised to hear news about, that APPS someone is trying to buy. The scenario seems to me very likely, at which the company will be bought by the same Google.

What can interfere with Digital Turbine

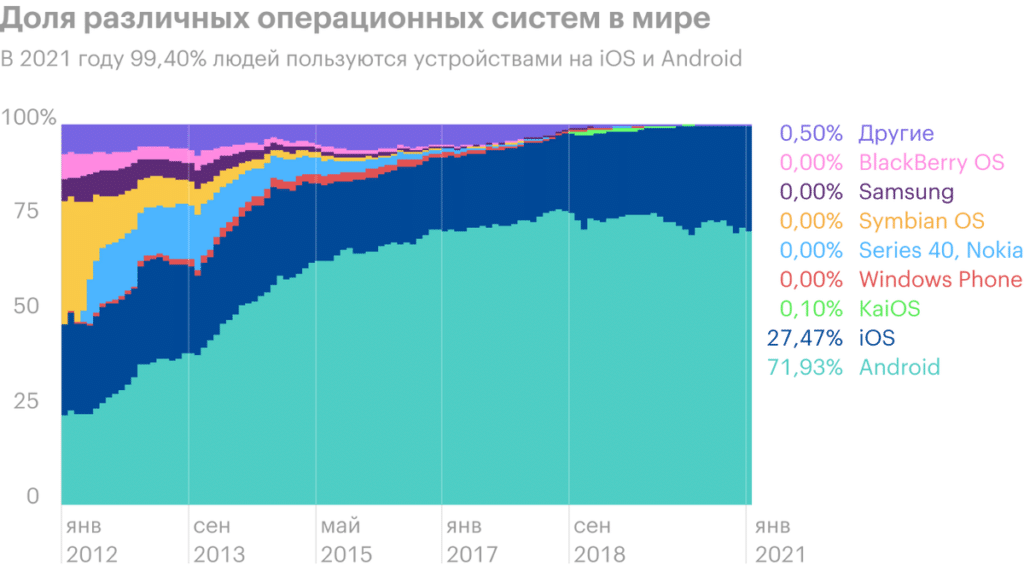

Yes, but. We have already told you about, how Apple villains rolled out a software update, allowing users of Apple devices to prevent applications from collecting information about them. This has already begun to affect the advertising market in a bad way and, in theory, could negatively affect APPS. Truth, I wouldn't expect a big drop in revenue., since the company makes most of its money on Android devices.

But iOS devices make up the majority in the richest and therefore most advertiser-friendly countries., so these Apple reforms are limiting the space for APPS to grow. But this is not a global minus., but rather an obstacle to the growth of the company.

And yet the price. Company P / E is not the smallest, which makes her quotes potentially very volatile.

What is the result of Digital Turbine

1 June the company will release a report for the last quarter. I would cautiously hope, that he will be good. But even without reference to this date, I think, that the shares can be taken now by 66,17 $, and then there are two options:

- wait, when will the shares be worth 82 $, and sell. This is much less than the historical maximum of quotes in 94,74 $, reached in March. With all the positives, mentioned above, I think, that we can wait for this for the next 14 Months;

- keep stocks at the heart next 15 years in the hope, that the company will be able to realize its potential for all 100%. Worth noticing, that over long distances, the likelihood of a company being bought by someone larger increases.