Now we have an extremely speculative thought: take stock of semiconductor manufacturer Cree (Nasdaq: CREE), to profit from the speculative rebound of these stocks.

Growth potential and duration : 13,5 % behind 14 Months; forty five percent in four years.

Why stocks can go up: crazy demand for the company's products, and its shares have declined in price this year.

How do we act: we take shares on 88,06 $ at the moment.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

Contrary to the name, the company has nothing to do with the race of aliens from Marvel comics. Cree makes semiconductor products for difficult electronics manufacturing.

In accordance with the annual report, the company's revenue is divided into subsequent segments.

Wolfspeed - fifty two percent. The department is engaged in the creation of components and materials for the creation of difficult electronics. Motivated audience of the sector are transport manufacturers, including electric cars, and various applications for it, also vendors of power solutions, including solar energy, and telecommunications. The sector's gross margin is thirty-nine percent of its revenue.

Light Emitting Diodes - Forty-eight percent. Chips and components in the respective field. The main audience of the sector is manufacturers of lighting devices, screens and vehicles. The sector's gross margin is twenty-one percent of its revenue.

Geographically, the company's revenue is divided as follows:

- United States - twenty-three percent;

- China - twenty nine percent;

- Europe - 27%;

- other, unnamed countries and regions - 21%.

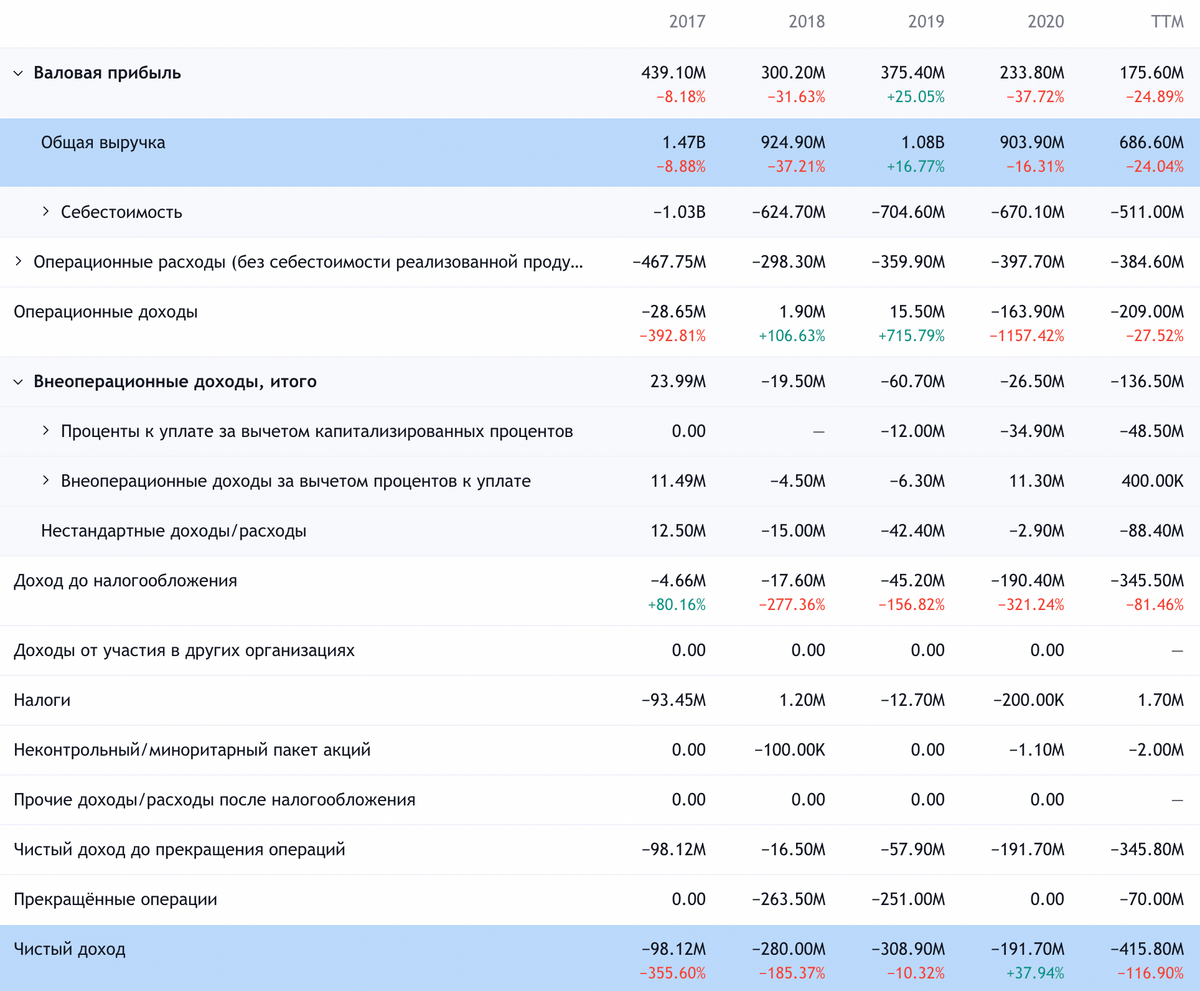

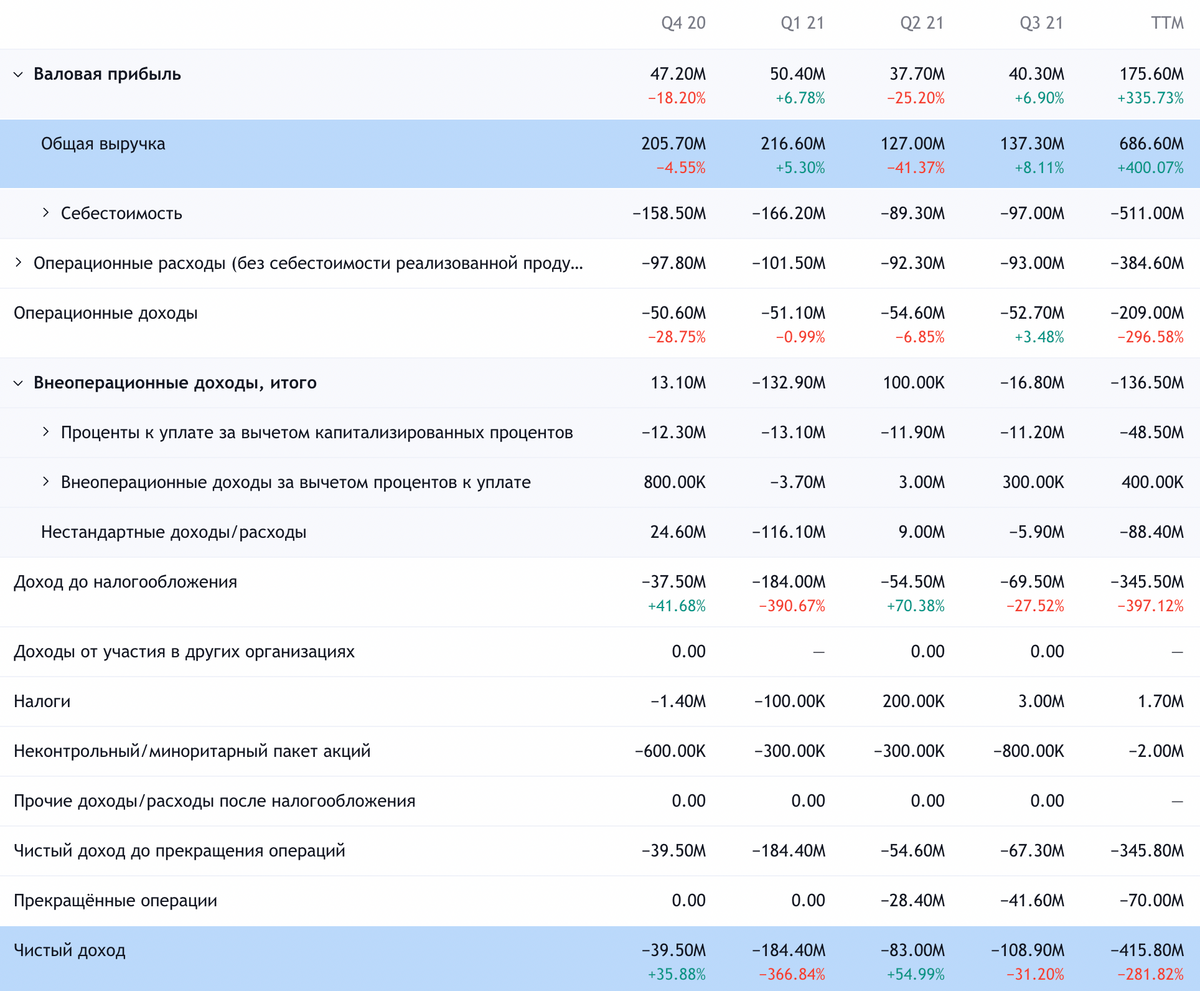

The company is unprofitable, due in part to high management and sales costs, and partly because of the high spending on R&D.

Arguments in favor of the company

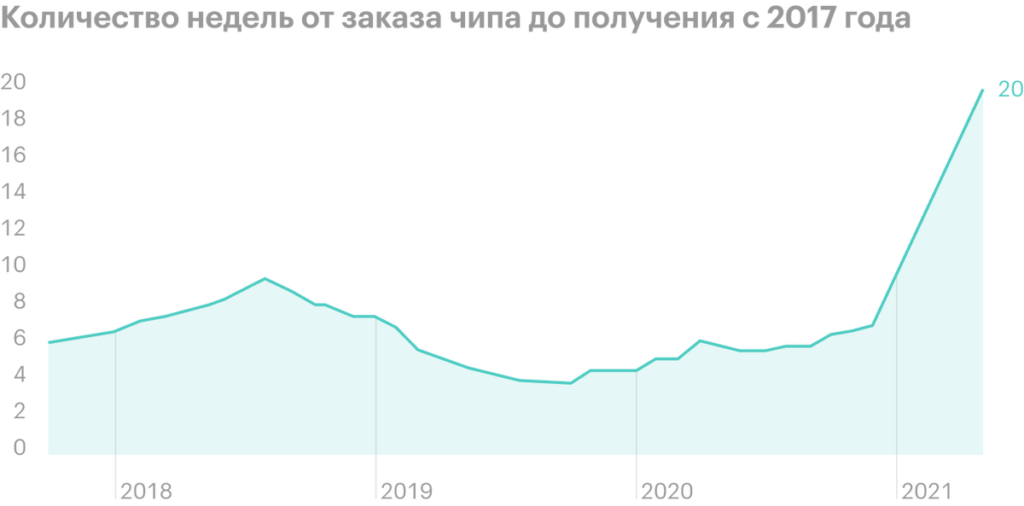

Really needed. The other day, the difference between ordering a chip and receiving it peaked in 3 of the year - 20 weeks, although until recently this figure was 18 weeks. And all because, that the workload of factories is growing due to a sudden jump in consumption in developed and not so countries. Therefore, Cree can count on good sales..

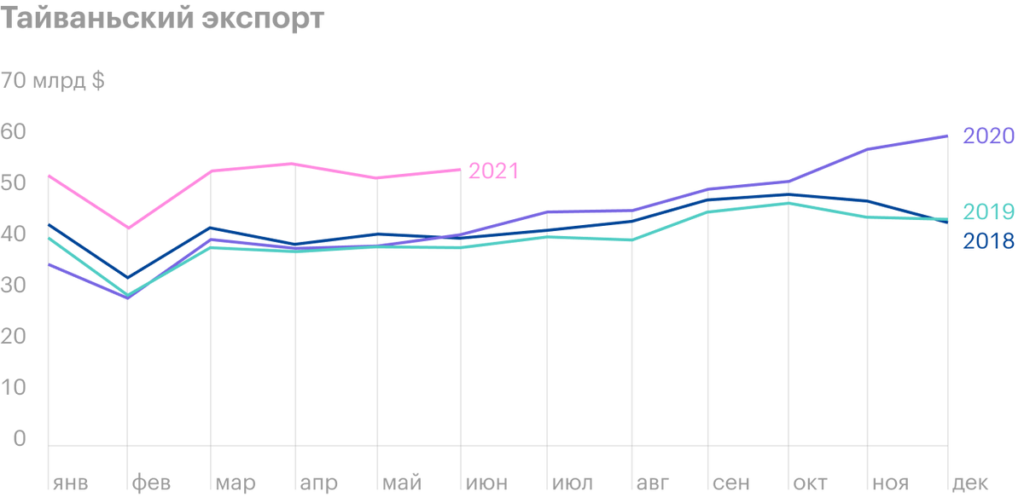

Also worth considering is the increase in production in Taiwan., as China is a major market for Cree. The Taiwanese economy is closely tied to the Chinese, and the structure of Taiwan is distinguished by a large proportion of high-tech manufacturing enterprises, which are perfectly integrated into the supply chains of Chinese electronics manufacturers on the continent. So the growth of industrial and export indicators of the island, probably, signals an increase in orders for Cree in China.

Something about perspective. The end users of the company are generally considered very promising - this is the field of telecommunications and the automotive industry.. In the case of telecoms, the company can look forward to an increase in demand due to the huge investments of the respective companies in the development of 5G infrastructure. This can be seen from the reports of the largest American telecoms and simply from the development of the Internet of things..

Transport around the world is becoming more voracious in terms of electronics, among other things and because of the Internet of things. But, certainly, electric cars require even more chips - and demand from this sector will grow. Even amazing, that Cree does not promote itself from this side - as a supplier of critical parts for the economy of the future.

Certainly, for the company, this all means good prospects for revenue growth, but, it seems to me, much more important, that investors will pump Cree quotes. Normally, because, what is "promising", and it will start, as soon as companies spend on 5G and the production of electric cars become significant enough.

Can buy. Given the above points, the company may well be bought, despite losses, larger enterprise. Cree's share price has fallen by a third this year., and therefore it can be bought relatively inexpensively: its capitalization is 10.17 billion dollars. Against the backdrop of planned spending on the construction of new plants - TSMC alone has $ 100 billion over three years - a possible purchase of Cree, say, $12bn looks like a not-so-big deal.

Certainly, we can't be sure, what Cree will buy soon, but overall it's a good time to buy it..

What can get in the way

Concentration. According to the report, familiar to us Arrow gives 15% Cree revenue. Unlikely, that Arrow decides to take and start twisting Cree's arms: Arrow is a regular reseller with extremely small margins. But logistical disruptions and delivery difficulties can play a negative role and not be reflected in Cree's reporting in the best way..

Quarantine. Coronacrisis had a bad effect on the company's business in tactical terms: disruption of supplies, plant closures and higher production costs. Although it indirectly caused a semiconductor shortage, which is now creating a positive environment for Cree. The likelihood of a new quarantine across the planet is very high, so you have to be ready for it.

Unprofitableness. The company has to invest heavily in equipment upgrades, so now she is unprofitable. Losses will end approximately in 2023 - this is not at all soon. Lack of profitability guarantees stock volatility, and makes it difficult to get loans. The latter is especially important, Considering, that rates will rise soon.

The company has over $1.25 billion in debt.. And although the amount at the disposal of Cree covers the most urgent debts, worth keeping in mind, that the company's operating activity is unprofitable. Well, with unprofitability, the risks of bankruptcy always loom nearby. What if there is no bankruptcy?, then the company's quotes can still suffer greatly after the news about the rate increase: the company's dependence on available loans is no secret to anyone.

Politics. Like other suppliers of high-tech products, Cree may face, that the US government will interfere with its Chinese business. This, certainly, will have the worst effect on reporting.

What's the bottom line?

Take shares on 88,06 $, and then there are two options:

- wait for growth to 100 $. Think, that we will reach this level within the next 14 Months;

- keep shares next 4 of the year, Expecting, When will the company break even?, and investors will begin to actively pump up shares of component suppliers "for promising sectors". Think, that in this case we can expect a return to the level 128 $, - so much for these shares were asked back in February.

The probability of buying a company by someone seems to me equally possible in both cases.. But investors should keep in mind the company's unprofitability, even if this unprofitability is supposed to have a deadline.