Now we have a speculative thought: take the securities of the IT consulting organization Cognizant Technology Solutions (Nasdaq: CTSH), to receive income on the inevitable growth of the company's income.

Growth potential and duration : fourteen percent for 14 Months; eleven percent per annum for fifteen years.

Why stocks can go up: computer scientists are used to living in a big way and this will not end soon.

How do we act: we take shares on 77,01 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

The company is dedicated to serving the IT needs of companies: from application development and integration to infrastructure services and maintenance of business activities.

In accordance with the annual report of the company, its revenue by types of customers and industries served is distributed as follows:

- Money Services - 33,8 %. Service of banking and insurance companies. The sector's operating margin is 25,8 % from its proceeds.

- Public health protection 29,1 %. Treatment centers and those, who is engaged in R&D in the field of medicine. The sector's operating margin is 28,5 % from its proceeds.

- Products and Resources - 22,2 %. Retail, consumer products, creation, logistics, energetics, Housing and communal services, passenger transportation and cordiality branch. The sector's operating margin is 29,2 % from its proceeds.

- Communications, media and technology — 14,9 %. The sector's operating margin is thirty-two percent of its revenue.

Revenue by contract type:

- Consulting and technology services — 61,14%.

- Outsourcing - 38,96%.

Revenue by country and region:

- North America - 75,6%.

- Europe - 17,94%. UK gives 8% from segment revenue, the rest is in continental Europe.

- Other, unnamed countries and regions - 6,46%.

Arguments in favor of the company

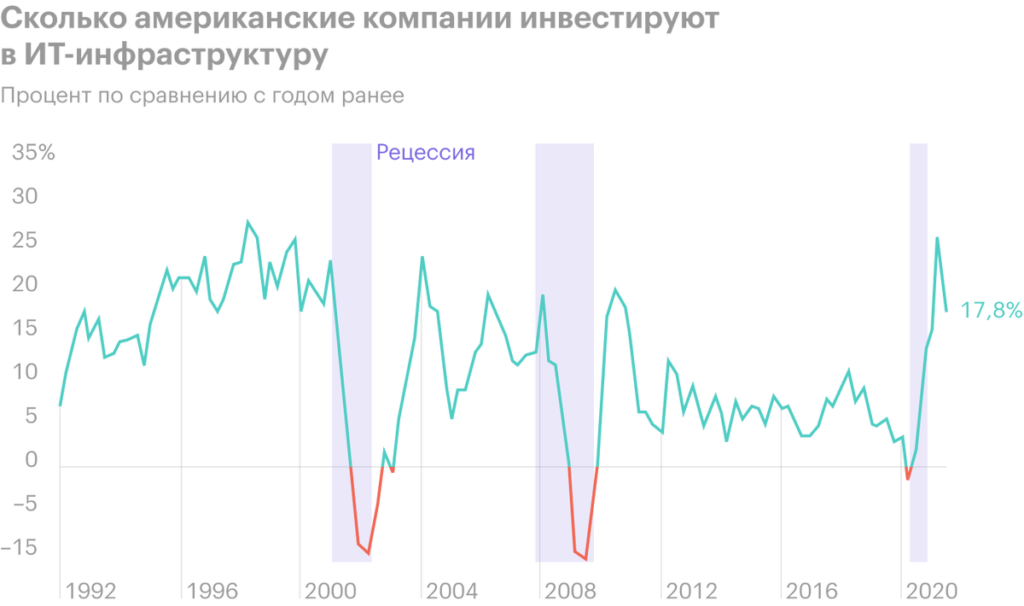

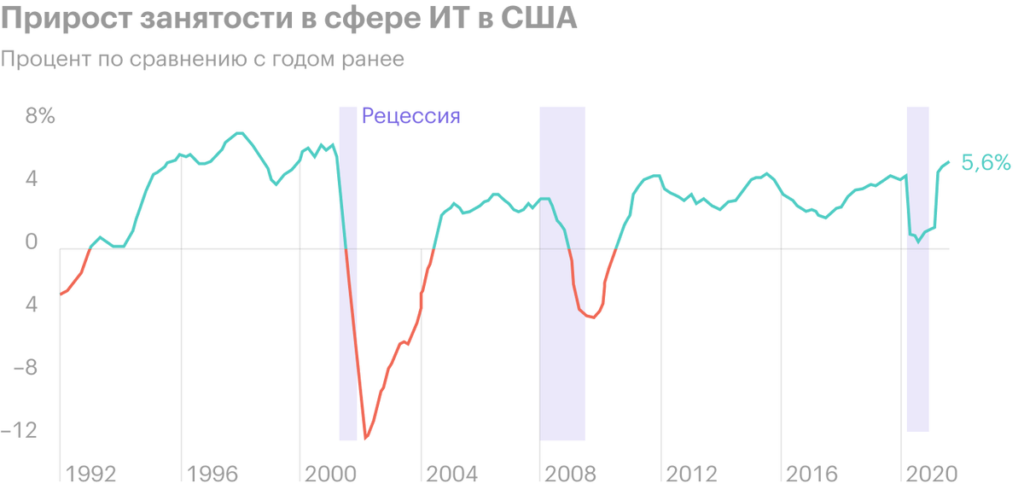

IT people never live in poverty. In the short term, Cognizant favors an increase in spending on computing equipment and IT services by US companies. The pandemic has affected: now everyone needs to digitalize many aspects of business. And in the long run, Cognizant plays into the hands of, that American companies began to spend more on IT assets, than material even before the pandemic, - and this growth in spending will stop only in the event of a thermonuclear war. Modern civilization and economy are too dependent on high technologies - and this dependence will only grow. Therefore, the Cognizant business will perform well in the long run..

Price. Compared to most competitors, the company is not very expensive: she has P / It's about 24,43. So it is quite possible to count on the growth of shares here.: business is very worthy.

What can get in the way

Payouts. The company pays 96 cents of dividends per share per year is about 1,25% per annum, - what she spends 506.88 million dollars a year - less than a third of her profits over the past 12 Months. Basically, there is enough money at the disposal of the company to cover its urgent debts. But I think, that the company will spend a lot of money on expanding and modernizing its business, and therefore dividends, in theory, can cut. Spending on the acquisition of new divisions from the company has been at a very high level in recent years..

"What an honor, when there is nothing to eat ". Digitization by digitization, and the new quarantine can adjust the plans of companies in terms of expenses, including for IT infrastructure within 1-2 quarters. All this is superimposed on the unhealthy rapid growth of the market in the middle of a pandemic.. So a little investor disappointment in the company's quarterly results could send these stocks disproportionately down..

What's the bottom line?

We take shares now by 77,01 $, and then there are two options:

- wait, when stocks exceed historic highs and rise to 88 $. Think, that we will reach this level in the next 14 Months;

- hold shares 15 years.