Now we have a speculative thought: take shares in the supplier of products and services for pharmaceutical manufacturers Catalent (NYSE: CTLT), to earn income on the growth of the company's business.

Growth potential and duration : fifteen percent for 14 Months; twelve percent a year for fifteen years.

Why stocks can go up: the hysteria around a severe epidemic will not soon subside.

How do we act: take shares at the moment 133,86 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

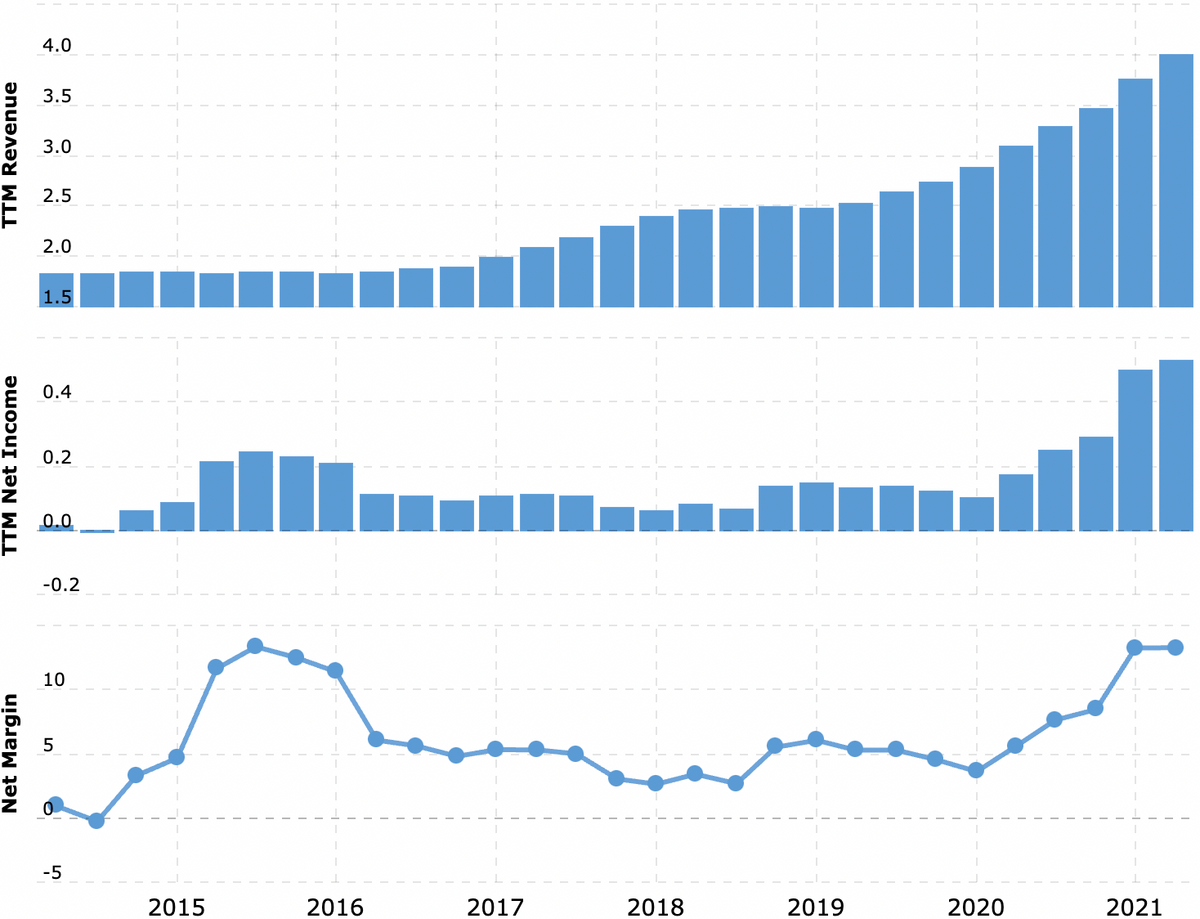

The company produces solutions in the medical field. Customers – usually, these are drug companies – they give Catalent part of their own production and R&D. The company also provides services in this industry.. According to the report, the company's revenue is distributed as follows.

Biology - Forty-eight percent. Development and creation in the field of cell therapy, viral gene therapy, development of pharmaceutical forms. Sector EBITDA margin — 31,53 % of the sector's revenue.

Soft-gel and oral technologies - twenty five percent. Development and creation of pharmaceuticals in the form of pills. Sector EBITDA margin — 23,41 % of the sector's revenue.

Oral and special solutions - seventeen percent. Analysis and creation of pharmaceuticals, as in the form of pills, and in powder form. Sector EBITDA margin — 23,32 % of the sector's revenue.

Supply services - ten percent. These are logistics services, which Catalent provides to companies, who have done research in a clinical setting. Sector EBITDA margin — 27,62 % of the sector's revenue.

In fact, in the first three segments, the company provides drug manufacturing services — 48% revenue — and R&D — 44% company revenue. The company's clients are representatives of the pharmaceutical industry: AstraZeneca, Bristol-Myers Squibb, GlaxoSmithKline, Johnson & Johnson, Modern, Pfizer and others.

According to the company's presentation, geographically, the revenue is split as follows:

- USA - 60%.

- EU countries — 32%.

- Other, unnamed countries - 8%.

Arguments in favor of the company

The Beginning Is the End Is the Beginning. For the year, the revenue of the largest segment of the company - "Biology" - increased by 151% thanks to Catalent's participation in a variety of programs, related to coronavirus research, development and production of drugs for it. Already now it is possible to determine, that this is a very promising area of activity for Catalent.

Available data on the effect of vaccines and the epidemiological situation allow us to make certain predictions. They're like that.: quarantine will never end. Vaccines then work, then do not act against coronavirus, then act, but not everyone, against new strains they either act, whether they don't work, whether they act, but who's lucky?. On news and analytics, consensus is visible only in one: the entire population should be injected and as often as possible, and the emergence of new strains and diseases is inevitable.

Taking into account, frankly,, controversial results of vaccines against new strains, probably, scientific research in this area will also take place constantly. After a severe crisis of the end 2020 - Beginnings 2021 with its shortage of vaccines, logistics and production problems, it is logical to expect, that now spending on R&D and production in the field of drugs for dangerous infections will be preventive, not situational. All this will drag on for a very, very long time.. With little downturns, but in general, the degree of tin will stay at a level much higher than the era before the pandemic.

In the case of Catalent, this means, that the company and its shareholders can expect new strains of coronavirus. As well as new viruses - and everyone will have 20 strains and 30 waves. For the most marginal segment of the company, this will be a big plus.

Scoundrel all to the face. According to the report, no client gives the company more 10% revenue and no other type of goods gives more 8% proceeds. It's good, because the loss of one major customer will not greatly spoil the company's reporting.

The company's Soft Gel & Oral Technologies and Oral & Specialty Solutions segments have been somewhat affected by the fall in demand for conventional medicines due to the pandemic.. But the fall was not strong, And, which is much more important, the presence of these segments will insure the company during periods of "thaw" and "shift change". Hypothetically, when humanity will defeat the coronavirus, related Catalent revenues will fall along with quotes - until a new disease appears. So the presence of segments, not directly related to coronavirus, is also a plus for the company..

Well, the fourth segment, related to the logistics of medical laboratories, will grow indefinitely, while the modern patent system is in effect. Pharmaceutical companies are forced to constantly invest in the development of new drugs, to bring a new drug to market before, How will a patent expire on an already marketed drug?. After all, revenues from this drug will fall dramatically, because competitors will be able to produce cheap analogues. So even without the coronavirus, the company looks like a good investment option for the long term..

Can buy. A highly likely scenario, in which the company will be bought by some pharmaceutical giant in order to optimize its supply chains - and simply for the sake of business diversification. Or maybe, it will be a supplier of products and solutions for medical development like Danaher - for the latter it would be a logical decision. Catalent is relatively inexpensive: capitalization - 22,8 billion dollars and P / E — 43, - so this option is quite realistic.

What can get in the way

Accounting. Company 4,838 billion dollars in arrears, out of which 1,196 billion needs to be repaid within a year. Basically, a lot of money at her disposal: 896 million in accounts and 1,012 billion in arrears, but soon Catalent will buy Bettera for a billion dollars - partly with its own money, and partly through loans. As a result, the burden of debt for the company will become heavier.. Generally, you don't have to worry about the company going bankrupt.: given the success of this business, this option is unlikely, although it cannot be completely ruled out.. But there's a danger, what investors will decide, that you should not invest in companies with large debts in the period before the increase in rates and rise in the cost of loans.

Price. Target market of the company, according to her own estimates, is about 60 billion dollars. Catalent occupies this market 6,66%. But with its capitalization 22,8 billion dollars worth 38% market. Understandably, that this market will grow, but some investors may wonder, why is the company so expensive, and even with such debts. Moreover, Catalent shares are now at historical highs..

News Addiction. Periodically, humanity will win "tactical victories" over the pandemic, the situation may even improve a little. This will affect the news background. Here, for example, in the EU no longer sees the need for additional injections from the virus. Such news will have a negative impact on Catalent shares, especially since they have risen by 119%.

And good news is inevitable., even if there are no reasons for their appearance. From the description of the plague in Athens during the Peloponnesian War, Thucydides suggests the conclusion, that when the epidemiological situation looks completely gloomy and hopeless for the masses, then these masses begin to actively rampage. Therefore, the hysteria around the pandemic will be maintained at an optimal level., so that it seems like "there was order", but also so that “the thread is not torn off” and looting and riots with massacre do not begin, as it was in ancient Athens.

Actually, that's how it's happening now: the level of gloom is more or less balanced, especially when compared to the first half. 2020. For example, hiking in crowded places and trips are fraught with a lot of problems, but not completely banned - and for them it seems like you don’t even need to get special permission. It even got easier now, how, say, in May 2020.

In the case of Catalent, this means, that the shareholders of the company need to be mentally prepared for, that the company's shares will periodically fall on the background of news about, that "there are fewer people sick" or that "the omicron strain is receding". At long distances, the effect of such news will be invisible., but seasonal downturns are possible.

What's the bottom line?

We take shares now by 133,86 $. And then there are two options:

- wait 155 $. Think, that we will reach this level in the next 14 Months;

- hold shares 15 years. This is the most preferred option., since over long distances the probability of buying a company is greatly increased and the negative effect of news is greatly leveled.