Now we have an extremely speculative thought: take shares in software manufacturer C3 AI (NYSE: TO THE), to get income on their rebound after a powerful fall.

Growth potential and duration : 22,5 % behind 15 Months; thirty eight percent in two years; 249% fifteen years.

Why stocks can go up: AI is a promising topic.

How do we act: we take at the moment 50,61 $.

An idea for this company was offered by our reader Konstantin Utolin in the comments to the analysis of DoorDash. Suggest your thoughts in comments.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

The company makes software in the field of artificial intelligence. C3 AI provides a set of solutions for other organizations to create their applications, which operate on the basis of AI.

At the same time, these applications can deal with a bunch of different things.: from security surveillance and customer flow management to data exploration and maintenance. The company's software finds application in extremely diverse industries: in the extraction of natural resources, Production, Logistics, Housing and communal services, monetary services, Aerospace & Defense. How C3 AI software works, can be carefully read in her annual report. In accordance with the same annual report, the company's revenue is divided as follows.

Subscription Eighty-six percent. Subscription of the company's customers to access its software in the cloud. The sector's gross margin is eighty percent of its revenue.

Prof services - Fourteen percent. Software setup, education employees and application development services. The sector's gross margin is forty-nine percent of its revenue.

Revenue by country and region:

- USA - 65%.

- Other North American countries — 0,38%.

- Europe, Middle East and Africa - 30,58%. France and the Netherlands each 12% from the entire revenue of the company.

- Asian-Pacific area - 3,27%.

- Other regions — 0,77%.

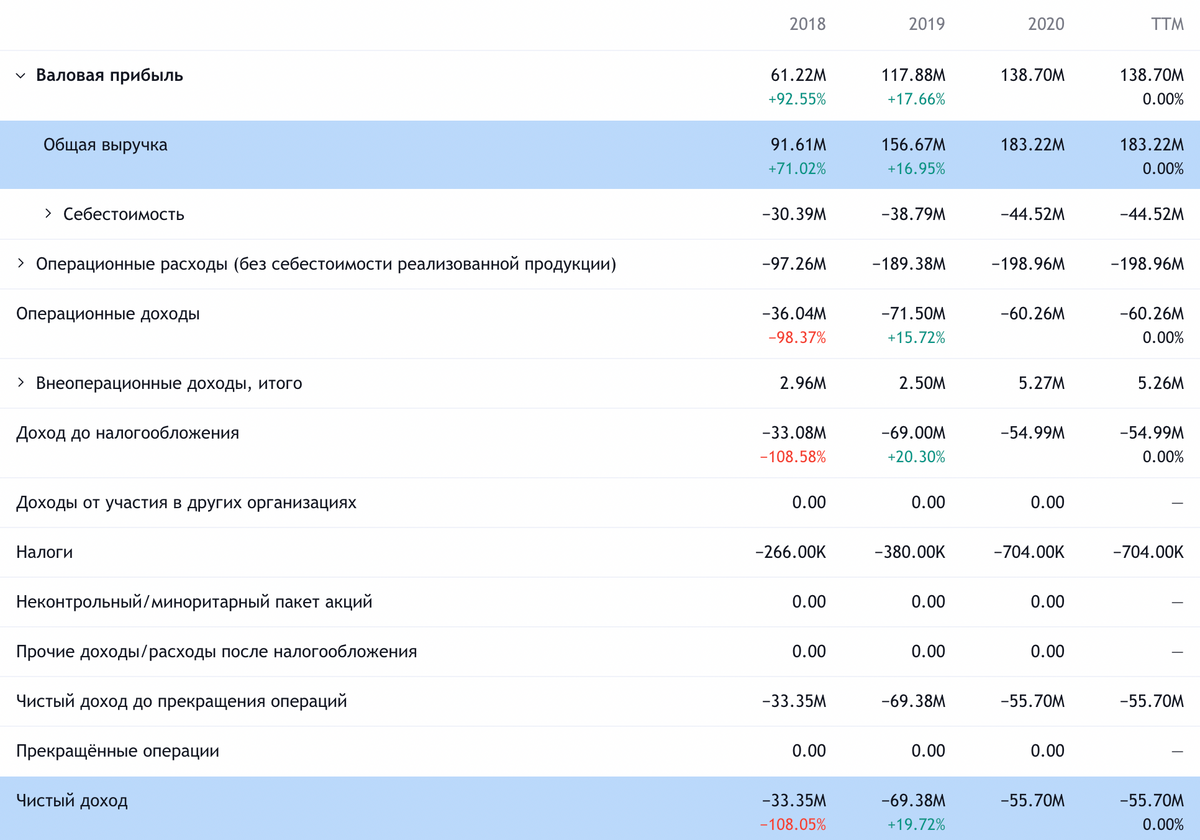

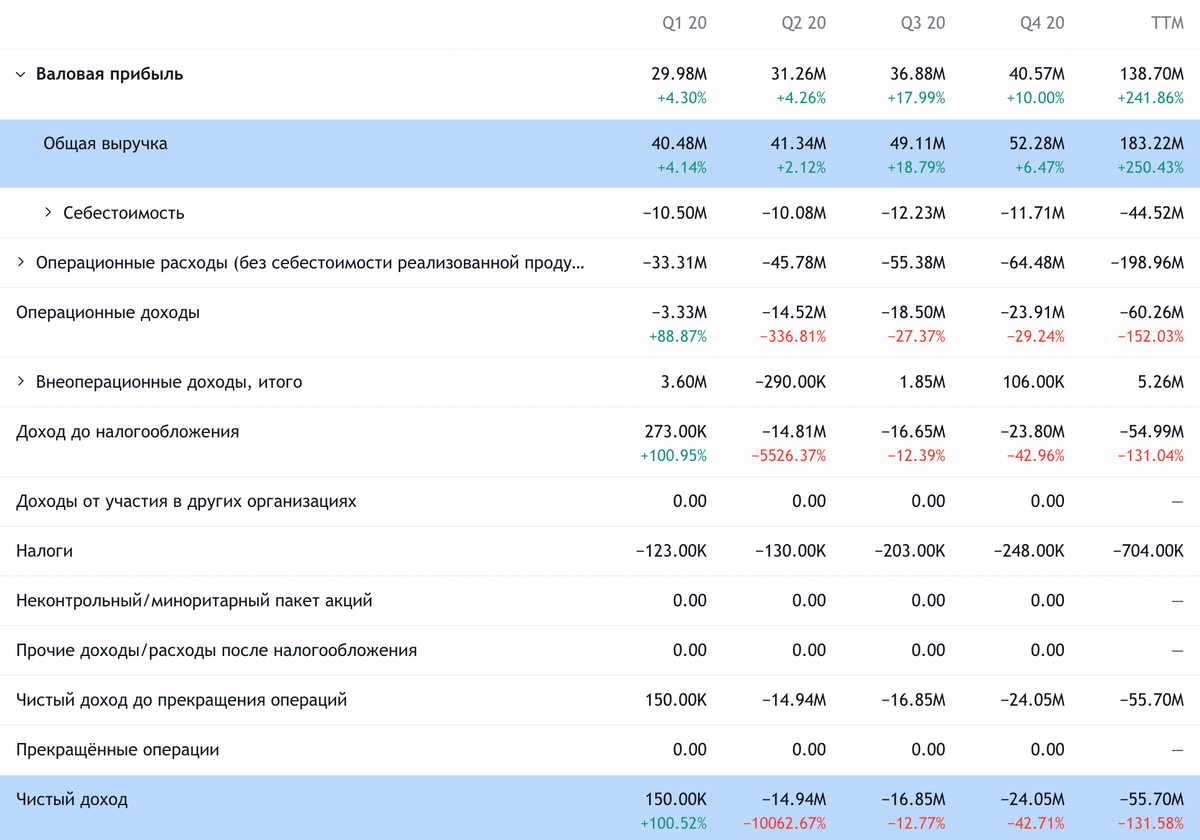

The company is unprofitable.

Arguments in favor of the company

Fell down. Over the past 10 months, the company's shares fell by 70% relative to its historical peak. Now they are very close to the price., which they asked for 8 December 2020 during the IPO, — 42 $.

Baker Hughes Oilfield Services Enterprise, which also acts as a shareholder and major customer of C3 AI, recently sold a large volume of shares. Looks like, many investors decided, what is this signal, that things are going badly in C3 AI, — the value of shares has decreased significantly. But, to paraphrase Freud from an anecdote, "sometimes a sale is just a sale". Baker Hughes is a loss-making company, and shares C3 AI its management, obviously, sold because, that money was needed.

The main reason for the fall in C3 AI quotes can be considered a combination of unprofitability, high cost and recent quarterly results. They were not much better than investors' expectations., and unprofitable startups are usually expected to have cosmic revenue growth rates.. Without denying the sins of the company, it can be assumed, that the stock will rebound.

Robots are everywhere. As in the idea of UiPath, an important growth driver for the company – the process of labor automation around the world. The breadth of application of C3 AI software in a wide variety of industries is quite conducive to this.. And now the growth of the company is facilitated by an increase in wages and a shortage of workers in the United States..

Mysterious iron. Now in the world there is a big stir with everything, what is related to AI. In particular, the largest technology consulting companies persistently impose on enterprises the "integration of AI into the workflow". So we can expect A large number of companies to receive C3 AI solutions.. In part, this will be dictated by the objective needs of the corporate sector., but to a very, very large extent, the decision on the development of AI applications will be made by the managing directors.. And it is possible, what will these decisions be, based on arguments along the lines of "I have a son of Tuta TEDx watched... In general, He speaks, AI is a topic... let's also do AI in the company: will calculate the optimal level of frequency of use of the coffee machine ".

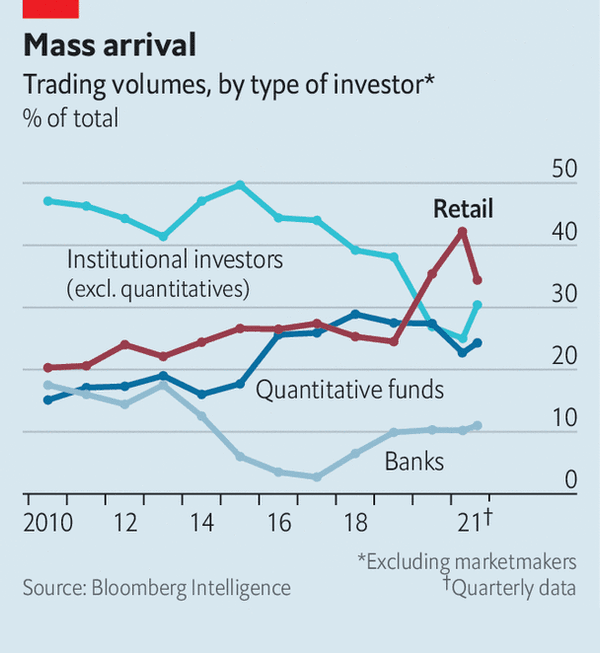

So the probability is very high, what AI applications will soon do even those, who doesn't need them, - Just because, that "fashionable and progressive". For the same reason, I would expect an influx of retail investors into the company's stock., who like everything bright and shiny. Given their great influence on the stock exchange, such investors will be able to pump up C3 AI shares quickly enough: company capitalization is only 5,23 billion dollars.

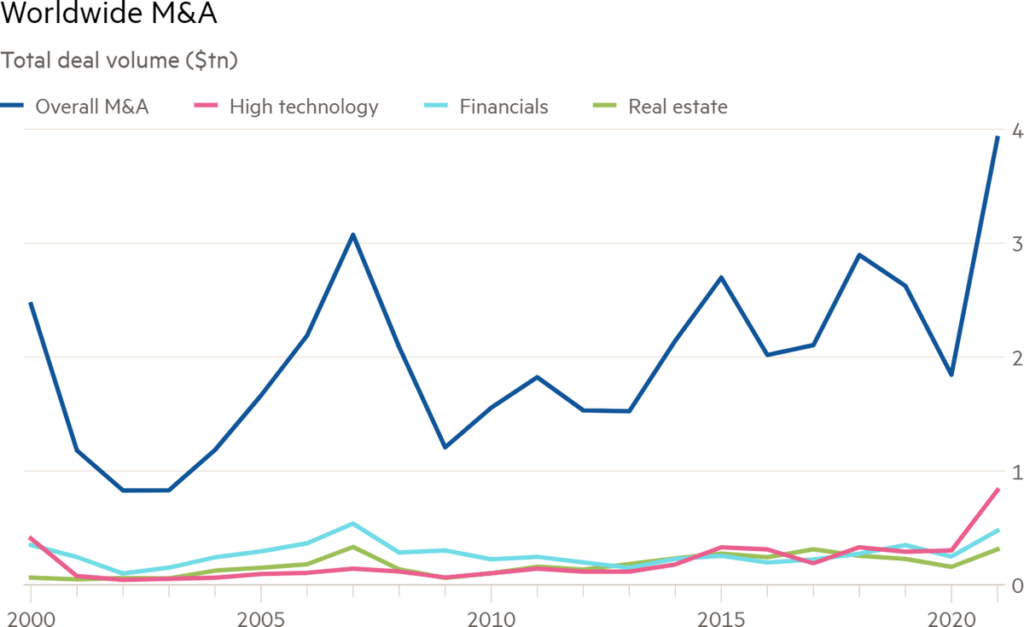

Can buy. Promising direction, small capitalization and the recent fall in stocks are all reasons for, for someone larger to buy the company. Amidst a sea of high-tech mergers and acquisitions, the purchase of C3 AI will not be the largest transaction.. By the way,, the founder and director of the company Thomas Sibel is already in 2006 sold his startup to Oracle for 5,8 billion dollars. Sibel has good connections in Silicon Valley, and it may well find a good buyer for C3 AI.

What can get in the way

Concentration. According to company report, two large resellers of the company's solutions account for 31% her proceeds. Two of her direct clients - Baker Hughes and Engie - give more than 10% company revenue. Changing relationships with one of the major resellers and customers can negatively affect the company's reporting..

Adequacy of the assessment. There are different estimates of the company's target market capacity. The most conservative, which includes only SOLUTIONS in the field of AI development for enterprises, — 18 billion dollars. In this case, it will be, what does C3 AI take 1% market - and at the same time it costs 29% market. Most optimistic estimate, which takes into account all forms of software and applications for enterprises, - This is 174 billion dollars. In this case, you will get, what does C3 AI take 0,1% target market, and the company's capitalization is 3% from its volume. All in all, even after the correction, the company is still very expensive.. So it's worth being prepared, that quotes will storm.

Unprofitableness. Unprofitable company guaranteed stock volatility. Its quotes may fall from the additional issue of shares, and bankruptcy is always a real prospect. Although some analysts recall, that the company has a lot of money at its disposal, which will be enough for years of work, and the debt of the C3 AI is very small - but you should not count on it much.

Probably, C3 AI will expand at the expense of different startups. And the average cost of startups at the late venture stage of development is now 914 million dollars - almost twice as much, than a year ago. This means, that in the process of expanding C3 AI will have to fork out a lot of money. And so you can prepare for that., that the next few years will be unmerciful to the company's accounting.

What's the bottom line?

Shares can be taken now by 50,61 $. And then there are the following options:

- wait 62 $, who asked for these actions in early July. Think, that we can reach this level in the next 15 Months;

- wait 70 $, which these shares were worth in early June. Here, probably, will have to wait a couple of years;

- wait for stocks to return to historic highs in December 2020 — 177 $. Here you should focus on 15 years. During this time, the company will succeed to a sufficient degree., to justify its value and become a major player in the most important niche, which no one will reproach for an abnormal price, how, for example, worked out with Autodesk. Or the company will go bankrupt, trying to achieve this. All in all, during this time, as Khoja Nasreddin said in a similar case, "one of the three of us is bound to die — or the emir, or ishak, or me".

Should be understood, that this idea is speculative and it is necessary to invest in it, only if you are willing to tolerate volatility and are generally aware of, that this is a risky startup.