<img class="aligncenter" src="/wp-content/uploads/2021/08/investideja-amphenol-potomunbspchto-nado-3a37913.png" alt="Инвестидея: Amphenol, потому что надо" />

Today we have a moderately speculative idea.: take stock of sophisticated electronics manufacturer Amphenol (NYSE: APH), in order to capitalize on the growth in demand for its products.

Growth potential and validity: 14% behind 14 Months; 11% per year for 10 years. All excluding dividends.

Why stocks can go up: there is a demand for the company's products.

How do we act: take now 73,55 $.

<h2 class='subheading'>Без гарантий</h2> <p class='paragraph'>Наши размышления основаны на анализе бизнеса компании и личном опыте наших инвесторов, но помните: не факт, что инвестидея сработает так, как мы ожидаем. Все, что мы пишем, — это прогнозы и гипотезы, а не призыв к действию. Полагаться на наши размышления или нет — решать вам.</p><p class='paragraph'>Если хотите первыми узнавать, сработала ли инвестидея, подпишитесь на Т—Ж в «Телеграме»: как только это станет известно, мы сообщим.</p><br /><h2 class='subheading'>И что там с прогнозами автора</h2><p class='paragraph'>Исследования, например вот это и вот это, говорят о том, что точность предсказаний целевых цен невелика. И это нормально: на бирже всегда слишком много неожиданностей и точные прогнозы реализовываются редко. Если бы ситуация была обратная, то фонды на основе компьютерных алгоритмов показывали бы результаты лучше людей, но увы, работают они хуже.</p><p class='paragraph'>Поэтому мы не пытаемся строить сложные модели. Прогноз доходности в статье — это ожидания автора. Этот прогноз мы указываем для ориентира: как и с инвестидеей в целом, читатели решают сами, стоит доверять автору и ориентироваться на прогноз или нет.</p><p class='paragraph'>Любим, ценим,<br />Инвестредакция</p>

What the company makes money on

The name sounds like something chemical, but in fact it is an industrial enterprise. The company designs and manufactures high-tech components for manufacturing plants.

According to the company's annual report, revenue is divided into the following types of goods:

- connected devices - 95,7%. Products and solutions for signal transmission and reception, in particular antennas, Sensors. Segment operating margin — 21,15% from its proceeds;

- cables and solutions in related industries — 4,3%. Segment operating margin — 9,59% from its proceeds.

Most of the company's products are 80,87%, supplied directly to manufacturing plants. 19,13% the company sells its products to resellers-distributors.

The company painted on the tenth slide of its presentation, which markets give her how much revenue:

- industry - 22%;

- automotive industry 17%;

- mobile devices - 15%;

- IT and data transfer - 21%;

- mobile networks - 6%;

- broadband connection - 4%;

- defense industry - 12%;

- commercial aircraft industry 3%.

Revenue by region:

- Asia - 46%;

- North America - 33%;

- Europe - 18%;

- the rest of the world - 3%.

Only two countries are named separately in the report.: USA - 27,83% of the company's total revenue and China - 28,99%.

<img class="aligncenter" src="/wp-content/uploads/2021/08/investideja-amphenol-potomunbspchto-nado-bfc0535.png" alt="Инвестидея: Amphenol, потому что надо" /></p>

Arguments in favor of the company

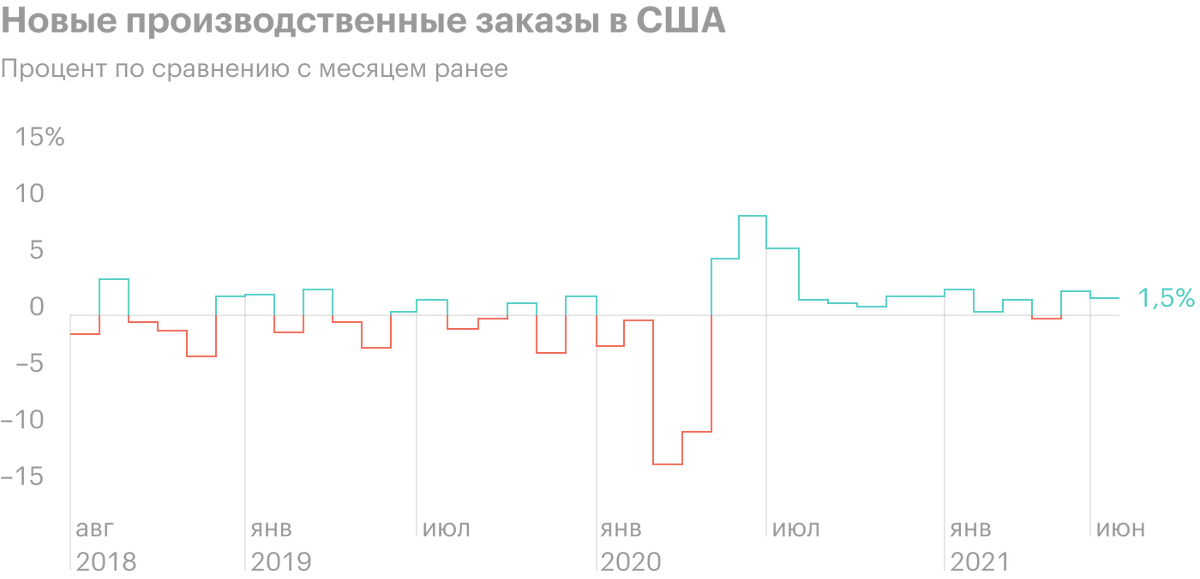

Order now and then. U.S. industrial orders rise above expectations, and while there are no prerequisites in the world for a reduction in industrial production in the main production centers. So the company can count on an increase in orders in the near future..

But in the long term, Amphenol can hope for a stable increase in orders.. She does, in fact, electronic filling for high-tech devices, and modern industry is becoming more voracious in this regard - which is very noticeable in the automotive industry, where a shortage of semiconductors leads to a shutdown of factories. Therefore, in the long term, the company can also count on positive, because its products will remain in great demand - which can only be prevented by a Luddite revolution or a thermonuclear war with a rollback of humanity in the Middle Ages. Even amazing, that Amphenol did not say a lot of difficult words about 5G and other Internet of things in the report, because it is in these sectors that the company, in fact, and working.

<p><img class="aligncenter" src="/wp-content/uploads/2021/08/investideja-amphenol-potomunbspchto-nado-611bd6c.png" alt="Инвестидея: Amphenol, потому что надо" /></p>

What can get in the way

Wrecked. Company, according to the latest report, 8,781 billion dollars in arrears, of which 2.996 billion must be repaid within a year. It also pays dividends 0,56 $ per share per year, this 0,79% per annum. It takes her 349.44 million a year to do this - almost 25% from its profits over the past 12 Months.

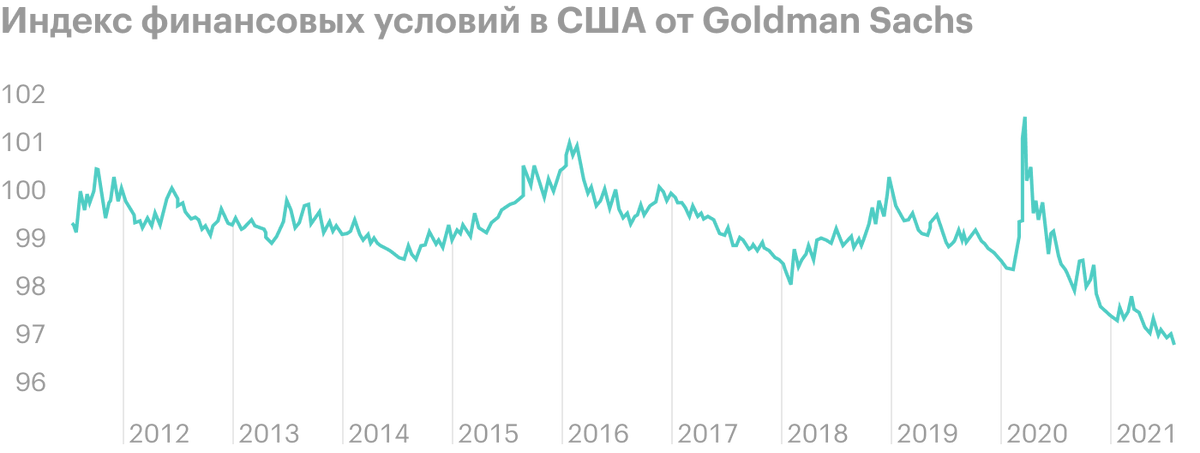

Basically, money at her disposal should be enough for everything: it has 1.209 billion in accounts and has debts of counterparties for 2.072 billion - a total of 3.281 billion. And if it's not enough, then the company can easily borrow at a not very high percentage, Considering, how comfortable are the conditions for loans in the USA today. But if you take into account the upcoming rate hike, it's not very good.

Now the company is actively spending on expansion - over the past 50 years Amphenol bought 50 companies - and therefore can cut payments simply for the sake of this noble goal.

It is unlikely that shareholders will be so fundamental payments in 0,79% per annum, that they will start selling shares in the event of a cut in dividends, but it is worth bearing in mind this moment.

China. China is a major market for the company, and this can bring problems in two areas:

- slowdown in industrial growth in China may affect the company's orders. There is no talk of a terrible reduction: there is growth, just slows down. Rather it may turn out like this, that the growth in orders from China may not be so large, as we would like;

- Amphenol exports advanced technology products to China and may be subject to a possible U.S. ban on such exports. This is a permanent risk.

What's the bottom line?

<

p class=’paragraph’>We take shares now by 73,55 $. And then there is 2 Options:

- wait for the stock to rise to 84 $. Given the positive environment for the company, its not very high price and P / E 32,6, I consider this level achievable within the next 14 Months;

- hold shares 10 years, to see, how the company realizes its full potential.