Today we have a moderately speculative idea: take stock of chemical manufacturer Advansix (NYSE: ASIX), to capitalize on the growth in demand for the company's products.

Growth potential and validity: 12,5% behind 14 Months.

Why stocks can go up: because, as the great chemist Walter White said in Breaking Bad, “Chemistry is the science of growth, disintegration and transformation". There is demand for the company's products, she can earn.

How do we act: we take shares now by 29,32 $.

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

This is a chemical industry enterprise. According to the report, Advansix's revenue is broken down by the following chemical feedstocks:

- Nylon — 24%.

- Caprolactam — 19%.

- Chemical substances - 32%. Acetone, phenol, cyclohexanone give 80% segment sales.

- Ammonium sulfate - 25%.

Advansix has a presentation, where, without specific figures, there is information about the final consumption areas of the company's products. Slightly more than a quarter - fertilizers and agriculture, a little less than a quarter - construction work, about 15% occupies the production of plastic, about 10% is the production of solvents, the rest is divided in different shares between the production of adhesives and coatings, packaging materials and the mysterious "other".

Geographically, revenue is allocated as follows:

- USA - 76,94%.

- Other regions — 23,06%. Here 52,43% provided by Canada and Latin America.

- Asia - 25,84%.

- Europe, Middle East and Africa - 21,73%.

Arguments in favor of the company

"Concrete mixer prevents concrete". All is well in the main markets of the company: the profitability of agriculture is increasing, the construction industry is full of life, and other sectors are fine. This is evident in the company's latest report.. I'm waiting, that with strong consumer activity in America and beyond, the company's sales will grow even more.

Price in every sense. The company has a relatively small P / E 12,72, which provides room for further growth. And the company has a very small capitalization - only 822,46 million dollars. I do not think, that it will become a new "memorial action", but still, a small size here can play an increase in quotes - just the effect of the influx of investors into these shares will be noticeably felt due to the small size of the company. It can also in theory attract potential buyers..

What can get in the way

Not every concentration in chemistry is useful. According to company report, top ten clients give 43% sales of the company. One of them - Shaw Industries Group - gives 14% company revenue. A change in relationship with one of the company's major customers may adversely affect the company's reporting.

A bit of accounting. Company 768,195 million dollars in arrears, out of which 259,482 million to be repaid within a year. But she doesn't have much money at her disposal.: 14,124 million in accounts and 149,461 mln of counterparties' debts. I have no doubt, that the company will be able to borrow enough money if necessary, but still, one should keep in mind the large debt burden in the context of the upcoming increase in US rates.

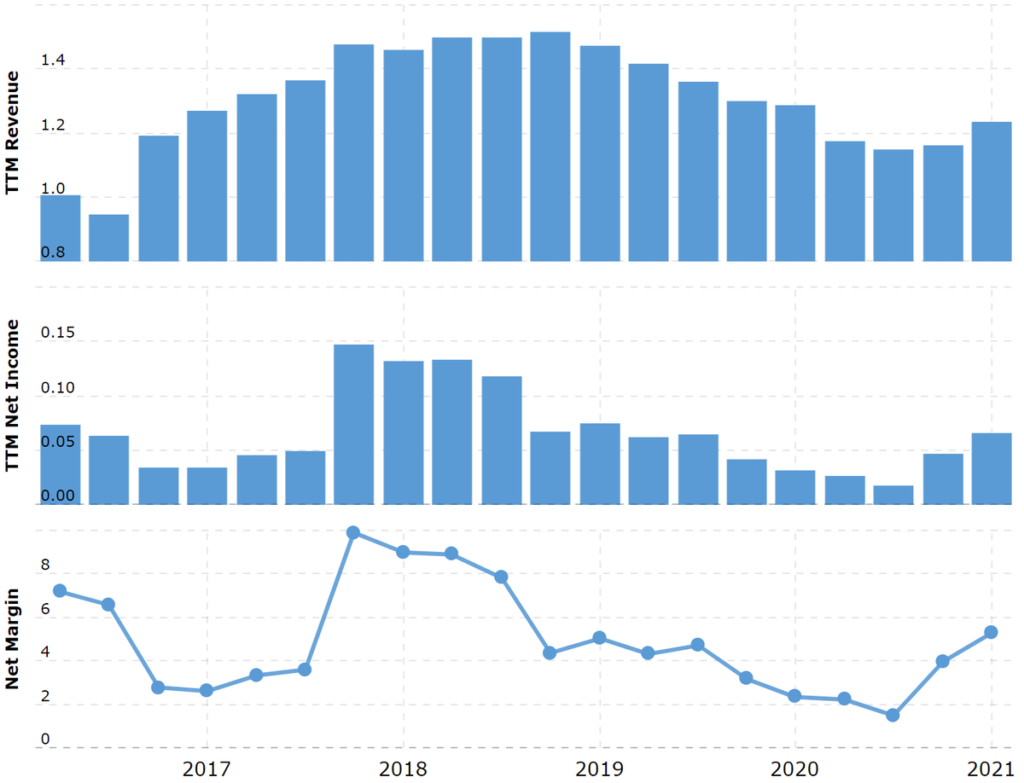

Expendable materials. 76% company's expenses on raw materials - cumene. This raw material is widely used in the oil refining industry.. Given the greater activity of refineries and the growth of fuel consumption in the United States, can be expected, that cumene prices will rise, and this may negatively affect the reporting of Advansix. You should also be wary of rising transport costs.: the final margin of the company is not very high, less 6%, so that logistics costs can give an unpleasant surprise to shareholders.

What's the bottom line?

We take shares now by 29,32 $. Taking into account all the positive aspects, we can expect the share price to rise to 33,5 $ during the next 14 Months.