If you are actively trading, then you have a lot of deals. If you trade correctly, you make a profit. This means that we must pay tax from this profit.. When working through a Russian broker, you do not need to do anything (as a tax agent, he will pay everything for you). But when working through a foreign broker, the situation is different..

Here you will calculate the amount of income and submit 3-NDFL yourself and you will have to attach a report to the declaration. What is the report? Report detailing transactions. The tax looks at it, to understand, how did you calculate the profit. In fact, this is a simple table with a calculation, but prepare her still that headache. Judge for yourself. You will need:

- Collect all trade transactions for the reporting period (for tax, this is a calendar year).

- Raise history for each trade (opening / closing dates, open / close prices, number and size of commissions).

- Consider the transaction currency, determine the ruble exchange rate of the Central Bank of the Russian Federation on the date of the transaction and convert all amounts into rubles.

- Calculate commissions for each transaction in two directions (purchase / sale) and convert them into rubles.

- Consolidate data from different brokers (if they have open accounts).

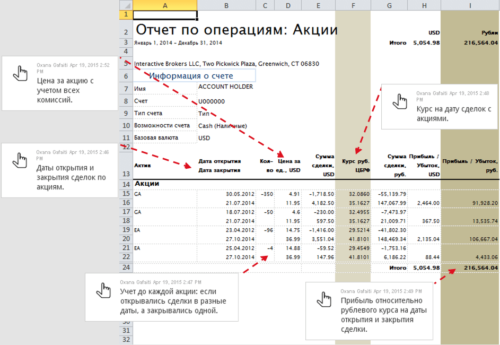

This is how, according to science, taking into account the requirements of the tax authorities, the process of preparing that report should look like, which you must accompany 3-NDFL. If, certainly, want to, so that your declaration is accepted the first time, and did not bombard with questions and did not require clarification. I was not ready to run such a marathon every year when preparing the report.. Therefore, a few years ago, my partner and I created a program, which prepares reports for Interactive Brokers for us. This is what this program does.

- Organizes transactions by date, operations, instruments and types of currencies.

- Calculates income for each transaction, taking into account commissions.

- Recalculates income from transactions at the exchange rate of the Central Bank of the Russian Federation on the date of their completion.

- Prepares data for filling out reports.

The output is multiple reports., prepared in accordance with the requirements of the tax service of the Russian Federation (when developing the program, we engaged a tax consultant and made inquiries to the Ministry of Finance and the tax). The number of these reports depends on your trading strategy.. These can be income statements: from dividends, coupons, distributions, deals with shares, bonds, futures, options and currencies (the program supports all currencies, to which the Central Bank of the Russian Federation sets the course). For example, if you work with stocks, you will get a similar report.

Where am I leading? To that, what if you, as I, trade with Interactive Brokers (if you have another broker, then the preparation of reports for 3-NDFL is agreed individually), you have many trades and profit from them, then I can help you with the calculation of income. Based on my reports, you will pay tax and sleep peacefully. Because you will know: if you need to withdraw money from a broker to Russia, then at any time you can do it and you will not have any problems.

What if the bank has questions?, you will have something to show. You will simply show confirmation of acceptance of 3-NFDL, about the tax you paid and get the money to your account. That's all. This is the recipe for trading abroad without a headache.

What are the deadlines for submitting a declaration?

Income must be declared no later than 30 April of the year, following the expired tax period (paragraph 1 ). Tax must be paid before 15 July of the year (paragraph 4 ). Wherein, working on the foreign stock market, the investor should remember that, that the 3-NDFL declaration is drawn up in rubles and the amount of income received is also reflected in it in rubles (base - point 5 ).

Therefore, all income, denominated in foreign currency, must be converted into rubles at the official rate of the Central Bank of Russia (CB RF). The conversion rate is the rate of the Central Bank of the Russian Federation, established on the date of receipt of income (GO: to find courses currencies for a specific date can be found here).

What documents the investor must submit along with the tax return? Is there an approved list?

How is there no such approved list of documents, and in the Tax Code this list is not regulated in any way. Main, so that the documents provided can confirm the amount of income received for the reporting period. Usually, it is enough to attach the following package of documents to the declaration:

- Certificate or contract, confirming the opening of a brokerage account.

- Report on operations at the broker for the reporting period with information on the amount, currency and date of income (you can prepare such a report in the broker's personal account).

- Settlement of transactions with conversion into rubles for each transaction (An example of such a report can be found here).

- An explanatory note for the inspector explaining the calculation of the tax base and the distribution of expenses.

What is the format for providing these documents? How many copies are needed, do i need to translate them and notarize the translation?

The documents, compiled in a foreign language, must be translated into Russian. Such translation can be done as a professional translator, and by the investor himself (basis - letter from the Ministry of Finance of the Russian Federation ). Documents must be submitted in one copy, but when submitting the declaration in person, two copies must be made, to keep one for yourself with a mark of acceptance.

Within three months after the submission of 3-NDFL tax checks the completed declaration (GO: its status can be clarified in the IFTS by registration). If the inspector has questions during the inspection, he can call you or send you a written request.

What taxes does the investor pay, holding shares of foreign companies?

Investing in stocks offers two types of income.: from the dividends paid on them and from the increase in their value. When receiving dividends and income from the sale of securities above the purchase price, the investor becomes liable to pay income tax. (GO: in addition, there are also implicit types of profit, for example, the broker can charge interest on the account balance or investment fund, which you are holding, can sell at a profit the securities in his portfolio. These and other transactions are reported on Form 1042-S.. The income received from them must also be entered in the declaration and paid tax on it.).

When calculating taxes for an investor, working in the American stock market, should be aware of the existing between our countries for the avoidance of double taxation. According to this agreement, in the United States, only tax on dividends is withheld from Russian individual investors (at rate 10%), capital gains income is not taxed - its investor calculates and pays independently already in Russia (at rate 13%).

1. Calculation of tax on dividends

To 2014 year inclusive of US dividend tax (10%) exceeded the tax rate, operating in Russia (9%). In this regard, an investor in Russia had to pay tax only on capital gains. However, since 2015 year the tax rate on dividends in Russia is 13%, resulting in a difference in 3% will have to pay extra. Let me explain with an example.

Let's admit, Russian citizen invests in the US stock market, buys shares of foreign companies and receives dividends on them. At the end of the reporting year, they brought him 6 000 Doll. Dollar rate, established by the Central Bank of the Russian Federation on the date of their payment, was 56 RUB/USD. (GO: for simplicity, here is a general course. When filling out the declaration, it is necessary to convert into rubles each receipt from dividends at the exchange rate on the date of their receipt.) Then:

- Amount of dividend income = 336 000 rub. (6 000 Doll. × 56 RUB/USD. = 336 000 rub.).

- Tax withheld and paid outside of Russia = 33 600 rub ((6 000 Doll. × 10%) × 56 RUB/USD. = 33 600 rub.).

- Dividends, received from 1 January 2015 of the year, taxed in the Russian Federation at the rate 13%, that's why: 336 000 rub. × 13% = 43 680 rub.

As a result, in Russia, the investor needs to pay additional taxes in the amount 10 080 rub. (43 680 rub. — 33 600 rub. = 10 080 rub.).

Basis for offsetting tax on dividends, paid outside the Russian Federation, is the report, provided by the broker (). Without this, the tax inspectorate will not offset the tax and then you will have to pay personal income tax to the budget at the rate 13%.

2. Calculation of tax on income from operations with securities

With regard to transactions with securities, then the investor, working in the US stock market, there is a duty to pay tax in the event, if at the end of the year they made a profit. Wherein, as mentioned above, it avoids double taxation and pays taxes only in Russia. The tax rate in this case is 13%. The calculation of the tax amount is carried out on the basis of "income minus expenses".

In other words, the investor can reduce the amount of income by the amount of costs incurred (GO: for example, broker and depository commissions). To do this, he should attach documents, confirming such costs. For example, trading account statement, containing information on income from operations and related expenses (GO: you can prepare such a report in your personal account on the broker's website).

Based on this extract, the investor in free form prepares a detailed calculation indicating the income for each transaction (how to do it, read here). When preparing the calculation, it is important to take into account, if the income was received in more than one amount, and, for example, from different deals on different days, then in this case, income is accounted for separately for each day and recalculated at the exchange rate of the Central Bank of Russia on the date of the transaction. In other words, you cannot combine all income into one amount (GO: as in the case of dividends).

What are the consequences of failure to submit or late submission of the declaration?

If the declaration is not submitted or is submitted late, then the tax office may collect a fine from the investor in the amount of 5% unpaid tax, but not more 30% the specified amount and not less 1000 rubles plus penalties for each day of delay. You can read more about this in . In its turn, in you can find out about liability for non-payment or incomplete payment of tax, and in - about the consequences, arising from tax evasion.

Where and how to fill out the declaration?

Since July 2015 years, the process of filling out and submitting a tax return for individuals has become much easier. Now you can generate and submit 3-personal income tax in electronic form, without visiting the tax office.

3-NDFL: instructions for filling out the declaration for traders and investors

The easiest way to do this is through a special online service "Taxpayer's Personal Account".

You can get into it with the help:

- Site account .

- Portal account .

- Electronic signature key.

Filling out the declaration online

Step 1. Go to the site of the Federal Tax Service and log in to the "Personal account of the taxpayer".

Step 2. In the upper horizontal menu, select the section "Personal Income Tax", and in the drop-down list - the item "Fill in / send the declaration online".

Step 3. On the page that opens, we are exploring the possibilities of the service "Personal account of the taxpayer" and electronic signature. If you do not have an electronic signature, it's worth creating. It will save you time, paper and save you from visiting the post office.

As you can see from the description, service capabilities allow:

- Fill out a declaration in the form 3-NDFL online.

- Upload the completed online declaration to a file for printing and submission to the tax authority in paper form.

- Send the declaration electronically, by signing an electronic signature.

Now we go down to the bottom of the page and press the blue button "Fill in a new declaration".

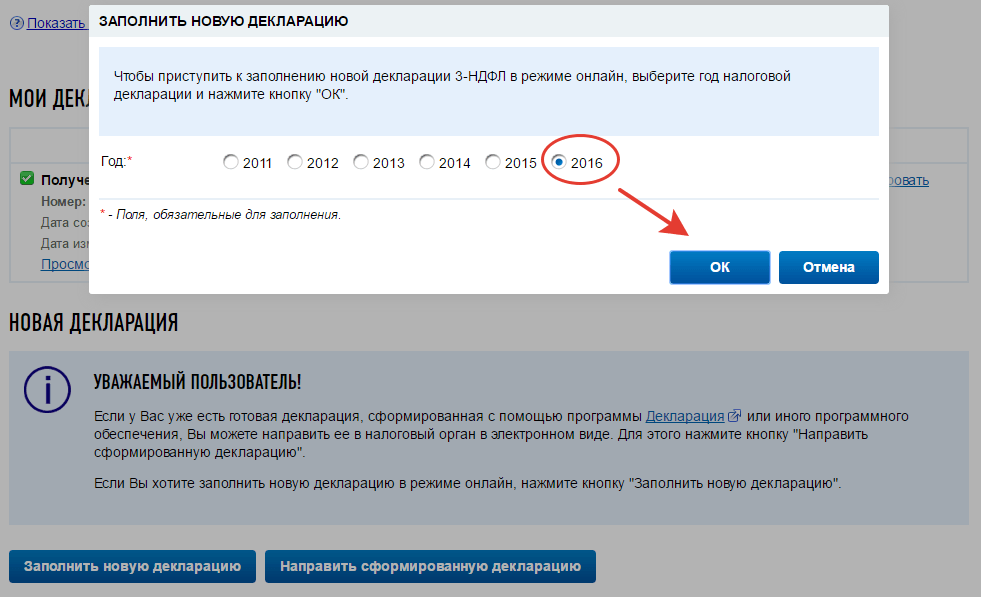

In the window that appears, select the year, for which we want to report and file a tax return. Press the "OK" button. After that, we will be redirected to the section "Filling out and submitting an electronic tax return 3-NDFL".

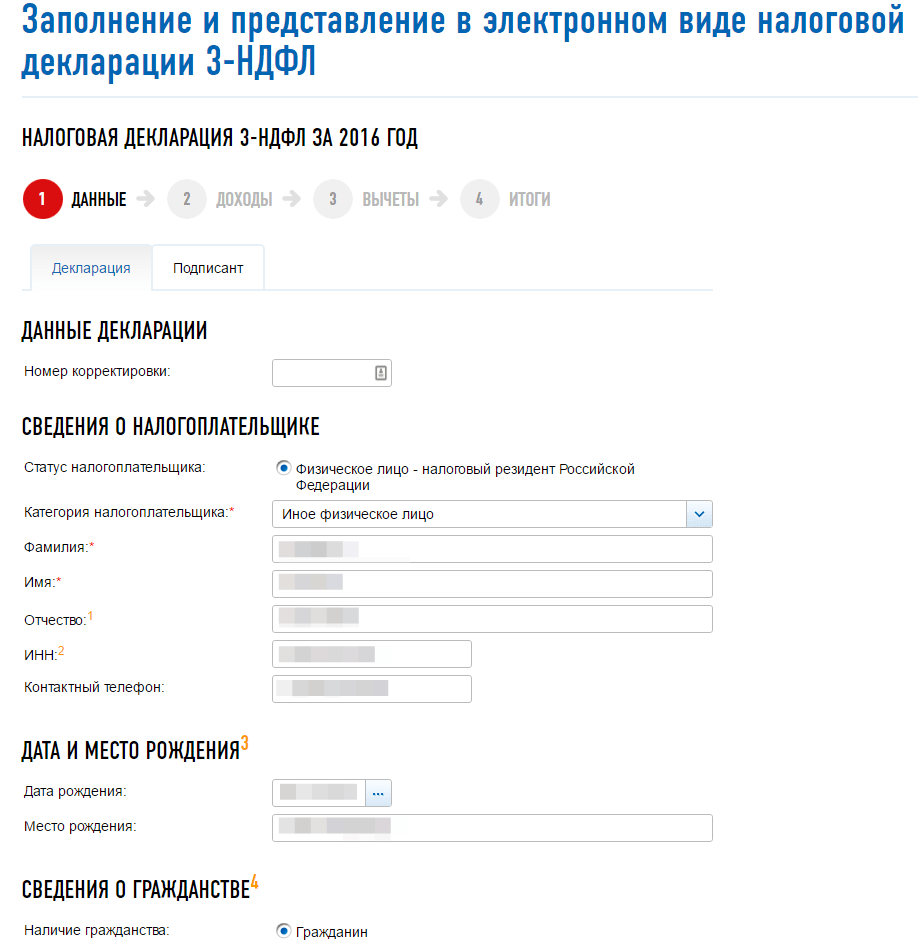

Step 4. In the section "Filling out and submitting in electronic form the 3-NDFL tax return" we follow the directions of the assistant and step by step fill in the information of the sections 1. Data -> 2. Income -> 3. Deductions -> 4. Results.

Step 5. Go to the "Data" section. As seen, Last name fields, "Name", "Patronymic" already filled in. Adding information to the Location field. At the specified address, the service will select an inspection for sending the declaration.

If we indicate the TIN, then information about the date and place of birth, citizenship and passport data can not be entered. Otherwise, these fields must be completed (cm. notes at the bottom of the page). After adding the information, press the "Next" button and proceed to the most interesting thing - filling in the information about income.

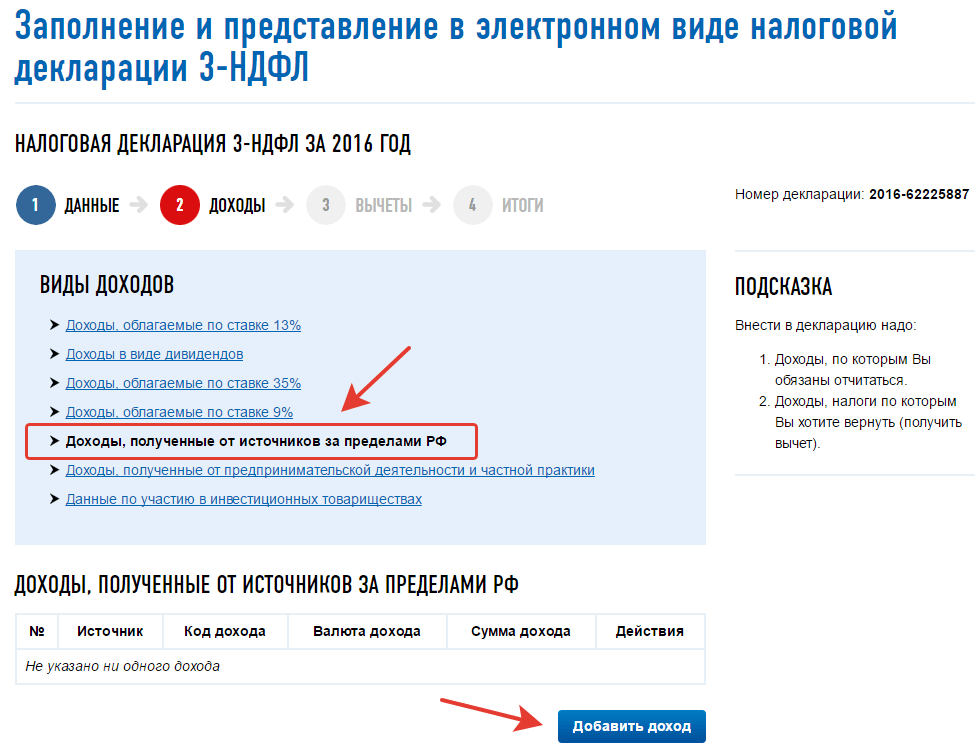

Step 6. In the "Income" section, by default, the upper item "Incomes, taxed at a rate of 13% ". But since we are reporting income, received on the foreign stock market, then select the item "Income, received from sources outside the Russian Federation ". Then go to the page "Income, received in foreign currency ".

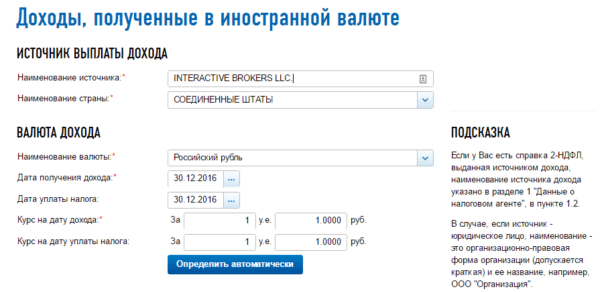

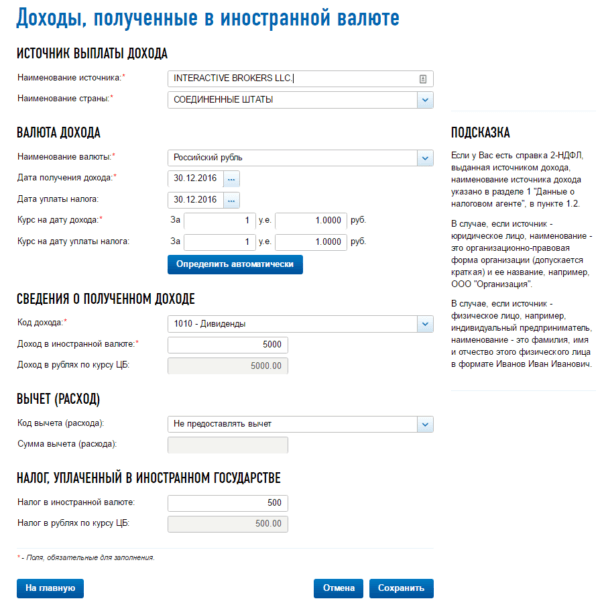

Step 7. On the Income page, received in foreign currency" in the field "Name of source" write the name of the broker. In our case, this is Interactive Brokers. Enter the United States in the Country Name field..

Further, we proceed from the fact, that we have detailed reports with the conversion of transactions in foreign currency into rubles at the exchange rate of the Central Bank of the Russian Federation. Therefore, when filling in the "Name of currency" field, we select "Russian ruble".

We already have totals in the reports, therefore, in the fields “Date of receipt of income” and “Date of payment of income tax”, we put the last business day of the reporting year. (If you do not have explanatory reports, then you select the date of receipt of the income for the operation.) In the field "Exchange rate at the date of income" indicate 1 and press the button "Detect automatically".

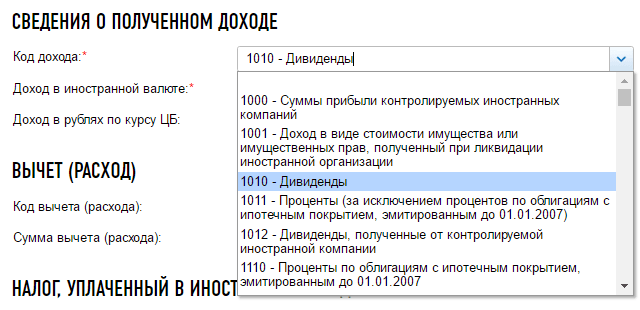

Now we proceed to enter information about the income received. To fill in the "Income code" field, select the appropriate type of income from the drop-down list.

The income code depends on the financial instrument and the market:

- For income from the sale of stocks and bonds, the code 1530.

- For dividend income, the code is 1010.

- For coupon income, the code is 1011.

- For income from foreign exchange transactions, the code 2900.

- For income from the sale of options and futures, the code 1532.

- For income from selling options on futures code 1535.

For example, if during the reporting period we received income from the sale of shares, bonds and stock options, then for each instrument we need to create a separate record. In this record, we indicate the corresponding income code (stock (1530), bonds (1530), stock options (1532)) and write the amount of income. We calculate the amount of income for each instrument taking into account those requirements, which are presented by the tax office.

- Note. If you are filling out a declaration on reports prepared by me, then you take the total amount of income in the corresponding report in the Amount field, rub. or Profit / loss, rub.

Field "Tax, paid in a foreign state ", to be filled in if tax is withheld in the country of receipt. For example, if we receive dividend income on American shares, then in the USA tax is usually withheld from us 10% tax (less often 39%). If we have transactions with different amounts of tax withheld, we summarize and fill them separately. We additionally comment on this in the explanatory note to 3-personal income tax. The total US tax paid can be found in the broker's report, tax form or in the field "Hold. tax, rub." my prepared dividend report.

In this way, when filling out this section, we indicate the total amounts, received under each income code. To confirm these amounts, we attach reports with calculations to the declaration and accompany them with an explanatory letter. (About that, what other documents should be attached, we'll talk below.)

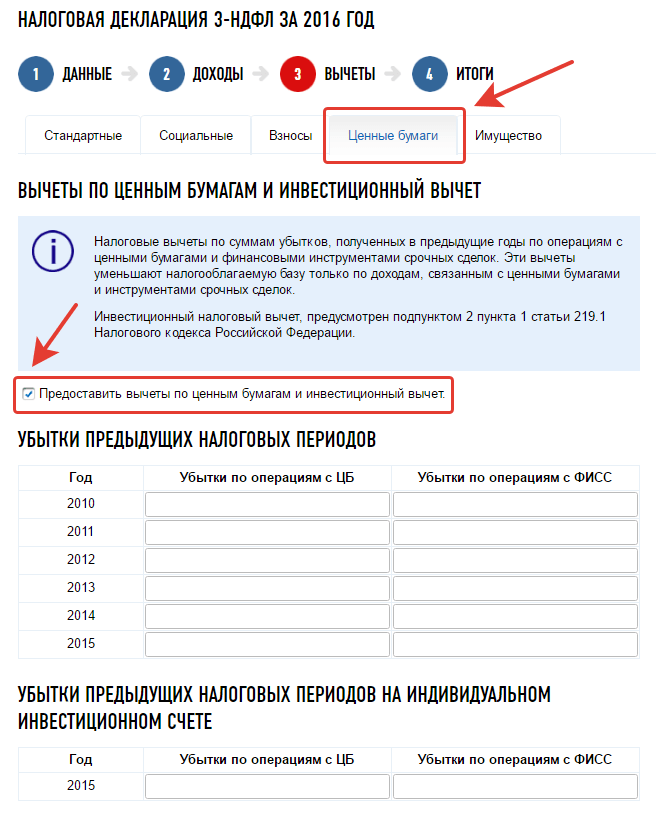

Step 8. Go to the section "Deductions". In it, by default, the tab for entering standard tax deductions is active. If you are in accordance with Art. 218 Tax Code of the Russian Federation have the right to receive them, then check the box "Give standard tax deductions" and add the necessary information. We are also interested in another tab - "Securities". Here you can specify information on the amount of losses, received in previous years, and thereby reduce the taxable base.

To display the form, we put a "tick" in the line "Provide securities deductions and investment deduction". In the appeared table, fill in the corresponding columns, indicating the total amount of losses on transactions with securities (CB) and on operations with financial instruments of forward transactions (FISS). We accompany the specified amounts with reports with calculations

- Note. Tax can be refunded for 3 recent years, and offset losses - for 10 years.

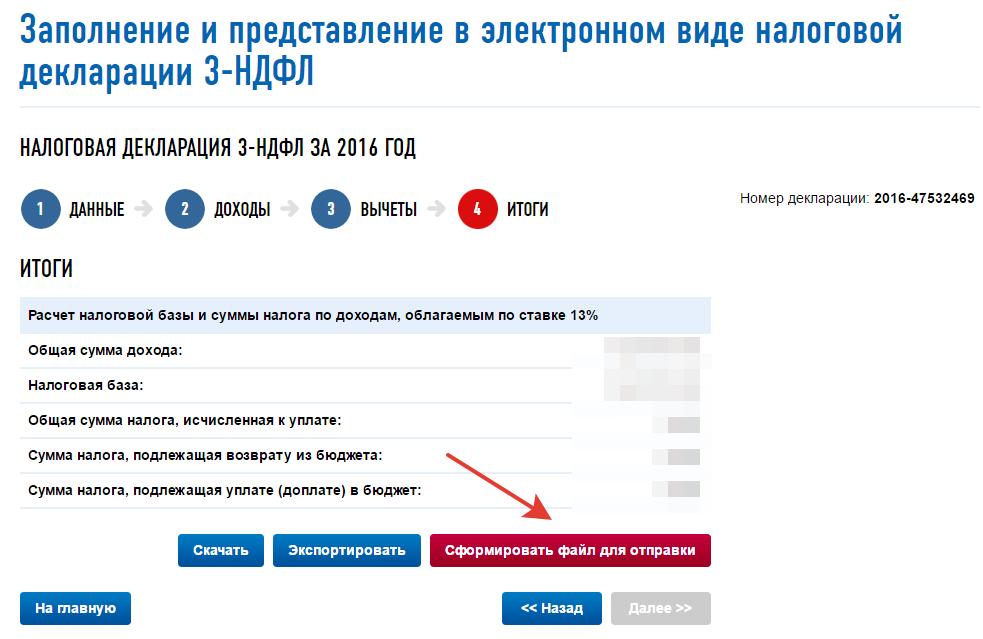

Step 9. We go to the finish line. Go to the "Results" section. Here we form a file with a declaration for sending, by clicking the "Generate file for sending" button.

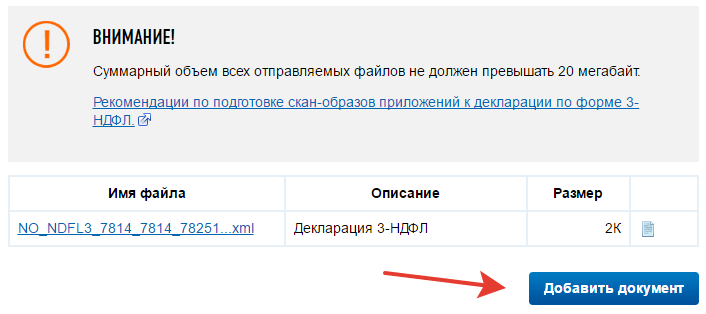

Step 10. Attach supporting documents. In order for the declaration to pass a desk audit, it must be accompanied by documents, confirming the amount of income. What are these documents? As such, there is no approved list. But, as my experience shows, usually the following package of documents is sufficient:

- Help or contract, confirming the opening of a brokerage account.

- Report on operations at the broker for the reporting period with information on the amount, currency and date of income (you can prepare such a report in the broker's personal account).

- Settlement of transactions with conversion into rubles for each transaction (An example of such a report can be found here).

- Explanatory note for the inspector explaining the calculation of the tax base and the distribution of costs.

We attach these documents, by clicking the "Browse" button and selecting the desired file. In the "Description" line, add brief information about the document (for example, brokerage account agreement) and click the "Save" button.

Step 11. We sign and send the declaration. To do this, in the section "Sign with a key of an enhanced unqualified electronic signature" we enter a password, which was indicated when forming the signature and press the button "Sign and send". (In case we forget the password, we can create a new key and sign the declaration with it).

Step 12. That's all. Now we just have to pay tax on the income received. (due date until 15 July) and track the status of our declaration. You can do this in the "Documents of the taxpayer" section. > "Electronic document management". Within three months from the date of filing the declaration, it will be checked, and you will see the change in its status in your account.

Sources of :

https://mindspace.ru/33123-3-ndfl-dlya-trejderov-i-aktivnyh-investorov/

https://mindspace.ru/33790-3-ndfl-instruktsiya-po-zapolneniyu-deklaratsii-dlya-trejderov-i-investorov/

https://mindspace.ru/23272-kak-investoru-podgotovitsya-k-sdache-nalogovoj-deklaratsii/