The abstracts of Beni the helicopter pilot in the Land of the Rising Sun

31 May 2003 G.

Inflation or deflation: creative suggestions by Ben Bernanke

1. The state of affairs in the economy here (in the Land of the Rising Sun) really very difficult. This is connected not only with structural, monetary and economic difficulties, but also with political and social forces, limiting?? firmness of policy. But of course, that rapid growth in the Land of the Rising Sun and other large industrial states will contribute to a strong, equilibrium and sustainable recovery, than that, which is only justified by the growth of the United States.

2. In addition to macroeconomic policy and the difficulty of deflation, microeconomic measures are also needed - restructuring and recapitalization of banks, developing more profitable capital markets, revitalization of the troubled corporate sector and broader structural reform.

but, I think, that the end of deflation and the conduct of banking, Money, corporate and structural reforms can and should be carried out in parallel.

3. Three nuances on the agenda, Having?? attitude to modern financial policy in the Land of the Rising Sun:

3.1 In-1-x, quantitative targeting, instead of that, to target an increase in the general price level (applied by the Central Bank of Russia with 2014 year - author's note), Bank of the Land of the Rising Sun is worth considering

Similar to predictive targeting of an increase in the general price level, price targeting makes amendments depending on, what happened in the recent past.

3.2 In-2-x, I would like to address a fundamental institutional issue, which is connected with the state of the Bank's balance sheet in the Land of the Rising Sun and its ability to pursue a more aggressive financial policy. Balance sheet data should not seriously constrain central bank policy, but in practice they do it. But, how will i discuss, relatively common measures are available, which will get rid of this limitation.

3.3 Finally, and the most fundamental, I will consider one of the likely strategies for ending deflation in the Land of the Rising Sun: interaction between monetary and fiscal management.

More details on each item:

4. IN 1998 Bank informed the Land of the Rising Sun, that will end its zero-rate course at the end of deflation.

For that purpose, to make it happen, inflation is needed above zero, and if the current interest rates in the Land of the Rising Sun are negative for a certain period, it would be useful, if the zero interest rate policy were more precise about,

Over the past 5 years the price level in Japan has decreased, fixing the cumulative decrease from 4% to 9%. GDP deflator fell by almost 9%, the private consumption deflator fell by 5.5%, and the size of wages decreased by 4.5%. To restore the price level, which prevailed before a long period of deflation, a policy of active reflation of the economy is required.

Price level targeting:

Bank of Japan will announce its intention to restore the price level (measured by some standard price index, such as CPI minus fresh food) to the value, which he would have achieved, if instead moderate inflation had occurred from the deflation of the past five years, say, 1% in year.

note, that the proposed price level target is mobile and equal to 2003 year approx. 5% + actual price level in 1998 year and is growing by 1% in year.

Since deflation implies falling prices, while the target price level is increasing, a price gap is formed (Bernanke, 2000).

Bridging the price gap will take place in two stages, in the first stage or reflationary phase, the inflation rate will exceed the long-term desired inflation rate. At the second stage, the target price target will be achieved, which increases over time by the desired inflation rate.

5. I'm intrigued by the simple sentence, which, as I understand it, was proposed by the Japan Business Federation, Nippon Keidanren. According to this proposal Treasury Department Converts Fixed Interest Rates on Japanese Government Bonds, at the disposal of the Bank of Japan, at floating interest rates. This "conversion of bonds" is actually, fixed interest rate swap - will protect the Bank of Japan's capital position from an increase in long-term interest rates and eliminate most of the balance sheet risk, related to open market operations. in government securities. Furthermore, the budgetary implications of this proposal would be virtually nil, as any increase in interest payments to the Bank of Japan by the Ministry of Finance as a result of the bond conversion would be offset by an almost equal increase in payments by the Bank of Japan to the national treasury. Neutrality of the proposal, certainly, is a consequence of the fact, that by virtue of arithmetic any capital gains or losses in the value of government securities, at the disposal of the Bank of Japan, exactly offset by opposite changes in the issuer's equity capital of these companies.

That stimulate extended purchases of commercial paper, asset-backed, the government may, at the request of the Bank of Japan, agree to swap government debt with the same maturity for commercial paper. The net effect will be, that the fiscal authority will take on the credit risk, arising from non-standard actions in the field of monetary policy, which seems appropriate.

An additional step on the road to economic growth could be the abandonment of the rules by the Bank of Japan, which he set for himself - for example, Your informal rule, that the number of long-term government bonds on its balance sheet must be lower than the outstanding balance of banknotes issued.

6. An alternative approach to incentives

The aging Japanese population will increase the government's budgetary burden in the coming decades.

Inflation or deflation: creative suggestions by Ben Bernanke

Politicians are reluctant to use expansionary fiscal policies due to Japan's large public debt. People may be more inclined to save, rather than spend, when they know, that these cuts increase future government interest spending and, thus, increase future tax payments for themselves or their children. Amazing, what, despite low interest rates, about 20 percent of Japan's central government budget, or about 16,8 trillion yen this year, dedicated to servicing public debt.

If people think, that government projects are wasteful and add little to national wealth or productivity, then taxpayers may view an increase in government spending simply as an increase in the burden of government debt, which they have to carry. And as a result, they will respond to increased government spending by cutting their own spending..

To enhance the impact of fiscal policy, it would be helpful to break the link between expansionary fiscal action today and tax increases tomorrow.

My thesis is, that cooperation between monetary and fiscal authorities in Japan can help solve problems.

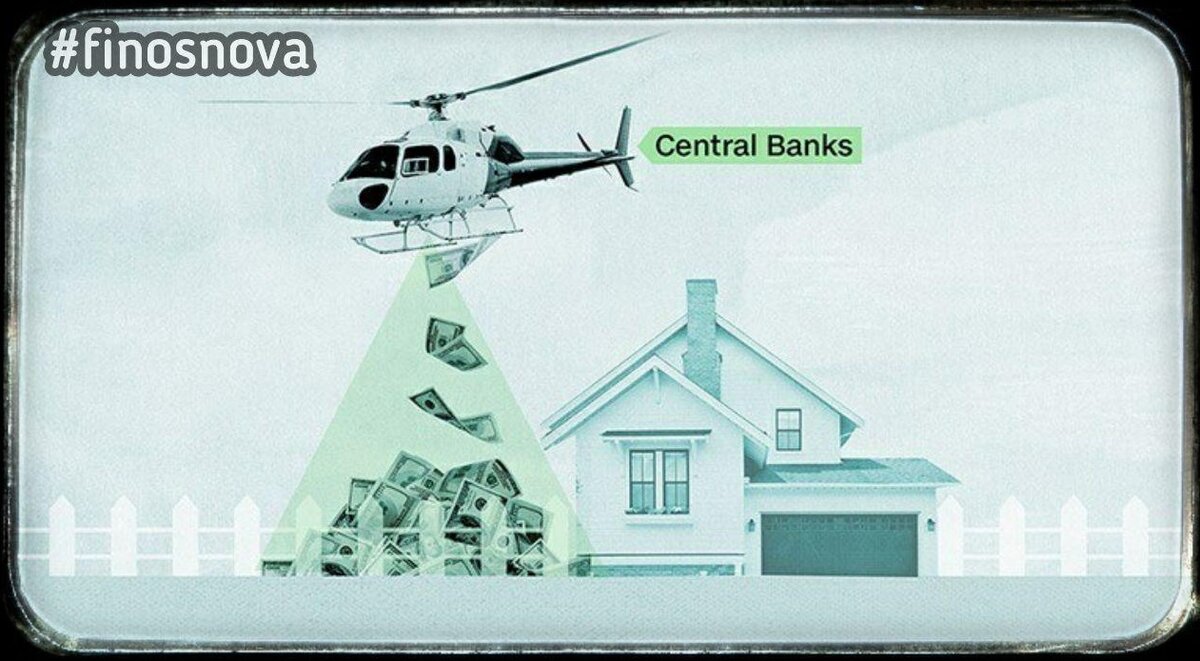

For example, tax cuts for households and businesses along with additional purchases of government debt by the Bank of Japan, so tax cuts are actually funded by money creation.

The balance of the Bank of Japan is protected by a bond conversion program, debt increase is bought by the Bank of Japan, not sold to the private sector. Monetary and fiscal policies together increased the nominal wealth of the household sector and led to an increase in nominal spending, and behind them and prices.

... History rhymes?

How do you think, will the US follow the Japanese path, proposed by Ben Bernanke?

Inflation or deflation: creative suggestions by Ben Bernanke