IBM technology company (NYSE: IBM) presented cash figures for the 2nd quarter of 2021:

- revenue increased by 3%., up to $18.7 billion;

- overall sales of cloud services increased by thirteen percent, up to 7 billion;

- net profit fell by three percent, up to 1.3 billion;

- operating foreign exchange flow decreased from 3,6 up to 2.6 billion;

- free currency flow decreased from 2,3 up to 1 billion;

- acquisition spending amounted to 1.7 billion, for income from securities - 1.5 billion.

Indicators by sector

У IBM 5 operating units. Here are the monetary indicators for each of them..

Cloud & Cognitive Software – hybrid cloud services and software, also with the introduction of artificial intelligence based on IBM Watson. Revenue increased by 6,1 %, up to 6.1 billion.

Global Business Services — consulting services for legal entities. Revenue increased by 11,6 %, up to 4.3 billion.

Global Technology Services — a complex of infrastructure facilities for legal entities and technical support. Revenue increased by 0,4 %, up to 6.3 billion.

Systems - servers, data stores and operating systems. Revenue fell to 7,3 %, up to 1.7 billion.

Global Financing - Loans for clients, trade representatives and suppliers, Working?? with company products. Revenue fell to 8,6 %, up to 0.2 billion.

Takeovers and expectations

In the 2nd quarter, IBM bought several companies outright: software developers using artificial intelligence myInventio and Turbonomic, as well as the consulting company Waeg.

IBM's revenue has been falling steadily over the past ten years: from 107 billion in 2011 to 74 billion in 2020. The company is waiting, that by the end of the year sales will increase. In the first quarter of 2021, IBM's revenue grew by 1%, and in the first half of the year 2%. In many respects - due to the exchange rate difference.

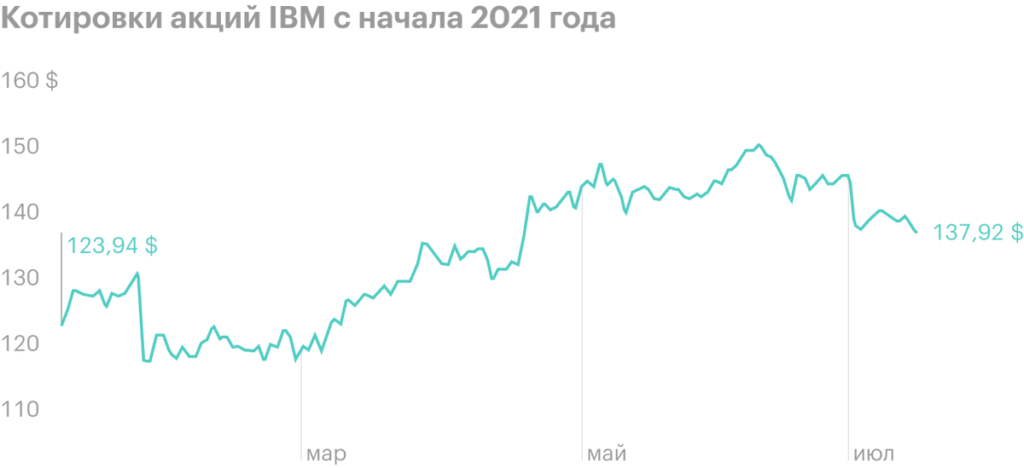

Promotions

Since the beginning of the year, IBM shares have risen by 11%, to 138 $. After the publication of the report on the postmarket, the company's securities added 4% and grew to 143 $. Analysts' expectations for the next 12 months — 144 $.

In April, IBM increased its quarterly dividend by a cent, to 1,64 $. Annual dividend yield — 4,8%.

IBM revenue in the second quarter, million dollars

| Revenue | The change | Excluding exchange rate differences | |

|---|---|---|---|

| Cloud & Cognitive Software | 6098 | 6,1% | 2,5% |

| Global Business Services | 4341 | 11,6% | 7,3% |

| Global Technology Services | 6342 | 0,4% | −4,1% |

| Systems | 1717 | −7,3% | −10,2% |

| Global Financing | 242 | −8,6% | −11,6% |

| Rest | 5 | — | — |

| Total | 18 745 | 3,4% | 0% |

Cloud& Cognitive Software

Revenue

6098

The change

6,1%

Excluding exchange rate differences

2,5%

Global Business Services

Revenue

4341

The change

11,6%

Excluding exchange rate differences

7,3%

Global Technology Services

Revenue

6342

The change

0,4%

Excluding exchange rate differences

−4,1%

Systems

Revenue

1717

The change

−7,3%

Excluding exchange rate differences

−10,2%

Global Financing

Revenue

242

The change

−8,6%

Excluding exchange rate differences

−11,6%

Rest

Revenue

5

The change

—

Excluding exchange rate differences

—

Total

Revenue

18 745

The change

3,4%

Excluding exchange rate differences

0%