20 April, the price for the supply of American WTI crude oil in May fell below 0 dollars per barrel. The situation caused a collapse in prices for other grades of oil., including the Russian Urals.

Briefly: Deliverable May futures for oil is a contract, at which the buyer purchases oil now at today's price, and the delivery of this oil takes place in May. And in May, the owners of futures will actually be brought oil - that is, it will need to be picked up and stored in American terminals.

But the problem is, that most of the transactions in futures are made by speculators - and they are not going to physically become owners of oil. But due to the coronacrisis, even real buyers have practically nowhere to store the purchased oil.: all terminals are full.

A few days before the end of trading in May futures, most traders decided to sell them, so as not to mess with the physical delivery of oil. But due to the decrease in demand for oil, there were no buyers - prices began to collapse. To avoid the physical delivery of oil, sellers tried to sell at any price, even paying the buyer a premium.

The situation may repeat itself with the following futures., if the state of affairs with coronavirus and economic activity does not change.

What is going on

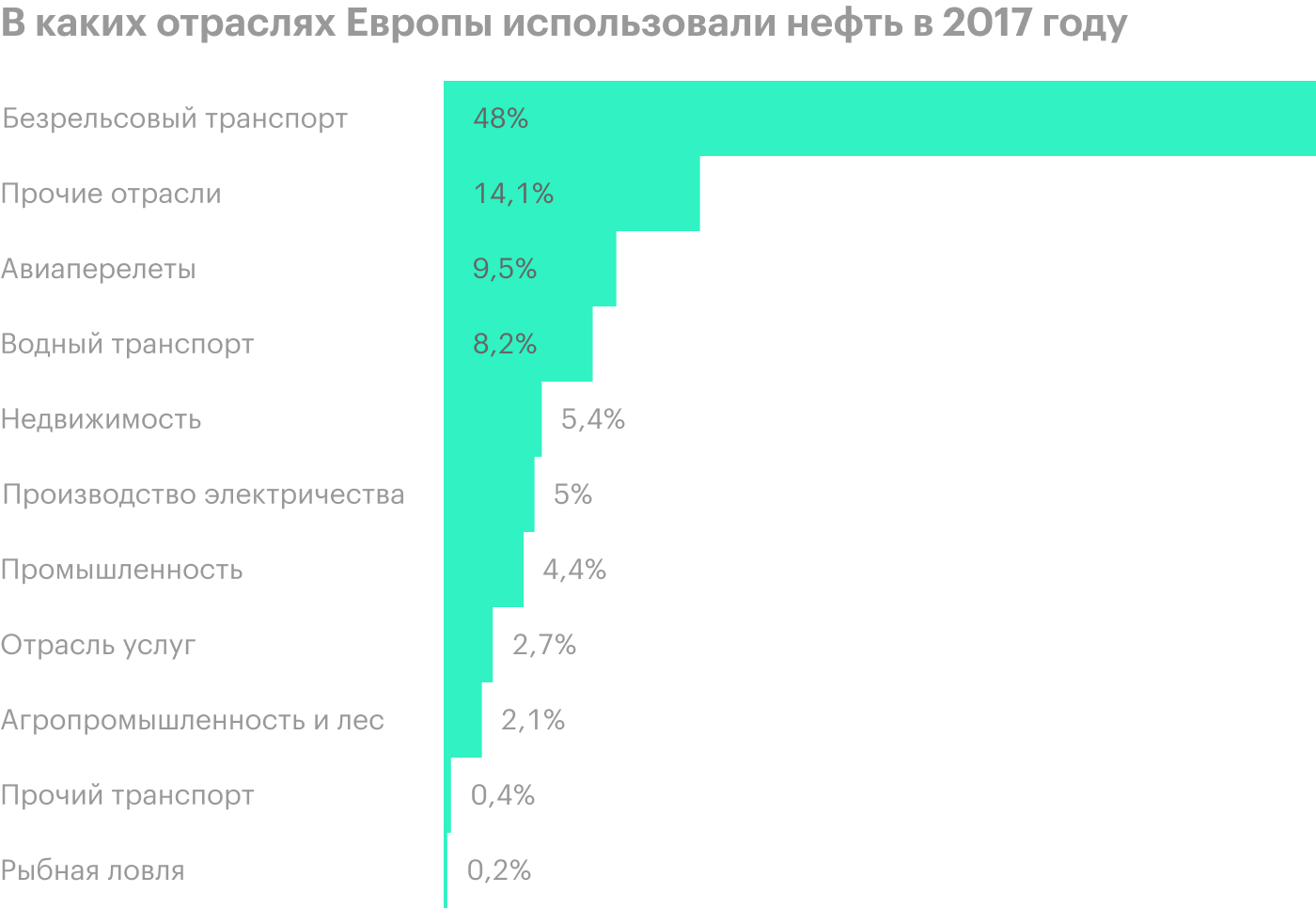

Two-thirds of the oil produced is used as transport fuel. To fight the coronavirus, most countries have introduced various restrictions on movement within cities and between them - transport has become much less used.

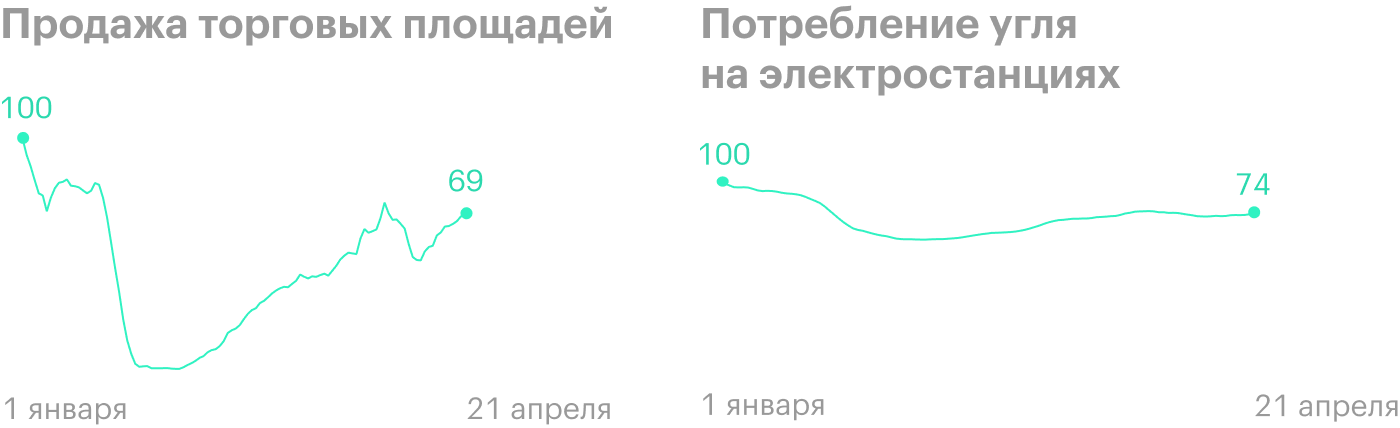

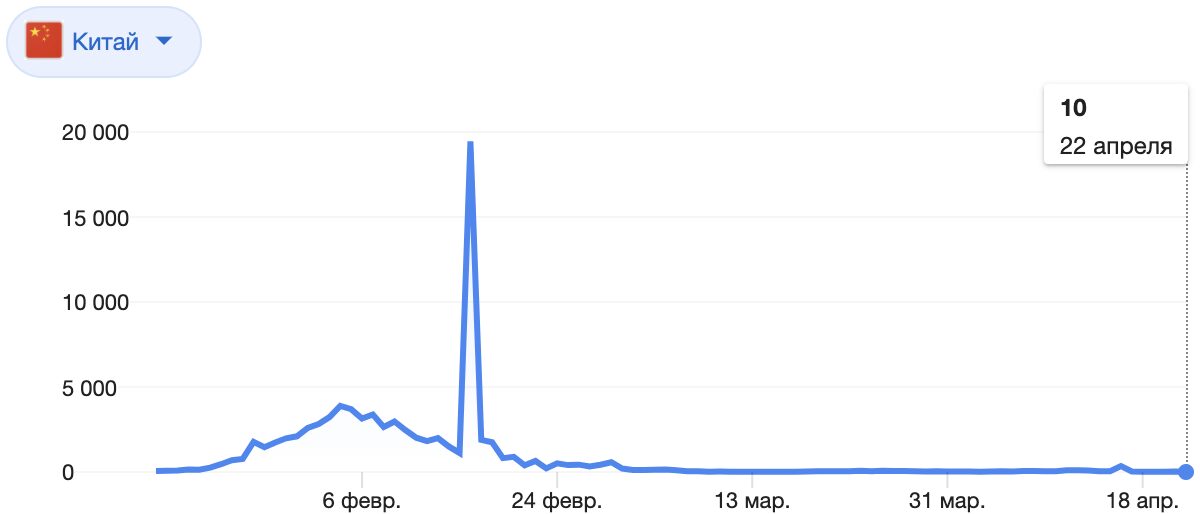

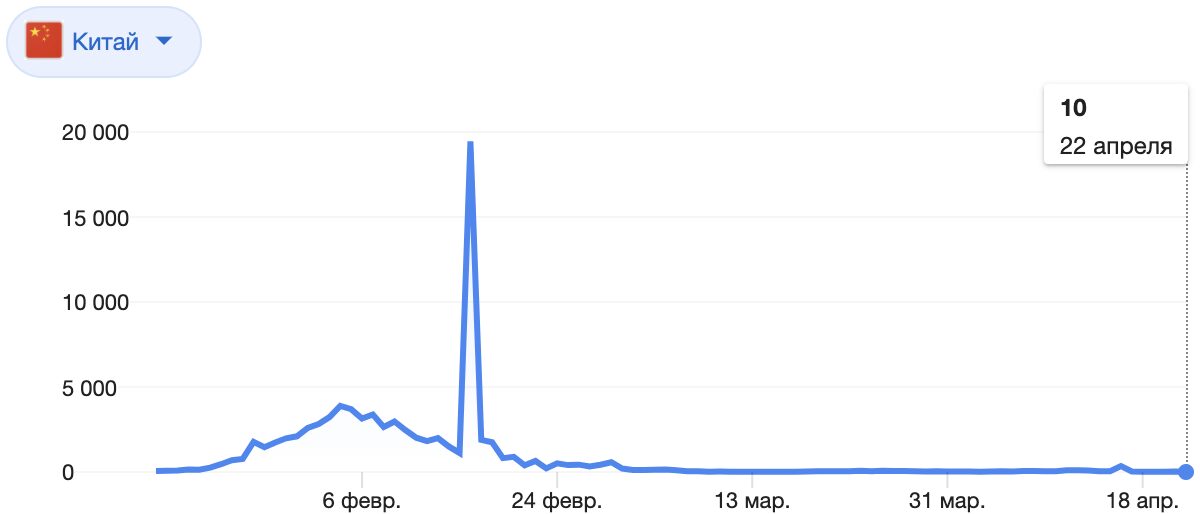

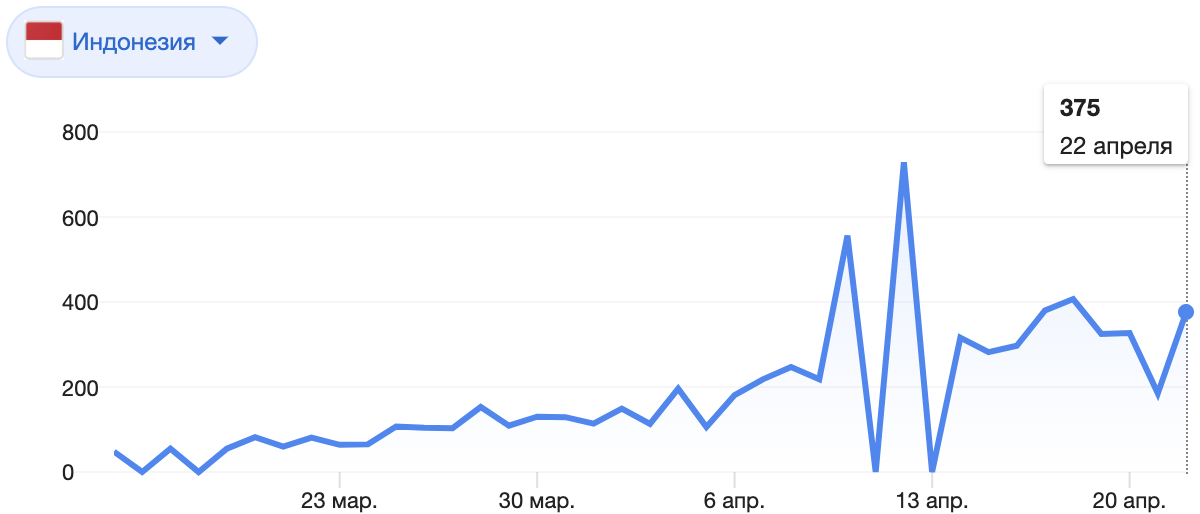

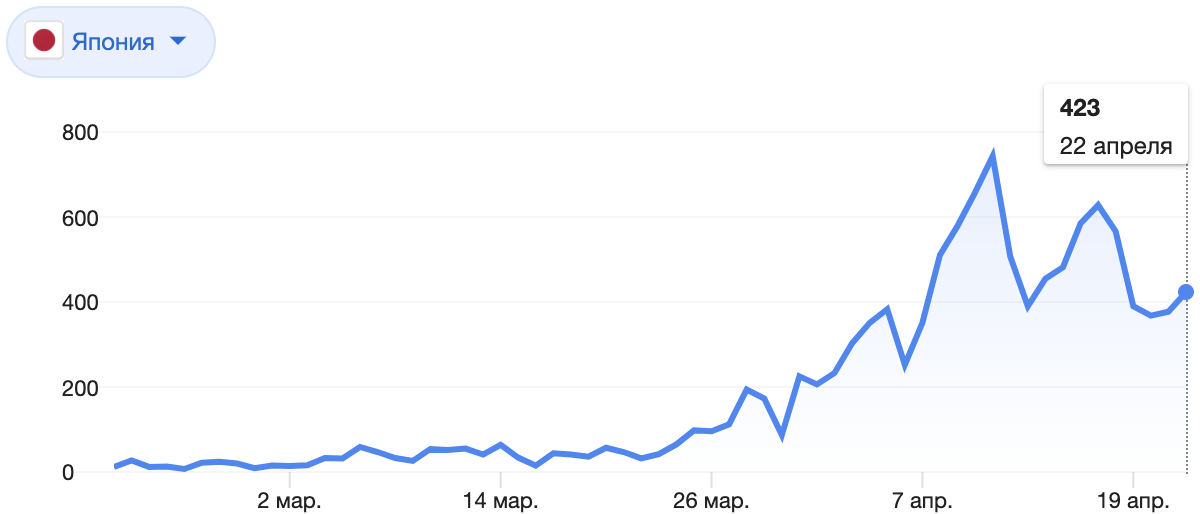

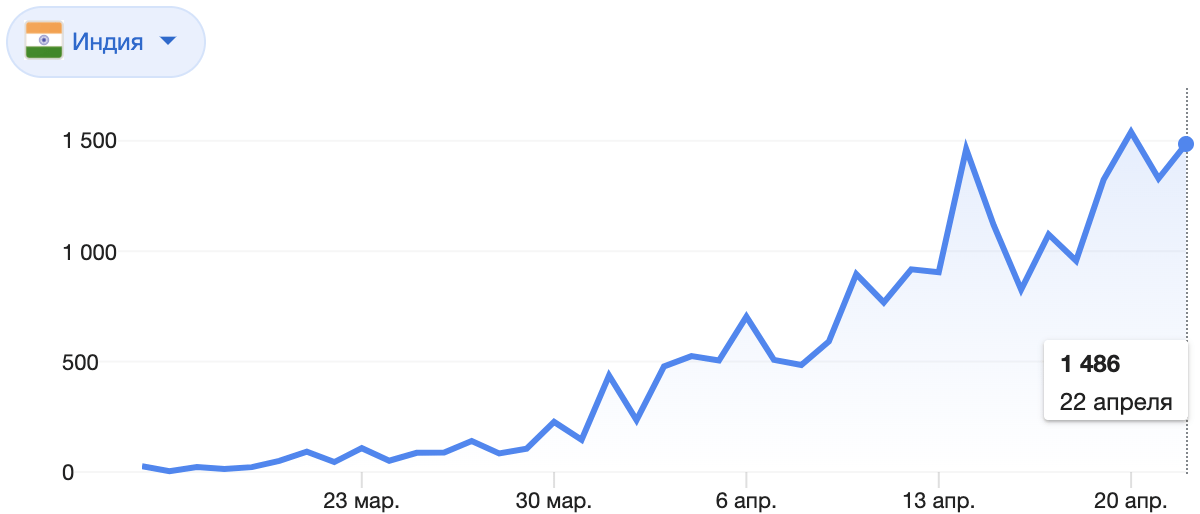

China lifted most of the restrictions almost a month ago, but if you look at the Financial Times economic indexes, then most of the economy has not yet recovered to its previous level.

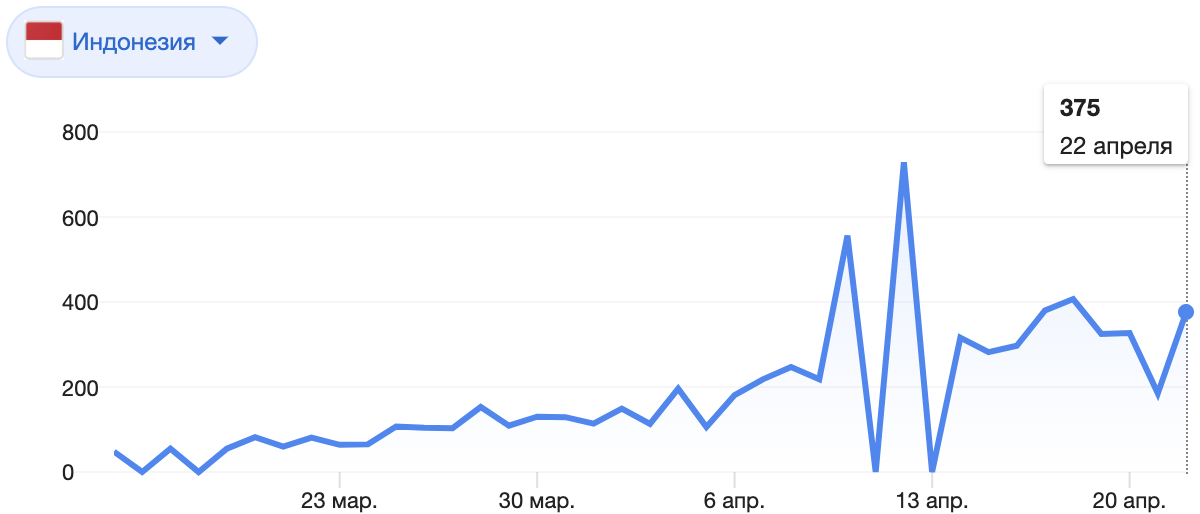

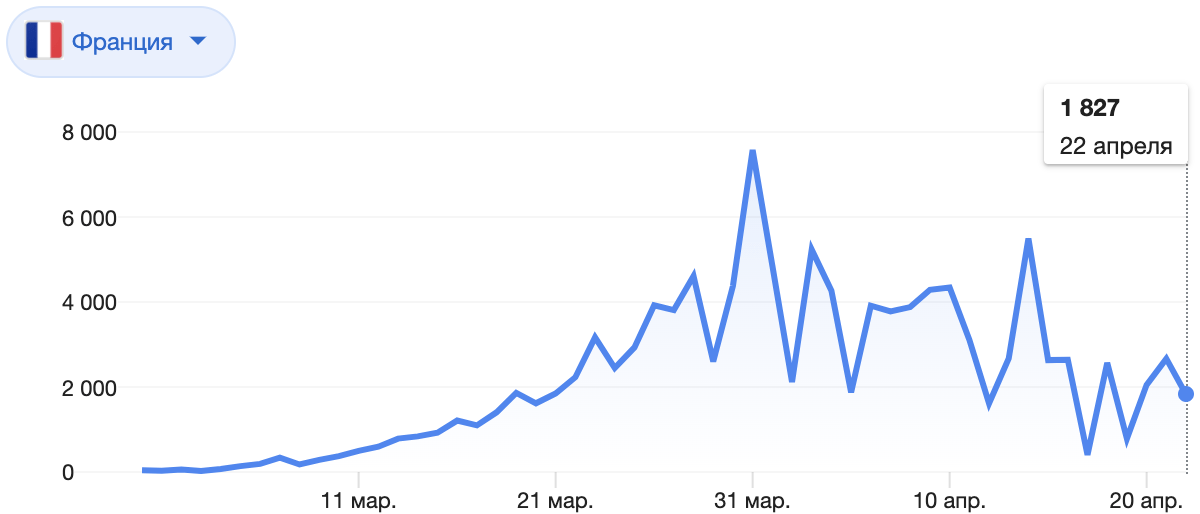

IN 10 In the largest economies of the world, the number of new cases of coronavirus infection per day is in the thousands. Before the quarantine is lifted, seems, still far. So,, and it is too early to expect a rapid growth in demand for oil and products from it in the coming months.

Demand for oil in these countries fell by 20-70% compared to the same period 2019 of the year. Countries have not cut production, therefore, surplus oil reserves began to form, that no one takes. The largest independent operator of oil storage terminals Royal Vopak said, that the vaults are almost fully loaded. It is difficult to stop oil production quickly and without losses: to recoup future costs of resuming production, serious price increases will be required.

In May and June, Russia and OPEC+ members plan to cut oil production by 9,7 million barrels per day. Other countries, not included in the deal, also plan to cut production.

What will happen to Russian oilmen

According to the Financial Times, Rosneft and Gazprom Neft will become unprofitable at the price of Brent oil in 15 dollars per barrel, and Lukoil - with oil prices below 10 Dollars. As long as prices are above these values, companies will be able to earn money and pay at least some dividends.

Most public Russian oilmen have little debt. Companies do not need to spend a lot on interest payments and pay off a large body of debt in the next few years.. This means, what, maybe, not have to forego dividend payments in favor of debt repayment. So far, only Rosneft has a decent debt, but her payment of most of it is heavily spread over 2-10 years.

What will happen to the dollar

The Central Bank has been selling foreign currency since the beginning of March, to keep the ruble from falling further. Russia receives 42% revenues to the budget from the sale of oil and gas. The lower the price of oil, the less dollars Russian companies will receive and pay to the federal budget of Russia. So,, the ability to import foreign goods and technologies is reduced.

Poor economic situation discourages large foreign investors, which means, demand for the ruble falls. Russia's budget is drawn up from the forecast of the oil price in 42,4 dollar per barrel. While the price of oil is lower, The central bank will sell currency from reserves. What will happen to the price of oil and the dollar in the near future - no one can say for sure.

What should investors do

Normally, hope for the best and prepare for the worst. The way to worry less is to gradually buy foreign currency and bring its share to at least 30% from savings.

If you want to take advantage of the situation, then you can look for shares of companies, who own tankers and can earn in the short term from increased income from renting ships for oil storage.

a source: https://journal.tinkoff.ru/news/neftyanochka