Apple electronic devices and accessories developer (Nasdaq: AAPL) made public the financial statements for the 3rd quarter of fiscal year 2021. Here's how it came out:

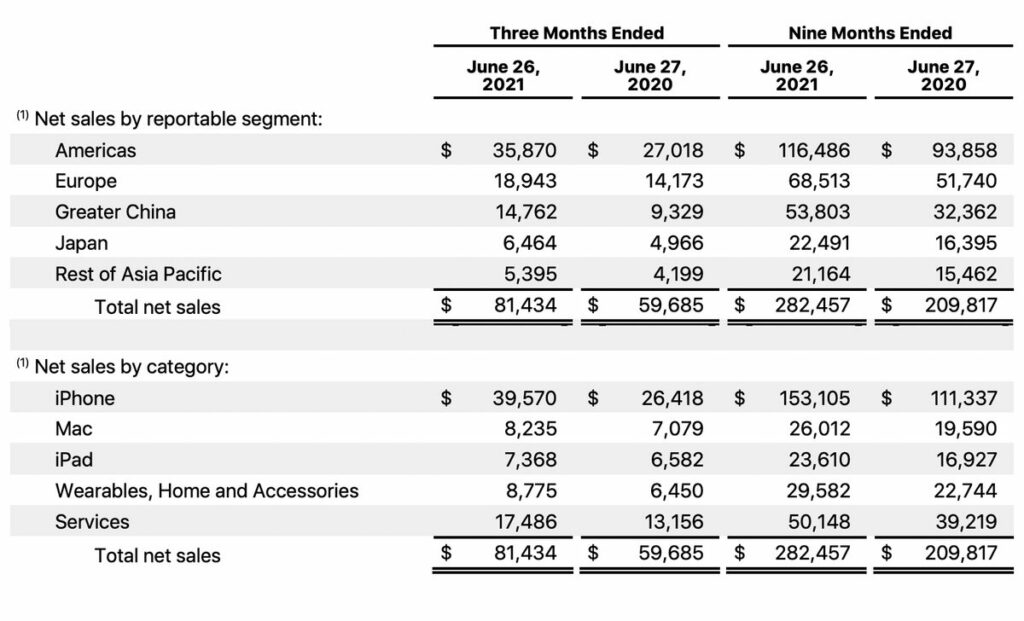

- revenue increased by thirty-six percent, up to $81.4 billion;

- operating income increased by eighty-four percent, up to 24.1 billion;

- pure profit increased by eighty-three percent, up to 21.7 billion.

“Our strongest operating performance for the June quarter includes new sales records in each of our geographies, double-digit growth in each of the product categories and a new highest high for the active device base ", - said Luca Maestri, money manager of the company.

Realization of the most popular product of the company, IPhone, up fifty percent, up to 39.6 billion. Mac implementations up sixteen percent, iPad - twelve percent, accessories - thirty-six percent, services - thirty-three percent.

Most of all, revenue grew in China - by fifty-eight percent, up to 14.8 billion. In the main market for the company, in North and South America, sales increased by thirty-three percent, up to 35.9 billion. In Europe, revenue increased by thirty-four percent, in the Land of the Rising Sun - by thirty percent, in other states of the Asia-Pacific region - by twenty-eight percent.

Apple's revenue could grow even more, if not for the global lack of chips. “The disadvantage primarily affected the Mac and iPad”, - emphasized the head of the company Tim Cook.

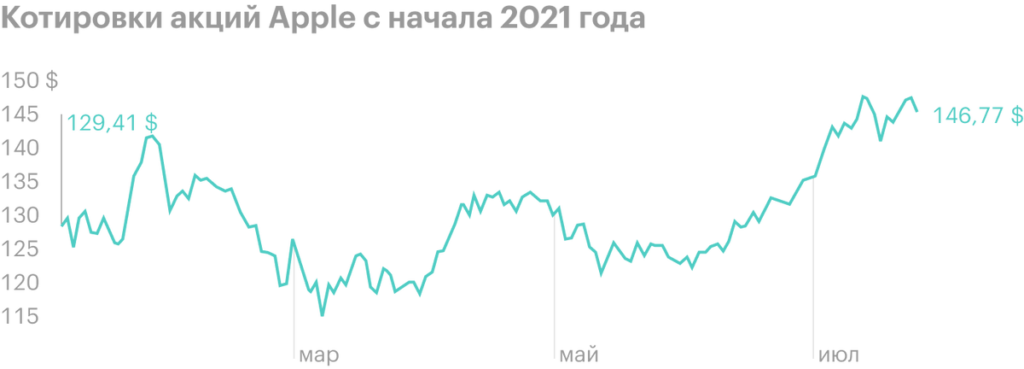

In line with Apple management forecasts, semiconductor supply disruptions impact iPhone and iPad sales next quarter. After the post-market report, Apple shares fell by two percent, to 144 $.

Separately, Cook noted the growth in sales of services: “Of course, that our long-term investment in our services is making a difference.”. Before the report, investors feared, that as quarantine restrictions are lifted, consumers will spend less time on entertainment. According to Cook, Apple's paid subscribers rise to 700 million. This is 150 million more, than a year ago.

Since the beginning of the year, Apple securities have added 13%. According to analysts, in the following 12 months stocks may rise another 9%, to 159 $.