FedEx logistics company (NYSE: FDX) disclosed cash figures for the 4th quarter of the 2021 financial year:

- revenue increased by thirty percent, up to $22.6 billion;

- operating profit increased by 279%, up to 1.8 billion, and adjusted operating profit by 117%, up to 2 billion;

- unblemished profit including non-cash items amounted to 1.9 billion, and adjusted unblemished earnings increased by 105%, up to 1.4 billion.

And oh so ended for FedEx 2021 cash year.:

- revenue increased by twenty-one percent, up to $84 billion;

- operating profit increased by 142%, up to 5.9 billion, and adjusted operating profit by eighty-eight per cent, up to 6.2 billion;

- net profit quadrupled, up to 5.2 billion, and adjusted net income increased by eighty-six percent, up to 4.9 billion.

FedEx Express, FedEx Ground and FedEx Freight are the main operating segments of the company. All of them 5:

- FedEx Express - fast worldwide delivery, main business sector.

- FedEx Ground - Economical Shipping in the US and Canada. Clients - companies and residents of private homes.

- FedEx Freight - delivery of small parcels by trucks.

- FedEx Services - a set of support services for other companies.

- The rest is various office and logistics services. This also includes spending, that are not related to the main operational work.

FedEx Express's fourth-quarter operating income more than doubled: increased the size of interstate and domestic shipments. Sector operating margin up 260 basis points, since the company has optimized its delivery network.

Quarterly revenue in the FedEx Ground segment added 27%: companies are using FedEx services more often, and the cost of services increased by 14%. Operating margin up 310 basis points on higher revenues and lower transportation costs. The operating profit was also negatively affected by the labor shortage..

FedEx Freight's operating margin doubled in the fourth quarter, with 8 to 16%: the average daily volume of parcels increased by 30%, and the cost of services added 6%.

In fiscal 2021, the company's operating cash flow doubled from 5 up to 10 billion dollars. Next year, FedEx plans to increase its capital expenditures from 5,9 up to 7.2 billion. The company can use the remaining money to increase dividends and pay off debt..

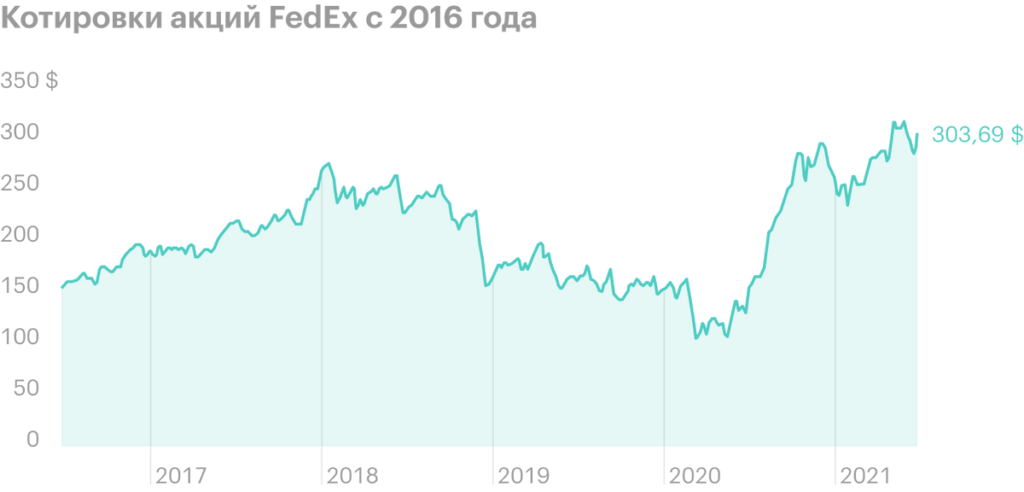

After the report, FedEx shares fell by 4%, from 303.7 to 290,4 $. According to analysts, the company's securities in the following 12 months can grow by 16%, to 336 $.

Revenue in the fourth quarter, million dollars

| 2020 | 2021 | The change | |

|---|---|---|---|

| FedEx Express | 8560 | 11 275 | 31,7% |

| FedEx Ground | 6394 | 8132 | 27,2% |

| FedEx Freight | 1615 | 2235 | 38,4% |

| FedEx Services | 7 | 8 | 14,3% |

| Rest | 782 | 915 | 17% |

| Total | 17 358 | 22 565 | 30% |

FedEx Express

2020

8560

2021

11 275

The change

31,7%

FedEx Ground

2020

6394

2021

8132

The change

27,2%

FedEx Freight

2020

1615

2021

2235

The change

38,4%

FedEx Services

2020

7

2021

8

The change

14,3%

Rest

2020

782

2021

915

The change

17%

Total

2020

17 358

2021

22 565

The change

30%

Revenue for the year, million dollars

| 2020 | 2021 | The change | |

|---|---|---|---|

| FedEx Express | 35 513 | 42 078 | 18,5% |

| FedEx Ground | 22 733 | 30 496 | 34,1% |

| FedEx Freight | 7102 | 7833 | 10,3% |

| FedEx Services | 22 | 32 | 45,5% |

| Rest | 3847 | 3520 | −8,5% |

| Total | 69 217 | 83 959 | 21,3% |

FedEx Express

2020

35 513

2021

42 078

The change

18,5%

FedEx Ground

2020

22 733

2021

30 496

The change

34,1%

FedEx Freight

2020

7102

2021

7833

The change

10,3%

FedEx Services

2020

22

2021

32

The change

45,5%

Rest

2020

3847

2021

3520

The change

−8,5%

Total

2020

69 217

2021

83 959

The change

21,3%