Federal Reserve System (FED, The federal reserve) (English. Federal Reserve System) - Specially created in 1913 year by the Federal Reserve Act (English. Federal Reserve Act) system, which collectively serves as the central bank of the United States of America. The state plays a significant role in the management of the FRS, although the form of ownership of capital is private - joint-stock with a special status of shares.

Federal Reserve System (FED, The federal reserve) (English. Federal Reserve System) - Specially created in 1913 year by the Federal Reserve Act (English. Federal Reserve Act) system, which collectively serves as the central bank of the United States of America. The state plays a significant role in the management of the FRS, although the form of ownership of capital is private - joint-stock with a special status of shares.

The structure of the Fed:

- twelve regional Federal Reserve Banks, fiscal agents of the U.S. Treasury

- numerous private banks (receiving inalienable, fixed income shares of Federal Reserve Banks in exchange for contributed reserve capital)

Federal Reserve Management System:

- Fed Board of Governors (Total 7, who are appointed by the President of the United States)

- Federal Open Market Committee (English. Federal Open Market Committee)

- a variety of consulting tips

From february 2006 Ben Bernanke holds the post of Chairman of the Board of Governors of the Fed.

History of the Fed

The first institution, acting as the central bank of the United States was the First Bank of the United States, created by Alexander Hamilton in 1791 year. His mandate was not renewed in 1811 year. IN 1816 year the Second Bank of the United States was formed; his mandate was not renewed in 1836 after that, how he became the target of criticism from President Andrew Jackson. With 1837 on 1862 years in the Era of Free Banks, the central bank did not formally exist. With 1862 to 1913 yy. in the United States, according to the relevant law, a system of national banks operated. A series of bank panics — in 1873, 1893 and 1907. created a serious demand for the creation of a centralized banking system.

Timeline of U.S. central banks:

- 1791 — 1811: First Bank of the United States

- 1811 — 1816: The central bank was absent

- 1816 — 1836: Second Bank of the United States

- 1837 — 1862: The era of free banks

- 1863 — 1913: National banks

- 1913 - Present: Federal Reserve System.

Creation of a third central bank

During the last quarter of the 19th century and the beginning of the 20th century, the US economy went through a series of financial panics.. The main impetus for the creation of a third central bank was the crisis 1907 of the year. Many economists and supporters of the Federal Reserve System have argued, that previous systems had two major drawbacks: "Inelastic" currency, and lack of liquidity. IN 1908 Congress passed the Aldrich-Vreeland Act, on which the National Monetary Commission was created in order to explore possible options for monetary and banking reform.

Federal Reserve Act

Senator Nelson Aldrich founded two commissions: one for an in-depth study of the American monetary system, another (which was led by Aldrich himself) – to study and prepare reports on European banking systems. Arriving in Europe with negative attitudes towards central banks, Aldrich changed his mind, having studied the German banking system and came to the conclusion about its advantages over the system of bonds issued by the state, which Aldrich previously preferred. Central bank idea met with harsh criticism from opposition politicians, who were suspicious of her and accused Aldrich of being biased due to his close relationship with wealthy bankers (Such, like J. P. Morgan) and in view of his daughter's marriage to John D. Rockefeller Jr..

IN 1910 year leading US financiers: Nelson Aldrich himself, bankers Paul Warburg, Frank Vanderlip, Harry Davidson, Benjamin Strong, Assistant Secretary of the Treasury Andrew Piatt for 10 days spent "brainstorming" on Jekyll Island to work out a compromise on the structure and functions of the future central bank. The result was a scheme, which Aldrich presented to the US Congress.

Aldrich advocated a fully private central bank with minimal government intervention, but made a concession that, that the state should be represented on the Board of Directors. Most Republicans approved of the Aldrich plan, but their support was not enough to pass the law in Congress. Progressive Democrats preferred the fallback system, owned and operated by the state, not controlled by the Wall Street financial system. Conservative Democrats defended the idea of private, but a decentralized backup system, which, through decentralization, would be taken out of the control of Wall Street. Federal Reserve Act, passed by Congress in 1913 year, reflected the opinion of mainly representatives of the US Democratic Party; most Republicans opposed its adoption.

The modern history of the Fed

In July 1979 of the year US President Carter appoints Paul Volcker as Fed Chairman. Volcker managed to curb galloping inflation, reducing it to 1 % by reducing money supply and tightening monetary policy. As Fed Chairman Paul Volkera in 1987 replaced by Alan Greenspan. In February 2006 Ben Bernanke took over as Fed chairman.

The legal status of the FRS

The legal status of the FRS is determined by the Law on the FRS in the form of a special financial institution, uniting features as an independent legal entity, and public state agency.

The independence of the emission center from the government is explained by the desire to ensure a balance between taxpayers and the government (being in the relationship of "employer" and "contractor"), as well as the historically established banking system in the United States, and to prevent the possibility of using the money issue in the short-term interests of the US Government (for example, to cover the budget deficit).

IN 1982 year the Central District Court of California ruled in the case "John Lewis v. United States", in which he defined, that the Federal Reserve Banks, included in the structure of the FRS (cm. below), are not institutions, against which individuals may be sued under the law on claims against government organizations and employees (Federal Tort Claims Act). This court ruling refers to the practice of applying the Federal Tort Claims Act to the Federal Reserve Banks and does not make any determination regarding the status of the Federal Reserve in general..

Fed functions

- fulfillment of the duties of the central bank

- maintaining a balance between the interests of commercial banks and national interests

- providing supervision and regulation of banking institutions

- protection of credit rights of consumers

- money issue management (with often conflicting goals: minimization of unemployment, maintaining price stability, provision of moderate interest rates)

- ensuring the stability of the financial system, control over systemic risks in financial markets

- provision of financial services to depositories, including the US Government and official international agencies

- participation in the functioning of the system of international and domestic payments

- elimination of liquidity problems at the local level

Member banks of the regional Federal Reserve

Any commercial bank, compliant with Fed standard requirements, can become a member (Shareholder) local regional office. Currently (2008 year) the structure of the FRS includes 38 % all banks and credit unions in the United States (about 5,6 thousand legal entities).

Full lists of banks-shareholders of the FRS are published on the websites of the corresponding regional branches of the FRS

Organizational structure –Top management

The governing body of the FRS is the Board of Governors (English. Board of Governors) as part of 7 members of, appointed by the President of the United States with the approval of the Senate of the United States Congress. Each member of the Council is appointed for a term of 14 years with the right to renew.

The Federal Reserve Act provides the President of the United States with the right to fire any Fed governor (in practice, this rule has not been applied).

The Board of Governors is chaired by the Chairman and his Deputy.

At the moment, the members of the Council are:

- Ben Bernanke - Chairman;

- Donald Cohn - Vice Chairman;

- Elizabeth Duke;

- Kevin Warsch;

- Daniel Tarullo;

- (2 places are currently temporarily vacant).

Fed headquarters are located in Washington DC.

Functions of the Council:

- oversight of the systemic functioning of the FRS;

- regulatory decision making;

- determination of requirements for foreign exchange reserves.

Federal Reserve Banks

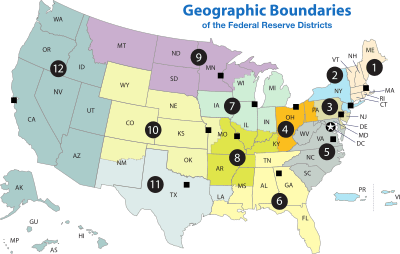

Subordinate to the Board of Governors 12 regional branches of the Federal Reserve, called "Federal Reserve Banks". Regional offices are geographically located in 25 branches and exercise their powers in the states assigned to them, named after those cities, where their headquarters are located (San Francisco, Kansas City et al. P.).

Each regional office has its own board of governors. 9 members of the council are divided into classes A, B and C:

- 3 Class A managers are selected by the Fed's shareholder banks from their own representatives (one from big banks, one off average, one from small)

- 3 class B managers are elected by the Fed's shareholder banks from among the people, not working in the banking system (one from big banks, one off average, one from small)

- 3 Class C Governors appointed by the Fed's Board of Governors.

Each regional office president is appointed with the consent of the Fed's Board of Governors. List of all regional bank governors published by the Federal Reserve ).

Each region has a numerical and alphabetic designation in alphabetical order according to the list:

| Territory number | Letter | Center location | Federal Reserve Bank | Website |

|---|---|---|---|---|

| 1 | A | Boston | Federal Reserve Bank of Boston | http://www.bos.frb.org |

| 2 | B | New York | Federal Reserve Bank of New York | http://www.newyorkfed.org |

| 3 | C | Philadelphia | Federal Reserve Bank of Philadelphia | http://www.philadelphiafed.org |

| 4 | D | Cleveland | Federal Reserve Bank of Cleveland | http://www.clevelandfed.org |

| 5 | E | richmond | Federal Reserve Bank of Richmond | http://www.richmondfed.org |

| 6 | F | Atlanta | Federal Reserve Bank of Atlanta | http://www.frbatlanta.org |

| 7 | G | Chicago | Federal Reserve Bank of Chicago | http://www.chicagofed.org |

| 8 | H | St. Louis | Federal Reserve Bank of St. Louis | http://www.stlouisfed.org |

| 9 | I | Minneapolis | Federal Reserve Bank of Minneapolis | http://www.minneapolisfed.org |

| 10 | J | Kansas City | Federal Reserve Bank of Kansas City | http://www.kansascityfed.org |

| 11 | K | Dallas | Federal Reserve Bank of Dallas | http://www.dallasfed.org |

| 12 | L | San Francisco | Federal Reserve Bank of San Francisco | http://www.frbsf.org |

Functions of the regional branches of the FRS:

- set discount rates with the permission of the Fed Board of Governors

- monitor the state of local economic and financial institutions

- provide financial services to the U.S. government and other depositories

Federal Reserve Bank of New York

The most important of the regional branches of the Fed is the Federal Reserve Bank of New York., responsible for international financial and open market transactions. Unlike the rest of the Federal Reserve Banks, this reserve bank has a standing vote on the Federal Open Market Committee. Is considered, that the post of President of the Board of Governors of the Federal Reserve Bank of New York is the second most important in the governing structure of the Fed.

Timothy Geithner became the 75th Treasury Secretary in the Administration of the 44th President of the United States Barack Obama (en: Timothy F. Geithner), formerly head of the Federal Reserve Bank of New York.

Federal Open Market Committee

The Federal Open Market Committee is organizationally located between the Board of Governors of the Federal Reserve and the regional branches of the Federal Reserve. (FOMC), key organ, monetary policy manager. Its decisions are aimed at stimulating economic growth while maintaining the stability of prices and monetary circulation..

The voting rights in the committee belong to 7 the Fed governor and 5 representatives of regional offices, delegated on a rotational basis.

The minutes of the committee meetings are regularly published on the official website of the FRS.[3] The calendar of meetings and the time of publication of the minutes are known in advance and are significant financial news.

Shareholder banks

At the bottom level of the organizational structure of the FRS are the banks - the holders of the FRS shares.

Any commercial bank, Fed compliant, can become the owner (Shareholder) local regional office. Currently (2009 year) the structure of the FRS includes 38 % all banks and credit unions in the United States (about 5,6 thousand legal entities).

Fed shares, received by banks in exchange for reserve capital, have a number of limitations: they cannot be sold or exchanged, a fixed dividend is paid on them - 6 % per annum, profit-independent fed[4].

Functions of the Federal Reserve Banks:

- receiving a fixed dividend on Fed shares in exchange for the deposit

- participation in elections 6 from 9 local regional office managers (classes A and B)

Bank lists, included in the FRS, published on the websites of the respective regional offices

Features of the Fed as a Central Bank

Capital ownership

The Federal Reserve's capital is purely shareholding. In this regard, the United States is different from countries, where the capital of the Central Bank is wholly owned by the state (United Kingdom, Canada) or is a joint stock company with a state share in it (Belgium, Japan).

Operating profit

The Fed is issuing money, which is mainly directed to the purchase of obligations (bonds) U.S. Treasury (in special cases , and other assets). In this way, USD exchange transactions are based on trust in the US Government and the US financial system as a whole.

Beyond seigniorage, Fed income is interest payments on Treasury bonds, income from payment transactions, Deposits, operations with securities.

The salaries of the Fed governors are appointed by the Congress. IN 2008 year, the chairman's annual salary was 191 300 US dollars, other governing bodies of the Council - 172 200 US dollars.

After the payment of salaries to managers and employees of the Fed and fixed dividends on shares, Fed transfers the remaining profit to Treasury accounts, which go to the revenue side of the budget. For example, in 2006 year the Fed received net income 34,195 billion US dollars, out of which 871 million was paid as dividends to shareholders, the revenue side of the budget received 4,272 billion, interest payments to the US Treasury amounted to 29,052 billion ([4]).

Fed's current balance sheet: Federal Reserve Statistical Report, Section H.4.1(English)

Independence

Providing broad decision-making autonomy to the Fed is coupled with accountability and verifiability, which must take place within the legally stipulated framework.

Under the Federal Reserve Act, The Fed reports annually to the House of Representatives of the US Congress, twice a year before the Banking Committee of the US Congress.

The Fed's activity is over 100 has been audited by the US Audit Office (English. Government Accounting Office), and is also periodically audited by independent audit firms.

| Federal Reserve System | |

| Headquarters | Washington, United States of America |

|---|---|

| The president(chairman) | I'm Bernanke |

| Currency | US Dollar |

| Base discount rate | 0.25% (-0.75%) 16.12.2008G. |

| Base deposit rate | 0.50 % (-0.75%) 16.12.2008G. |

| Website | www.federalreserve.gov |