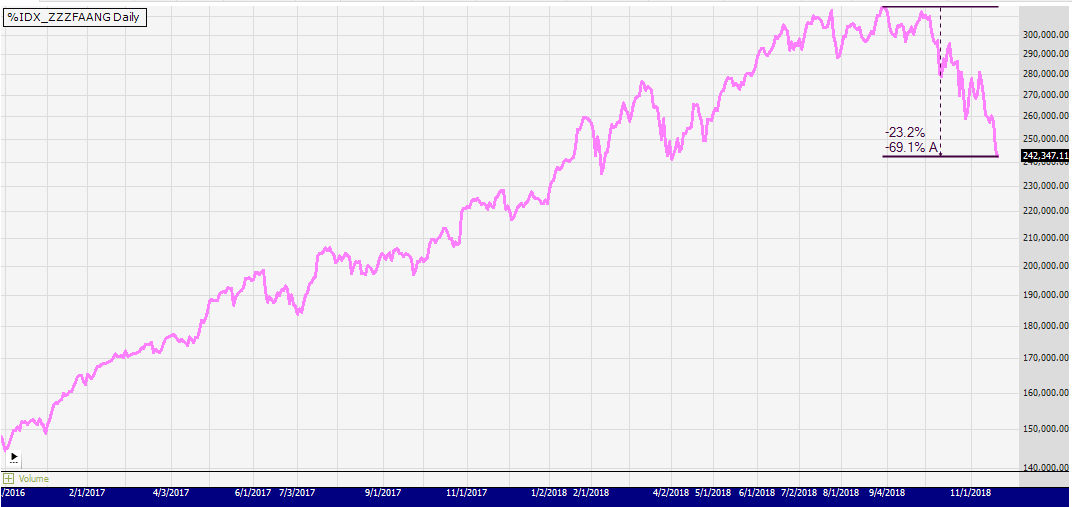

Who doesn't know, I will explain that the abbreviation FAANG refers to a group of shares, which includes Facebook, Amazon, Apple, Нетфликс и Гугл. This is because at one time these stocks were the leaders of growth and the pride of the new America.. Then they grew ahead of the market, and now they are falling stronger than the market. Here is the FAANG Equilibrium Index, built in WL IndexLab at closing prices, no intraday fluctuations (high and low). He has already lost 23%, while SP-500 total 10% (if you count by closings).

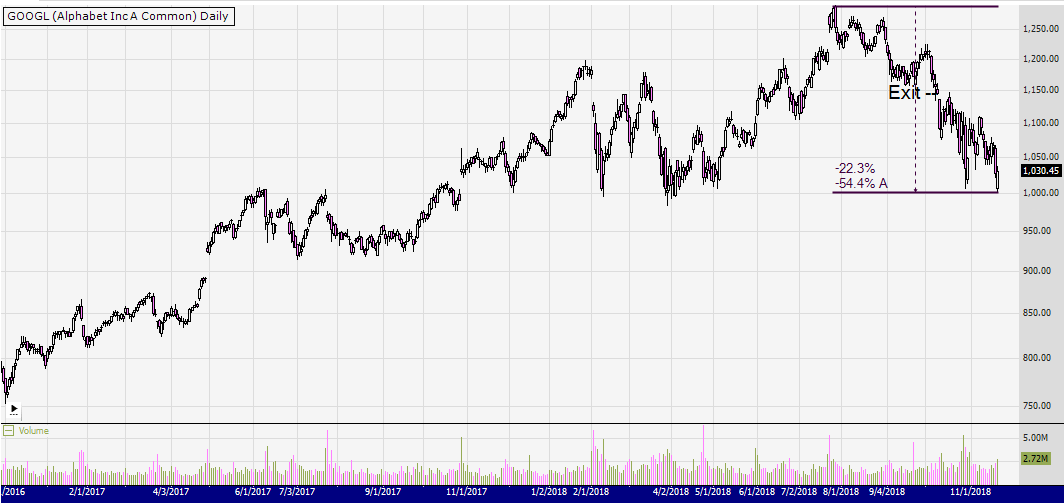

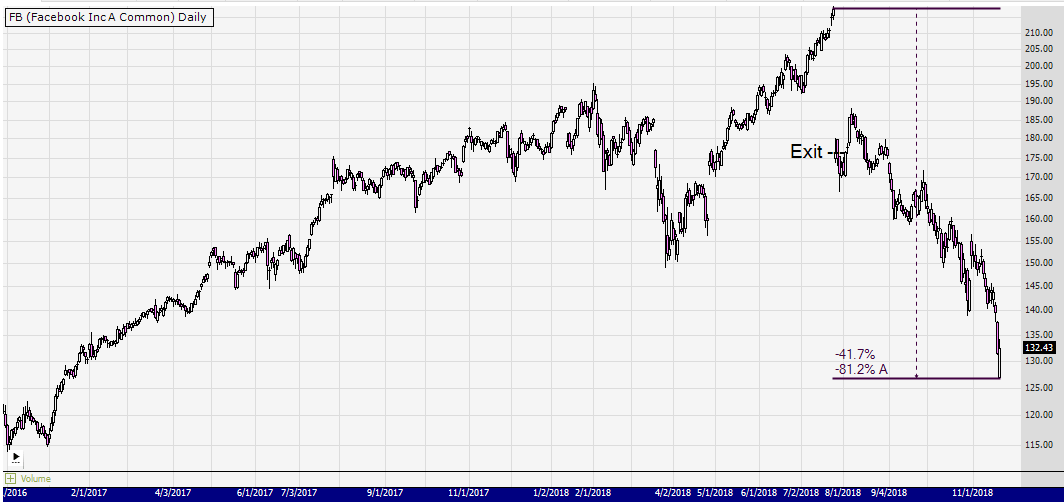

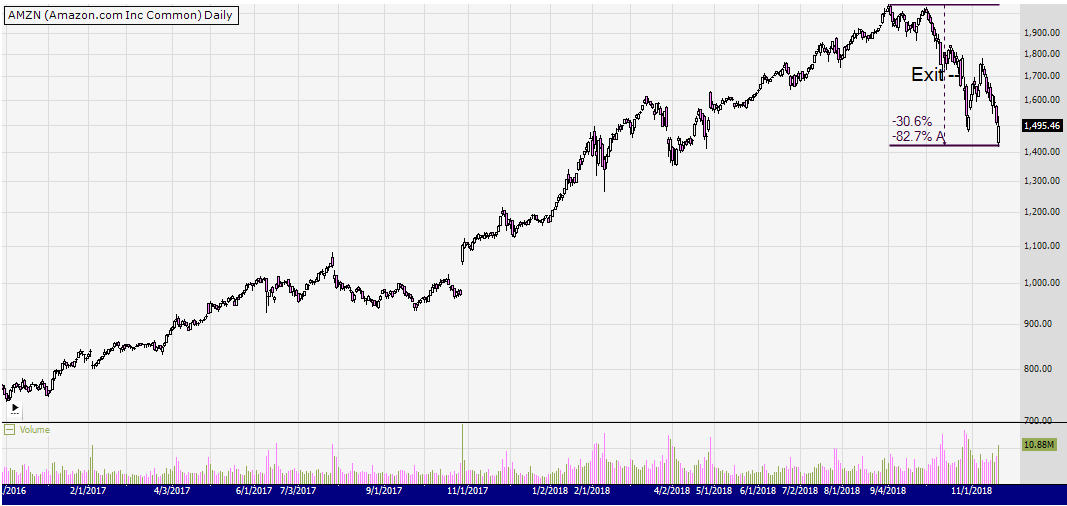

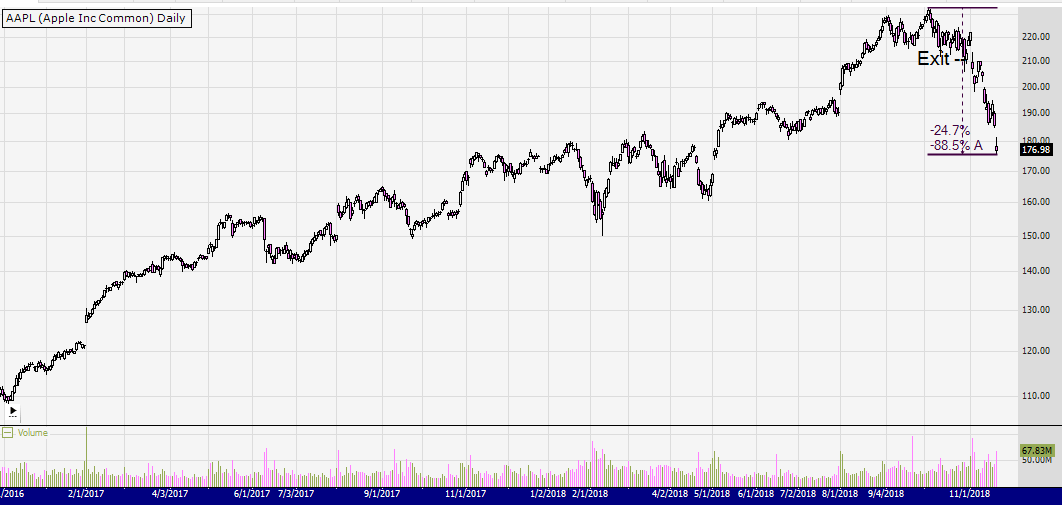

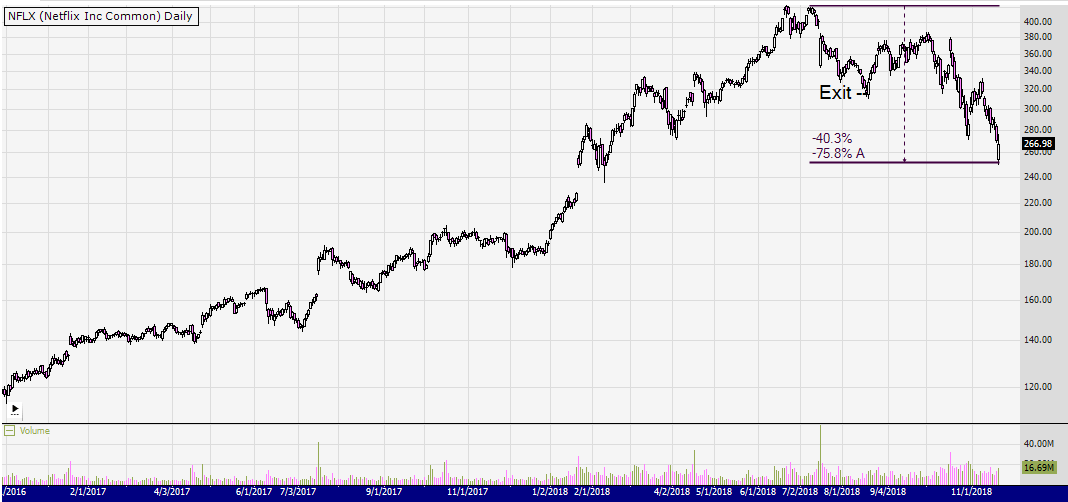

Now let's move on to the individual charts of these companies.. Naturally, for each of them I had long-term positions, because they were the leaders of growth. The point of the final exit from the position on the charts is designated EXIT.

Facebook shares fell the most, almost on 42% from high to low. I think that after the corrective rally there will be a good point for opening a medium-term short., since the potential for falling is not limited here.

Amazon fell on 30%

Apple fell on 25%

Netflix in second place in falling after Facebook. -40%. Too, I think that the fall can continue. In the past years, Netflix, after rapid growth, has been corrected more than once by 70-90%. I don't think there will be an exception this time.

Google fell on 22%