According to Bloomberg, Chinese Regulators Want New Sanctions Against Taxi Service DiDi. How the authorities will punish the company, not yet known, but here are the options: big fine, suspension of activities, nationalization or delisting from the American stock exchange.

How it all started

DiDi's IPO on the New York Stock Exchange 30 June. The next day, the company's shares rose by 16%, and capitalization - up to 79 billion dollars. Within a few days, the Chinese Cyberspace Administration launched an investigation. The regulator was worried about, how the company collects and stores user data. The service was banned from registering new users, and the application for ordering a taxi was removed from stores.

Chinese authorities suggested to DiDi to postpone the IPO and reconsider the attitude to data security. In the management of cyberspace feared, that large amounts of data will fall into foreign hands after being placed on the American exchange. DiDi wanted to list as soon as possible for two possible reasons. First: pressure from large investors. Second: regulator side pressure, who was about to introduce a new data protection law. According to the law, companies with more than a million users are required to pass a security check before listing on a foreign exchange.

Chinese regulators considered, that DiDi's decision to hold an IPO threatens the credibility of the authorities. Last week the Cyberspace Administration, Market Regulation Authority, the antimonopoly service and four other departments came to the company's office with a check.

In the three weeks since its initial offering, DiDi's shares have fallen by 28%.

And that?

The Chinese government is trying to balance between national interests and the interests of large technology companies, which move the country's economy forward. So far it turns out badly. It can be seen from the actions of the authorities, that the size of the profit of a particular company for the state remains in second place.

So, In April, the China Anti-Monopoly Service fined Alibaba with 2,8 billion dollars. In November last year, the authorities "asked" the financial company Ant Group, daughter of Alibaba, postpone IPO. And in early July, the Cyberspace Administration launched an investigation into two other companies, who have recently listed shares on the US stock exchange. Such actions of the regulator repel companies from innovation., and investors from investing in Chinese companies. And Alibaba shares are an example of this..

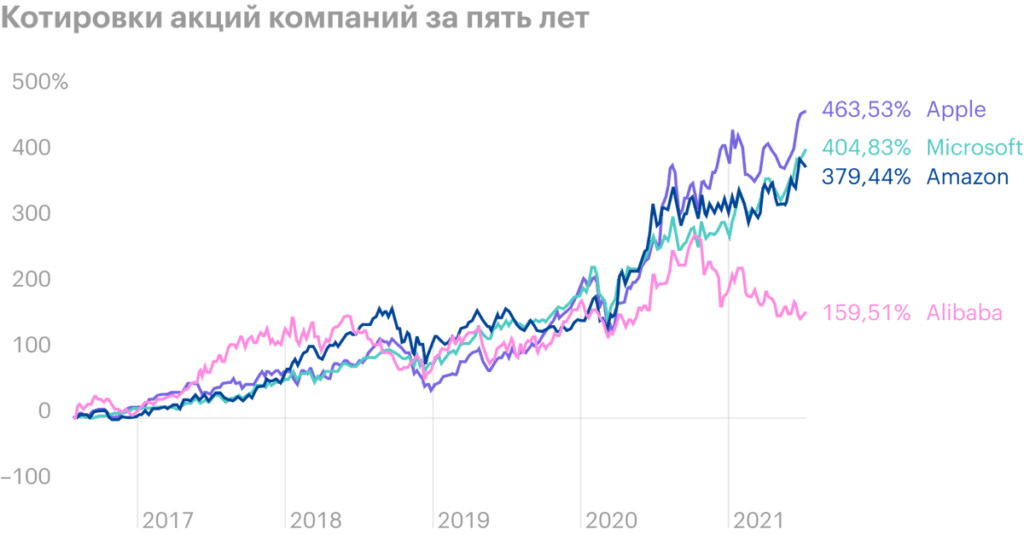

Alibaba capitalization is 600 billion dollars - four times less, than the American giants Apple, Microsoft и Amazon. The company's sales are growing much faster, on average by 48% yearly, and the shares are trading at 2018 of the year. It remains only to guess, how much would Alibaba cost, if I was from America.

Growth in company revenue over five years

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Alibaba | 47% | 74% | 41% | 28% | 52% |

| Apple | −8% | 6% | 16% | −2% | 6% |

| Microsoft | −3% | 6% | 14% | 14% | 14% |

| Amazon | 27% | 31% | 31% | 20% | 38% |

Marginality of large retailers

| Gross | Operating | Clean | |

|---|---|---|---|

| Amazon | 40% | 6,6% | 6,4% |

| Alibaba | 41,3% | 12,5% | 21,0% |