Today we have an extremely speculative idea.: take promotions of cloud HR-service Cornerstone OnDemand (NASDAQ: BANKRUPTCY), in order to capitalize on the growth in demand as for the services of the company, as well as its shares.

Growth potential and validity: 18% behind 14 Months; 11% per year for 15 years.

Why stocks can go up: demand for company solutions will grow.

How do we act: we take shares now by 57,33 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

It is a cloud platform for training and personnel management. What does it look like, can be viewed on the YouTube channel.

According to the report, the company's revenue looks like this:

- Subscription - 95,2%.

- Professional Services - 4,8%. Services for installing and optimizing the company's software for its customers.

Geographically, revenue is divided as follows: 63,4% the company's revenue comes from the US, the rest for others, unnamed countries.

Arguments in favor of the company

Need. America's skills shortage and rising labor costs. Under such conditions, CSOD allows you to do something, what all managers dream of, - make the most of available resources, training existing workers and managing them more rationally. Therefore, we can expect an increase in demand for the company's services.. On a spiritual level, CSOD has a lot in common with C3 AI, whose business prospects have approximately the same prerequisites.

Spreading Remote Work, requiring investments in education and management of employees in new conditions with an appropriate load on the COMPANY's HR departments, - also a big boon for CSOD.

Small capitalization. CSOD has a capitalization of $3.83 billion. This is quite a bit and greatly enhances the effect of the influx of an army of retail investors into these stocks.. And that's, that such an influx will take place sooner or later, I have no doubt.

Can buy. The company's competitors are much larger enterprises such as Workday, SAP и Oracle. Due to the low cost of CSOD, it is very likely that, that one of them will buy it. Moreover, CSOD in the last quarter showed operating profit for the third time in its history., so, may be, in economic terms, it is not at all hopeless - which potential buyers should have noticed.

What can get in the way

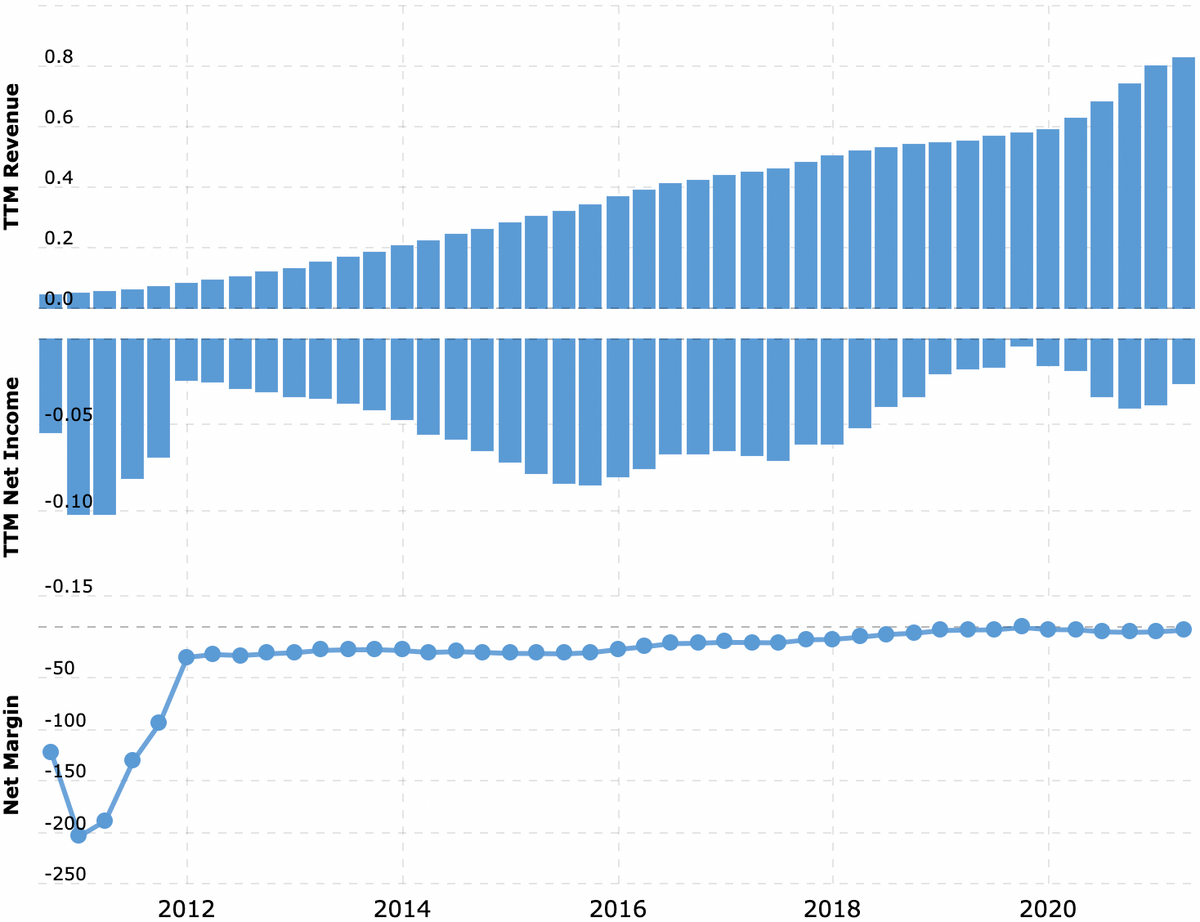

Unprofitableness. The loss of the company guarantees the volatility of shares and in the future may threaten bankruptcy. CSOD has a very large amount of debt: 1,68 billion dollars, of which 545.489 million must be repaid during the year. Not much money at the disposal of CSOD: 147 million on accounts and 140.7 million debts of counterparties. Such a large volume of liabilities, combined with a loss-making ratio, is very bad in the context of higher rates and more expensive loans.. So you should mentally prepare., that the company will finance its operations by issuing new shares, what can they fall from.

The impudence of the city loses. Target market of the company, according to her estimates, is approximately $21 billion. The company occupies approx. 3,95%, but it stands as 18,23% market. Confess, I have seen a more brazen ratio in IT: when the company occupies 0,5% market, but it stands as 50%, — but still it is impossible not to recognize, that CSOD is expensive. And this will also be an additional weight on quotes..

Not typical. In recent years, the company's revenue retention rate has been declining.: if in 2018 it was 105,7% and from the available customer base, the company received so much money, that this covered the losses from the departure of some of the subscribers, then in 2020 it was already 95,1% are normal indicators for the subscription business, but already have to spend effort and money to retain existing customers. All this delays the moment when CSOD breaks even and, frankly,, reduces the attractiveness of the company in the eyes of a potential buyer.

What's the bottom line?

You can take shares now by 57,33 $. And then there are two options:

- hold shares for the following periods 14 Months: taking into account all the positive aspects, the price of the company's shares, maybe, will exceed historical highs and reach the level 68 $;

- keep shares in sorrow and joy next 15 years: suddenly a new Microsoft will leave the company.

But, taking into account the losses and debts of the company, you should be prepared for the volatility of these stocks.