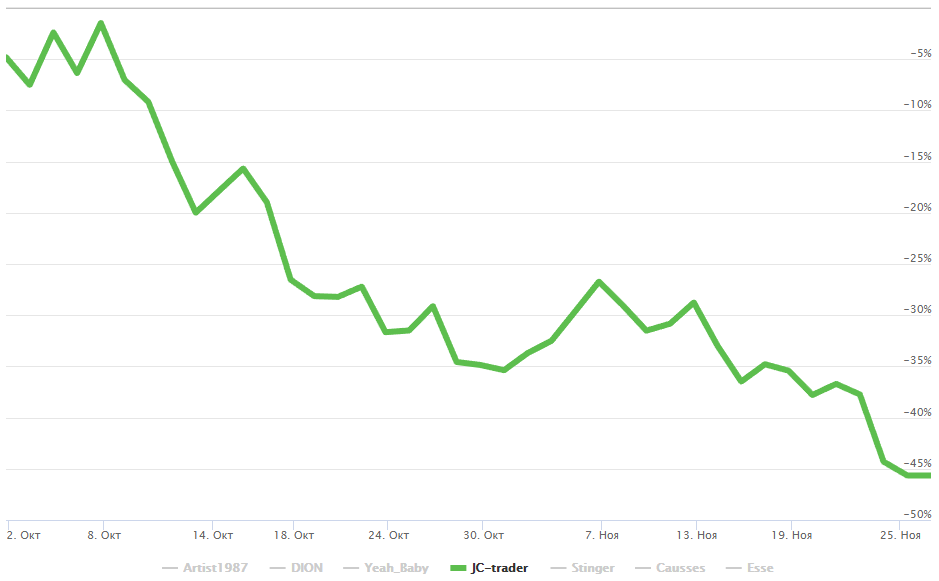

All in all, exposed me for concealment from the general public of the drawdown at the Champions League-2018. Thought, maybe no one will notice, but no, it was not there :)

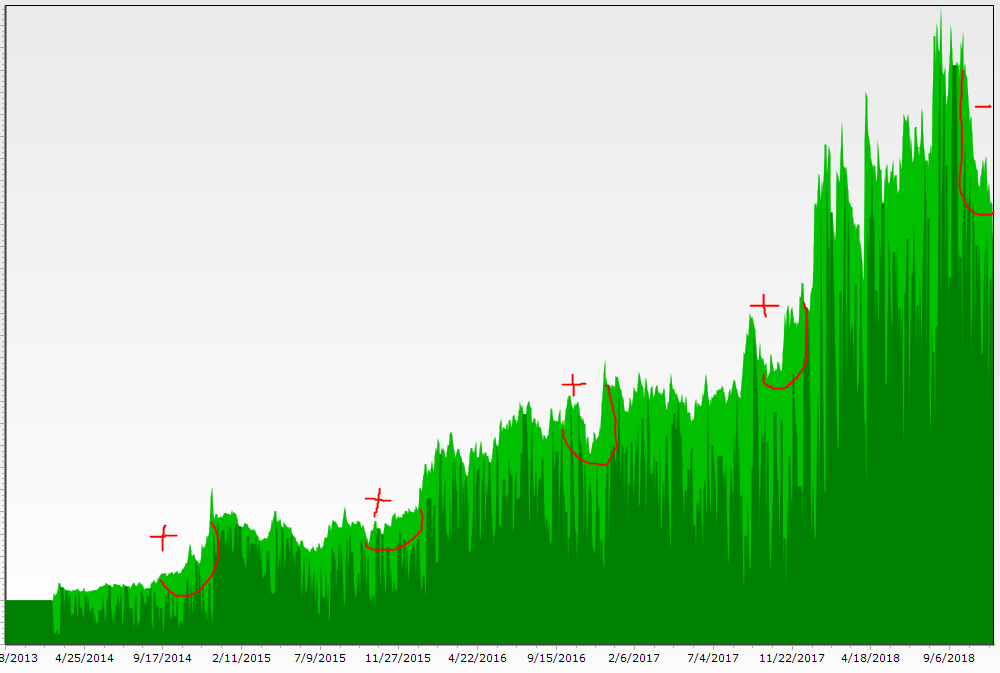

I trade the same system as in the previous LPI, without any changes, only in the past there was a more or less successful period for the system, but this time a drawdown began from the very beginning of the championship. In the picture of the theoretical equity of the trading system, the red line marks the past LPI, where for the first four LPI the end point of equity turned out to be higher than the initial one, but the current LPI is still in the red and is unlikely to be a plus.

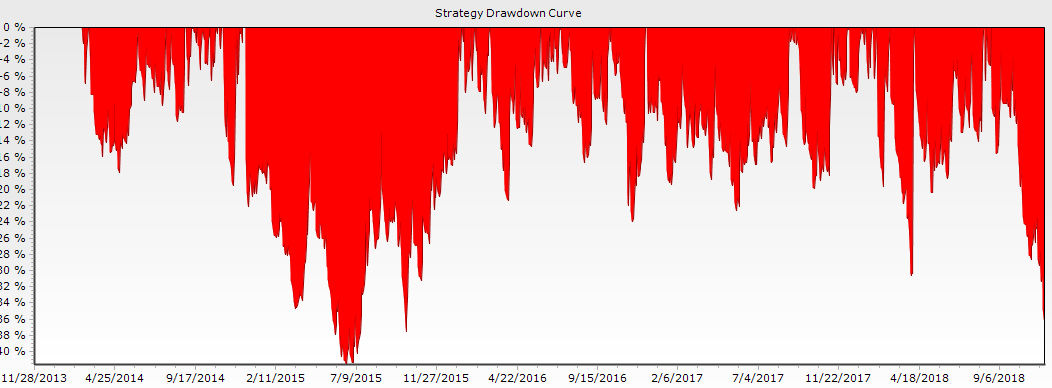

Если взлянем на schedule просадок, then we will see that today's drawdown is not the largest over the past five years. IN 2015 the drawdown reached 40%. So there is nothing catastrophic here yet. It's just unpleasant that the drawdown fell during the period of the LPI..

Immediately I foresee a question — how do you allow such a drawdown as much 40%? Here everything is simple. Drawdown depends on the accepted risk. I have it big — 5% for a deal, because I only hold risk capital in my futures account, who is ready to completely lose, although it is theoretically impossible to lose it, since the value of the trade decreases with each decrease in the futures account . He (risk capital for futures) equal to about 10% from money allocated to a Russian broker.

And yes, at all, it is very easy to regulate the drawdown — we reduce the risk from 5% to 1% per trade and the drawdown turns into -8%.

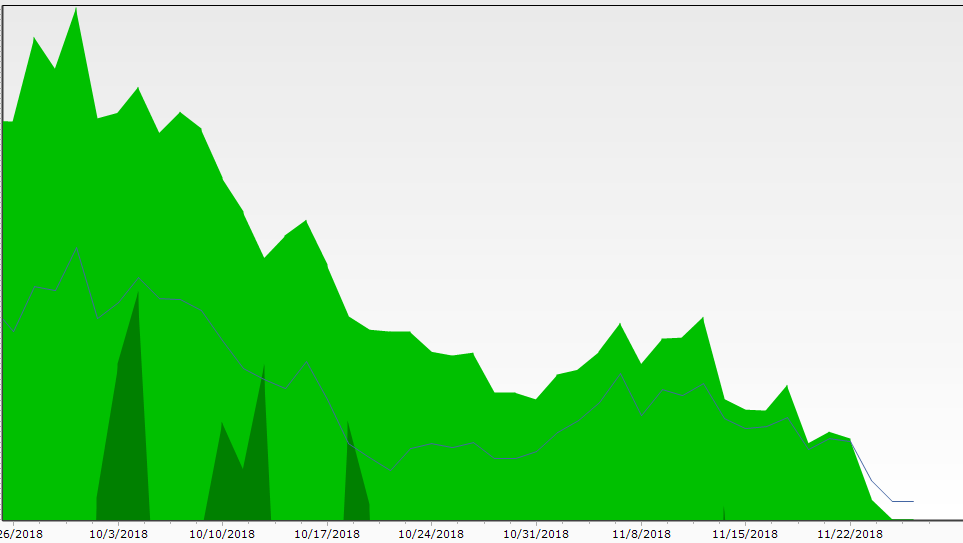

If you highlight the period of the LPI on the theoretical equity chart, then we see that the theoretical equity (above) almost one-to-one matches equity, copied from the LPI (down below).

So that, Everything's under control. No disaster. As they say, well-wishers don't worry, spiteful critics don't rejoice :)