Cherkizovo Company (MCX: GCHE) — the leader in the Russian market of meat products in terms of production and sale of chicken meat, Turkey, pork and sausages.

Vertically built structure allows the company to keep under control all business processes: from crop feeding and domestic feed production to production, processing and sale of meat products under their own brands in the Russian and foreign markets.

Prior to that, I reviewed the company's operating and cash results. Cherkizovo based on results 2020 of the year, where noted the highest rates during the crisis, despite the temporary restriction of the work of public catering companies and the decline in the earnings of residents. All business segments showed sales growth, and profit doubled in relation to 2019 year. In particular, the growth of export supplies due to access to the Asian and Middle Eastern markets was especially powerful..

12 April the company made public the industrial performance of the results 1 quarter 2021 of the year.

Position on the company's market

2020 the year was not easy for business and the industry as a whole:

- Prices for agricultural products have increased - the main raw material for meat producers. Russia introduced high export duties on grain crops, to protect the domestic market and halt production inflation. Based on the results of 2020 year the volume of feed production Cherkizovo satisfied domestic needs only on 43%, and the rest had to be purchased from third companies, therefore, rising prices for cereals and feed leads to an increase in operating costs, reduces margins and forces to raise prices for its own products.

- A serious blow to the export direction came from China. There found traces of coronavirus on the packaging of Cherkizovo products. As a result, China suspended purchases of poultry meat on 4 weeks.

- At the beginning of the year, outbreaks of bird flu were recorded in Europe and Russia.. Part of the production was closed, and the infected consignments were disposed of. As a result, there was an imbalance in the chicken market and additional risks for producers appeared..

I propose to evaluate, how these and other factors affected Cherkizovo's key production indicators in the first quarter 2021 of the year.

Overview of operating results by Segments of Cherkizovo

Poultry — the main source of income of the company. The sale of chicken and turkey accounts for more than 60% of all Cherkizovo's revenue in 2020 year.

For the first three months 2021 the holding sold for 3% less chicken meat year on year 169,25 thousands of tons. This decline was the first time in recent 5 years.

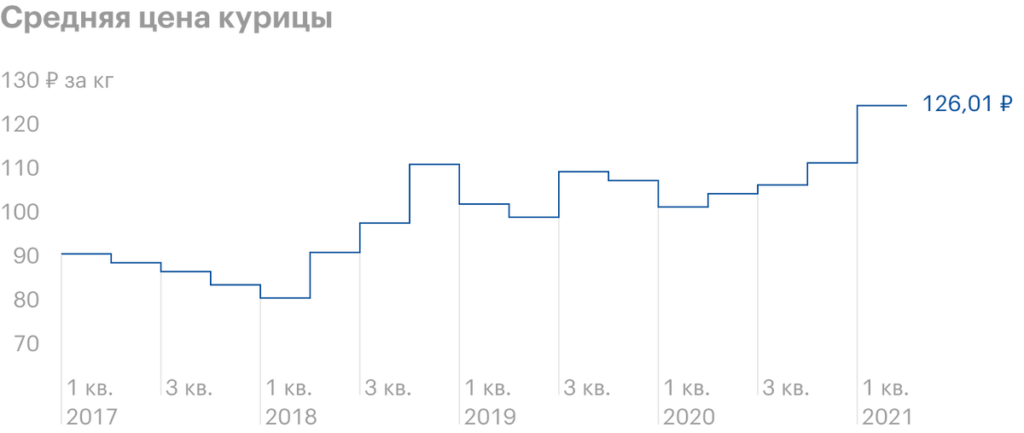

The price of chicken has skyrocketed 22% quarter to quarter — up to 126,01 P per kilogram. A rough estimate says, what is the proceeds from chicken sales for 1 quarter can almost 22% beat last year's results.

Dynamics of chicken sales according to the results 1 quarter, thousand tons

| 2017 | 125,55 |

| 2018 | 137,5 |

| 2019 | 151,6 |

| 2020 | 174,69 |

| 2021 | 169,25 |

Cherkizovo produces turkey together with the Spanish company Grupo Fuertes at the enterprises tambov turkey, producing products with 2017 pava-pava brand. Sales of turkey increased by 8% quarter to quarter — up to 10,69 thousands of tons is a record figure for the quarter.

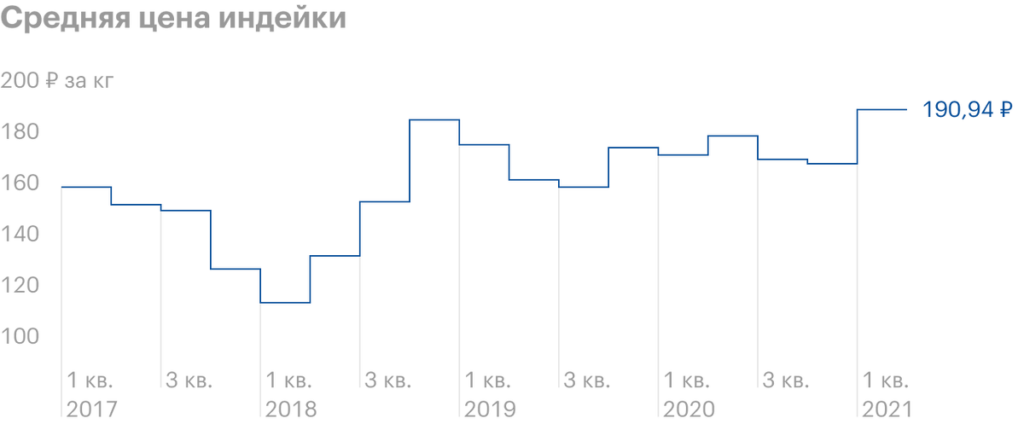

Turkey meat - dietary products, and it traditionally costs more than chicken. The average price per kilogram of turkey increased by 10% in 1 quarter - to record 190,94 R.

Dynamics of turkey sales according to the results 1 quarter, thousand tons

| 2017 | 3,34 |

| 2018 | 9,74 |

| 2019 | 8,22 |

| 2020 | 9,87 |

| 2021 | 10,69 |

Pork and meat processing.

Cherkizovo raises pigs, Use?? in the production of sausages and semi-finished products.

The size of pork production in live weight for the 1st three months decreased by twenty percent year-on-year: with 77,11 thousands to 61,92 thousands of tons. The company does not open the prerequisites for the fall, but talks about the decline in sales of live bait by seventy-nine percent and pork half-carcasses by thirty-two percent over the same period.. Lower production - a response to falling demand.

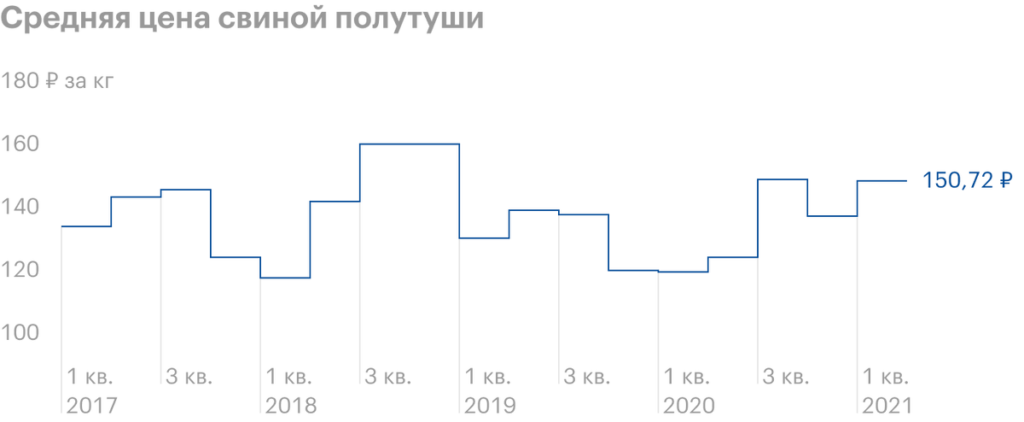

With all this, pork prices were higher., than in 1 quarter 2020 of the year. The average selling cost of pork bait increased by twenty-nine percent, half-carcasses by twenty-four percent, cuts by seven percent, and other pork products by forty-two per cent. The increase in prices is associated with the low base of the past year, when pork prices were historically low, and due to the devaluation of the ruble, inflation manifested itself and the price of feed increased.

Sales of meat processing products increased by four percent quarterly to 26,34 thousands of tons. The average cost of sales increased by five percent to 199,79 P per kilogram.

Dynamics of pork production according to the results 1 quarter, thousand tons

| 2017 | 44,98 |

| 2018 | 57,52 |

| 2019 | 68,13 |

| 2020 | 77,11 |

| 2021 | 61,92 |

What's the bottom line?

Three months is too short, to make reliable forecasts of operational and financial prospects this year. However, some trends can already be seen.

Production results say, that sales volumes at Cherkizovo have declined markedly against the background of the market situation and reduced export supplies to China, at the same time, retail prices for a large part of the products showed an increase.

Inflation in Russia in 1 quarter 2021 year has exceeded 5% - for the first time in a year and a half. This directly affects the food industry.. Meat producers are forced to raise prices for their products after agricultural producers, what hits the buyers.

In 2 Q3, Cherkizovo's sales volumes may rise on the back of last year's low base, when catering establishments limited their work in the spring amid the spread of coronavirus. Besides, after the completion of the checks, sales in China can be restored in full, what will help the company's exports.

The company's revenue at the end 1 quarter, probably, will be at a record level for this period, but it is important to evaluate, how the increase in grain prices affected the cost of sales and business margins.