17 May, Monday, telecommunications conglomerate AT&T (NYSE: T) announced the merger of its non-core division WarnerMedia with media company Discovery (NASDAQ: DISK). The new company will unite such brands, like HBO, Warner Bros., Discovery, DC Comics, CNN, Cartoon Network, Eurosport, Animal Planet and more.

“This agreement brings together two leaders in the entertainment industry and positions the new company as one of the leading streaming platforms.. Merger with Discovery to support fantastic growth and global launch of HBO Max, as well as improve efficiency, which can be used to create better content. The agreement will allow AT&T Increase Capital Expenditures for 5G and Fiber Optic Networks, to meet long-term demand. AT shareholders&T will retain their stake in the telecommunications company and receive a stake in the new company.”, - said the head of AT&T John Stankey.

Under the terms of the AT deal&T will receive $43 billion in cash and other liquid assets, and its shareholders 71% shares of the combined company. Discovery's share of shareholders will be 29%.

Expected, that the deal should close in mid-2022. After that AT&T will be able to concentrate on its core business: increase investment in 5G and fiber networks, significantly reduce debt and, maybe, start redemption of shares.

The company's management also mentioned "attractive dividends". AT them&T plans to allocate 40% from an expected free cash flow of $20 billion, that is about 8 billion. An important nuance: in the past two years, the company spent twice as much on dividends - 15 billion. Now the issuer's dividend yield is 6,6%. AT&T 35 years increases the size of dividends and is included in the list of dividend aristocrats.

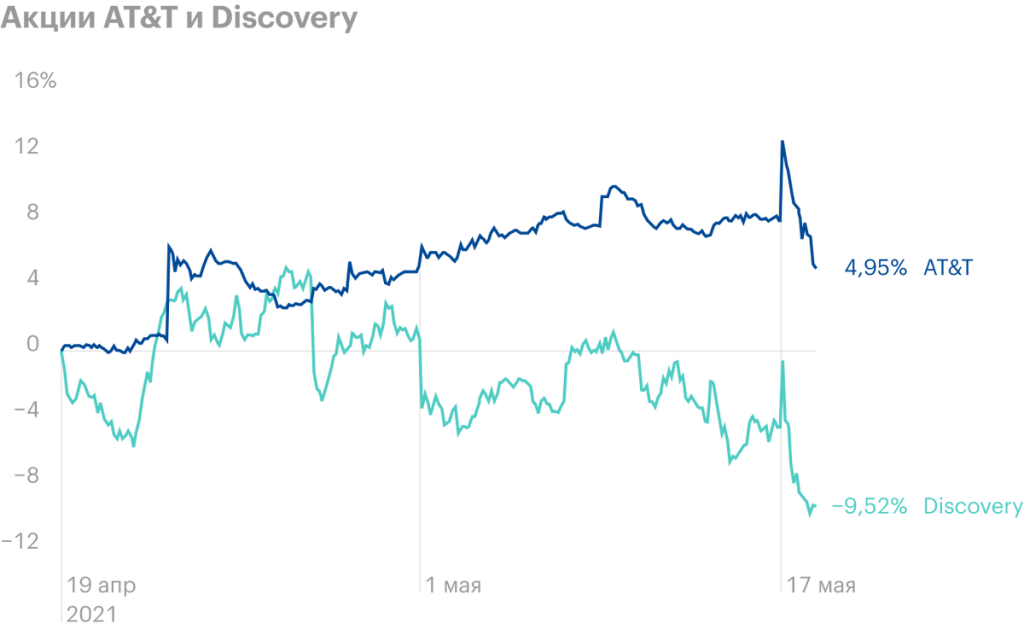

By the end of the main trading session on Monday, AT shares&T turned on 7%, and Discovery — on 14%.