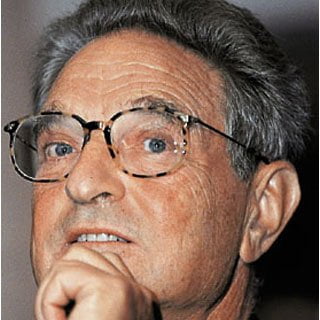

Steve Neeson (Steve Nison)

Steve Neeson, President of Nison Research International, Inc. (NRI), was the first, who discovered the Japanese method of technical analysis, known as "candlestick charts", for the West. He is an internationally recognized authority in the field., revolutionized technical analysis in the USA and Europe by applying these methods. He is the author of two popular books.: "Japanese Candlesticks" and "Beyond Japanese Candlesticks". He advises all over the world, including the Federal Reserve and World Bank. At NRI, Mr. Neeson specializes in webinars and consulting services to organizations. Detecting Early Reversal Signals With Japanese Candlesticks A prudent person has more than one bowstring for his bow.. ( Japanese proverb) Analysis of Japanese candlestick charts has this name, because its lines resemble candles. Used by generations of people in East Asia. Such graphs were in use long before columnar histograms or "tic-tac-toe", but were practically unknown to the Western world before, how I introduced them into use in 1990 year. This charting technique is now used internationally by many traders., investors and well-known financial institutions.