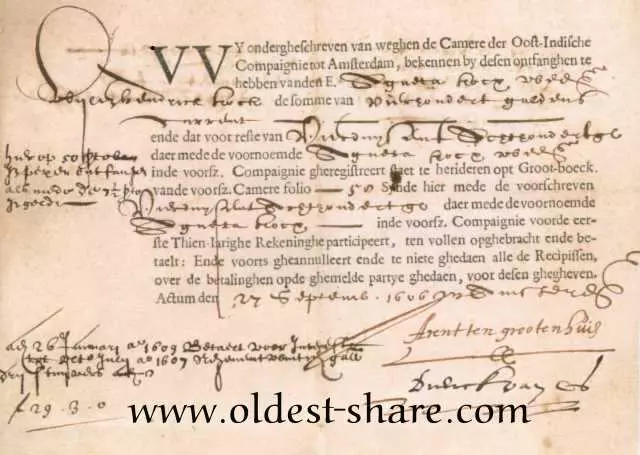

The oldest share in the world

History: Opening of the sea route to India – once the name, given in India, Asia Minor and all of Southeast Asia – in the House of the sailor Vasco da Gama 1499 established Portuguese colonial authority in the Indian Ocean. During the next 100 about years 200 flights were around the Cape of Good Hope to the east. The main motive was originally in the spice trade, but about 1600 other goods, trade was discovered in the east and they took a more prominent place, than in the spice trade. Only about half of all ships, which were sent, mainly, Portuguese and Dutch are all back. Atlantic expeditions thwarted the Ottoman Empire, which blocked access to the eastern Mediterranean for Western Europe. They were also the reason for subsequent alliances and the East India Company.. IN 1580 G. the two great maritime powers Spain and Portugal have merged.