One of the leaders of Citi Private Bank David Beilin advised to pay attention to the healthcare sector, and also highlighted promising industries and companies within the sector.

Health care is underestimated

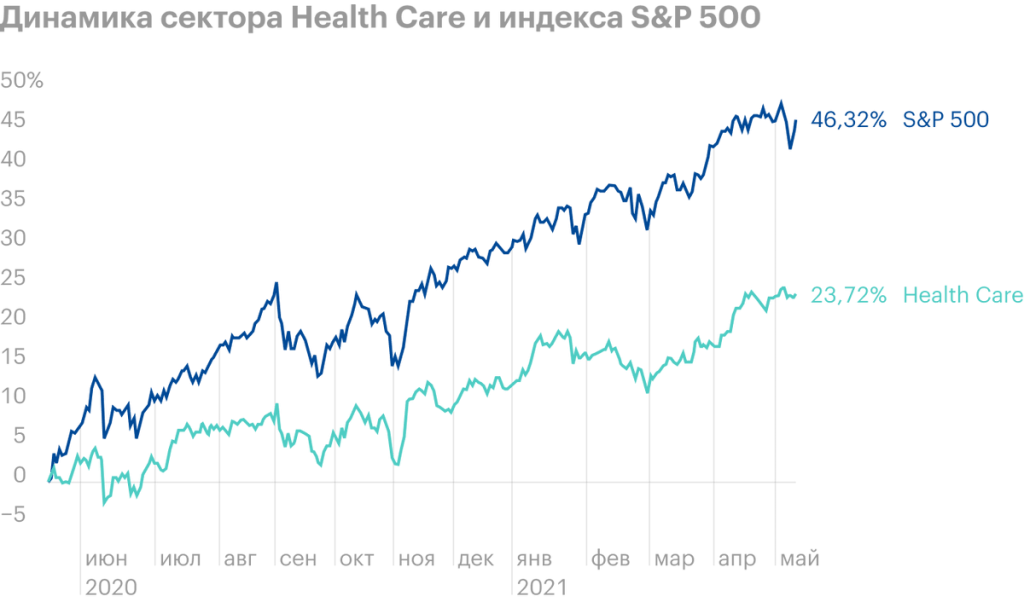

One of the defensive and recession-resistant sectors is healthcare. Income of companies from this area does not fall even during economic crises. Citi strategists celebrate, that during market corrections, health care falls less compared to other sectors.

According to Bailin, now healthcare attracts not only with its protective properties, but also a fair assessment. The sector grew twice as fast as the broad market last year: 24 against 46% S&P 500. Today forward ratio P / E sector of 8% more than its average 20 years of value. In S&P 500 is more than 34%.

Of the possible risks, the investment bank highlights the regulation of drug prices and the revision of the insurance system in the United States. "But we think, that the chances of major health regulations being passed, which will reduce the revenue of companies, below, than the market lays down ", Bailin said.

Forward P / E sectors and S&P 500

| Current value | Average value for 20 years | |

|---|---|---|

| S&P 500 | 21,2 | 15,8 |

| Information Technologies | 24,3 | 18,8 |

| healthcare | 16,7 | 15,5 |

| Goods of second necessity | 32,9 | 18,7 |

| Communication services | 21,7 | 19,2 |

| Finance | 14,5 | 12,4 |

| Industry | 25,5 | 16,1 |

| Essential goods | 21,0 | 17,0 |

| Utilities | 19,4 | 14,6 |

| Raw materials | 19,8 | 14,7 |

| The property | 22,1 | 15,9 |

| Oil & Gas | 18,9 | 13,8 |

S&P 500

Current value

21,2

Average value for 20 years

15,8

Information Technologies

Current value

24,3

Average value for 20 years

18,8

healthcare

Current value

16,7

Average value for 20 years

15,5

Goods of second necessity

Current value

32,9

Average value for 20 years

18,7

Communication services

Current value

21,7

Average value for 20 years

19,2

Finance

Current value

14,5

Average value for 20 years

12,4

Industry

Current value

25,5

Average value for 20 years

16,1

Essential goods

Current value

21

Average value for 20 years

17

Utilities

Current value

19,4

Average value for 20 years

14,6

Raw materials

Current value

19,8

Average value for 20 years

14,7

The property

Current value

22,1

Average value for 20 years

15,9

Oil & Gas

Current value

18,9

Average value for 20 years

13,8

Specific directions and companies

The main "long-term arguments" for investing in health care, according to Citi, are global trends: population aging, income growth in developing countries, vaccine innovation, gene therapy, medical devices, telemedicine and many more.

Of the companies, the bank notes the manufacturer of medical devices for diabetics Dexcom (NASDAQ: DXCM), manufacturer of robotic surgical systems Intuitive Surgical (NASDAQ: ISRG), as well as pharmaceutical companies Abbvie (NYSE: ABBV) и Merck (NYSE: MRK).

Cost indicators of companies

| P / E | P / S | Forward P / E | From the annual maximum | |

|---|---|---|---|---|

| Dexcom | 64 | 16 | 100 | −27% |

| Intuitive Surgical | 86 | 21 | 53 | −7% |

| Abbvie | 43 | 4 | 8 | −1% |

| Merck | 28 | 4 | 11 | −11% |

P / E

Dexcom

64

Intuitive Surgical

86

Abbvie

43

Merck

28

P / S

Dexcom

16

Intuitive Surgical

21

Abbvie

4

Merck

4

Forward P/E

Dexcom

100

Intuitive Surgical

53

Abbvie

8

Merck

11

From the annual maximum

Dexcom

−27%

Intuitive Surgical

−7%

Abbvie

−1%

Merck

−11%

Financial performance of companies

| Dividend yield | Operating margin | Average sales growth for 5 years | |

|---|---|---|---|

| Dexcom | — | 15% | 37% |

| Intuitive Surgical | — | 26% | 13% |

| Abbvie | 4,5% | 25% | 15% |

| Merck | 3,3% | 15% | 4% |

Dividend yield

Dexcom

—

Intuitive Surgical

—

Abbvie

4,5%

Merck

3,30%

Operating margin

Dexcom

15%

Intuitive Surgical

26%

Abbvie

25%

Merck

15%

Average sales growth over 5 years

Dexcom

37%

Intuitive Surgical

13%

Abbvie

15%

Merck

4%