According to JPMorgan, stock Amazon may still have significant upside potential after the recent drop in stocks and supply chain problems around the world.

What will happen next?

Analyst Doug Anmuth Confirms His Outperforming Market Rating" for Amazon, stating today, that current shipping difficulties can really help Amazon's long-term prospects.

''We recognize, that there are problems and uncertainties over the next few months, but we believe, that there will still be a significant shift towards e-commerce in the future, and AMZN has a very good experience of investing in the future ”.

And nmut is convinced, that Amazon and other companies were in a very weak position for two weeks, since Treasury yields have risen, and stock market, seem to be, shifted towards more cyclical sectors, such as energy.

.

Difficulties for the company

Supply chain issues further complicate Amazon's ability to show significant growth after 2020 years in e-commerce, but overall, the company should still show improvement.

- “We forecast continued strong revenue growth in 3 And 4 neighborhoods, although our rating is for 4 quarter in size $138 billion by 3% below the Wall Street consensus, what could be right, given growing concerns about growth in 4 quarter ", – says analyst.

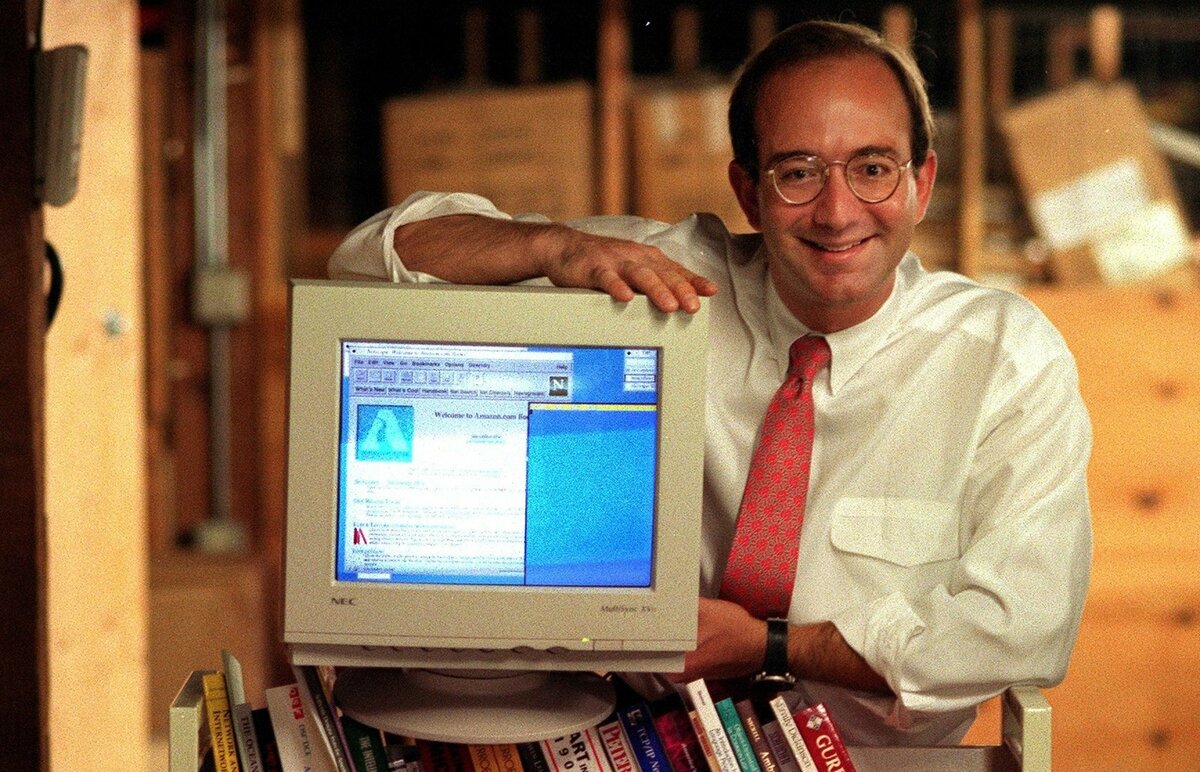

Jeff Bezos in his youth Jeff Bezos in his youth

JPMorgan has set a price target for Amazon at $4100 per share. It's over 28% above the close of the stock yesterday.

Potential reasons for the stock rally over the next few months include rising profits during the holiday season for Amazon and a possible increase in Prime prices in 2022 year.