On Tuesday, 28 September, major US stock indexes fell heavily, and the technological index Nasdaq showed the worst dynamics since March. According to experts, Rising Treasury yields are the main reason for the fall.

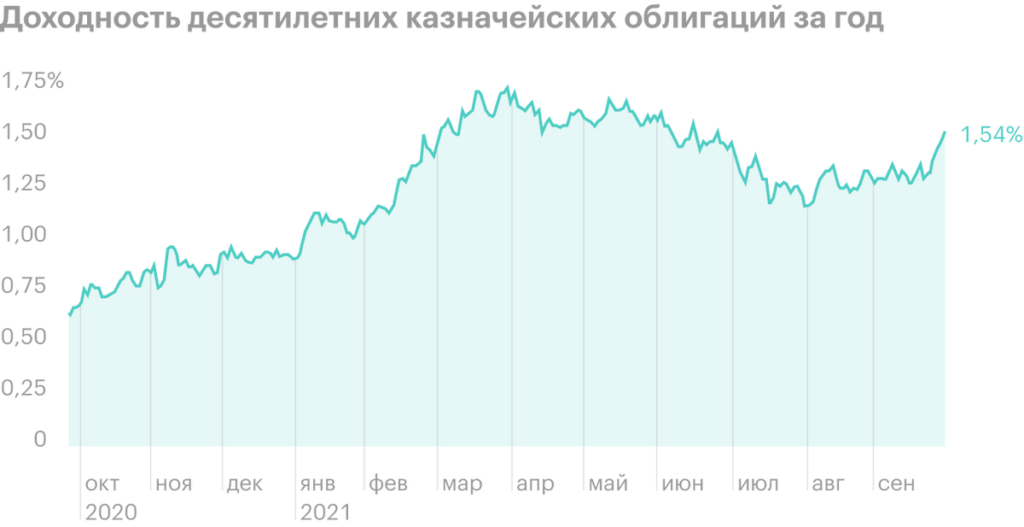

Following the results of the main session, the indices S&The P 500 and Dow Jones fell on 2 And 1,6%. Nasdaq lost more than others - 2,8%. But the yield on ten-year Treasury bonds rose to the highest in the last three months - 1,53%. Back in August, the yield on these bonds was 1,13%.

At last week's meeting FED noted the economic recovery and informed, that in the near future may reduce stimulus measures. Also, the head of the Fed Jerome Powell suggested, that disruptions in the supply chain could extend the inflation period longer, what the regulator expected. Reducing stimulus measures affects the debt market: the value of bonds falls, and profitability is growing.

High-growth tech stocks lose the most with rising bond yields: their future cash flows become less valuable. Popular companies look more and more overpriced, and the risk premium for owning such companies falls. It also becomes more difficult for a business to finance its growth and conduct buyback of shares.

A similar situation happened in March., when the yield on ten-year Treasuries rose to 1,74%. That's what they said then in the investment company Academy Securities: "Companies, who rely on the growth of cash flow, experience greater risk when rates increase. This is why the Nasdaq index 100, which includes technology stocks, sags much more, чем Dow Jones».

During the day, Apple stock, Microsoft, Amazon, Alphabet, Facebook and Nvidia fell 2-4%. Large tech companies have the most weight in stock indices and ETF, therefore pulling the entire stock market. “If the heavyweights are under pressure from rising bond yields, it will affect all actions", - noted in the investment company Susquehanna.