American Depository Receipt (English. American Depositary Receipt), ADR (English. ADR) - a derivative security freely traded on the American stock market for the shares of a foreign company, deposited with an American depositary bank. 95 % of ADR issues accounted for by three banks - Bank of New York, Citibank, J. P. Morgan Chase. ADRs are denominated in US dollars and are traded both on American stock exchanges, and in American OTC trading systems.

American Depositary Receipts ADR (English. ADR) - usually issued by American banks for foreign shares, which were acquired by this bank. Owner of ADR, like a real shareholder, receives dividends on them, and can benefit from an increase in market value. Since ADRs are issued in US dollars, their price is also influenced by the exchange rate.

History

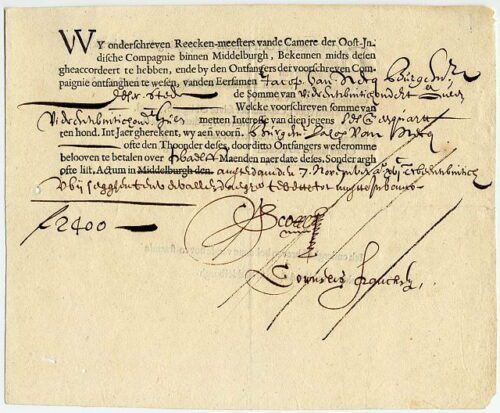

ADR appeared in 1927 year as a response to the restriction by UK law of the ability of British organizations to register shares abroad and a ban on the export of share certificates outside the country. ADR began to gain popularity in the 1950s as a means of, enabling investors to buy ordinary shares of foreign organizations on their market

ADR types

Prior to issuing an ADR, the issuing company should determine, what exactly does she want to get out of it and what is she willing to do for it. In this connection, there are several different types of programs., from which the company can choose a suitable

Unsponsored receipts

Unsponsored ADRs are released for sale in the markets OTC (over-the-counter market). With an unsponsored ADR program, there is no formal agreement between the depositary bank and the foreign company. Companies, whose shares are issued under this program, have the right not to declare their financial information according to American standards. The prices of such receipts are relatively low due to low liquidity and high degree of risk.

ADR I

The first level of ADR is the lowest level of sponsored receipts. It is also the easiest way for a company to obtain an ADR. . In this case, the company's level of reporting is not required to comply with GAAP standards., and SEC reporting should be minimal. No quarterly or annual reports are required from the company, prepared in accordance with GAAP standards. ADRI is the entry-level ADR. The largest number of ADRs is exactly the ADR of the first level. After receiving ADR I, the company can raise the level of the receipt to the second and third. However, access to large exchange markets for ADRs of this level is limited. ADR I are traded on OTC markets, but cannot be traded on the New York Stock Exchange (NYSE), American stock exchange (АМЕХ) And NASDAQ.

ADR II

If a company wants to access major exchanges such as NYSE, AMEX And NASDAQ, then she needs to get permission for ADR of the second level. To do this, she needs to go through full registration with the SEC. In addition, the company is required to provide annual Form 20-F reports., when filling out which the company must follow the GAAP standards.

ADR III

Level 3 ADR is used to raise new capital. Level 3 ADR issuers must register as themselves depositary receipts, and the initial shares of the company in the SEC and fill out Form F-1, 20-F, comply with GAAP standards. Issuing Level 3 ADRs is effectively equivalent to a public offering of shares on an exchange and requires the same level of financial disclosure. Also, the issuer must meet the listing requirements on that exchange., where ADR trading will take place.

Limited programs

Companies, who do not want to issue shares on the open market, and sell them to specific foreign investors (which, usually, are large private investment funds) can use the following programs.

144(a)

Private Placement ADR Category Rule 144A. According to SEC Rule 144A, companies can raise capital in the US through private placements of sponsored ADRs to qualified institutional investors (institutions, whose capital is at least 100 mln USD. USA). In this case, registration with the SEC is not required. The company does not have to provide financial statements.

Regulation S

Another way to limit the trading of receipts is to place Regulation S private ADRs.. US investors cannot hold or trade this category of receipts. Receipts are registered and issued to non-US residents and are not registered by US regulatory agencies.

Regulation S ADRs can be converted to ADR I after the restriction period has ended.

American Depositary Receipt is a certificate, issued by the American Bank, which certifies the holder's right to the corresponding number of securities, deposited on the account of the Bank of the issuer of the receipt or its authorized custodian. Without DR, it would be much more difficult for foreign investors to purchase securities of foreign issuers. Some of them are generally denied access to foreign markets..

A depositary receipt is a transferable security, issued in the form of a certificate by an authoritative depositary bank of world importance for the shares of a foreign issuer. Distinguish American Depositary Receipts (ADR) and Global Depositary Receipts (GDR), the difference between which, virtually, consists in the geography of their distribution. ADRs are freely traded on the US stock market, and the GDR - other countries, but still the most common are ADR. Legally, a depositary receipt is a certificate of depositing shares or bonds to the accounts of the relevant depositary (Bank of New York, JP Morgan, Citibank). The receipt is issued, when broker, who bought shares of an issuer, included in the ADR program, delivers them to the account of the depositary through the sub-depositary. The sub-depository informs the issuer of depositary receipts of the delivery, which then delivers the appropriate amount of ADR to the investor's account.

DRs Help Facilitate Trading in Foreign Shares, reduce the cost of transactions with securities, overcome legal restrictions on direct ownership of shares and expand the pool of potential investors, especially institutional. Many major companies have entered or are making efforts, to enter the Bank of New York Depository Programs (ADR/GDR) and Bank of Bermuda (ground floor). Bank of New York conducts large-scale work on operational regulation of the process of including new issuers in the depositary receipts program [2]. Among the reasons, encouraging issuers to start a DR program, there are two main: raising additional capital and improving the company's image.

A receipt can certify the right to a certain number of shares or part of a share. The specified match is selected in this way, so that the price for one receipt at the time of registration of the issue is the amount - of the order 100 US dollars. Quotation of securities is given as a percentage of their par value. Holders of Shares can deposit them with the Depository by crediting them to the account of the Depository, Custodian or persons authorized by them.

Various types of depositary receipts are traded in all world markets. They are included in the listings of exchanges and electronic trading systems of such financial centers., like New York (OTC, NASDAQ, NYSE), London, Luxembourg, Singapore, Berlin and others. From named markets London – the largest in volume. Its volume is 23% of total ADR sales. Issue and sale of ADR to companies, registered in the USA, difficult, due to restrictions imposed by Section 144A of the US Federal Securities Act, which allows only specialized market participants to trade ADR (Qualified Institutional Buyers/QIB’s).

Companies, registered outside the United States, Bank of New York offers the following types of depositary receipts (DR) : unsponsored and four sponsored ADR levels (first level program, second (Listing), third (Offering) and fourth (Private Placement) levels).

Unsponsored DRs are issued by one or more depositories in the amount of, necessary to meet market demand, but without concluding a formal agreement with the company. To date, the Bank of New York has decided to stop issuing unsponsored ADRs, due to the impossibility of exercising the necessary control over their circulation and price level.

The issue of unsponsored ADRs is initiated by a shareholder or a group of shareholders and cannot be controlled in any way by the issuer. This type of receipts has both advantages, and disadvantages. The main advantage is, that the financial reporting requirements for the issuer are minimal. American Commission, SEC, when registering unsponsored ADRs, requires the provision of documents, only confirming the compliance of the activities of the joint-stock company with the legislation of the issuer's country. Such ADRs cannot be quoted on the stock exchange. In recent years, there has been a strong trend towards a decrease in the growth in the number of programs for issuing receipts of this type..

The issue of sponsored ADRs is carried out at the initiative of the issuer itself. They can be issued by only one depositary bank, signing a special agreement with which is a prerequisite for registration. The sponsored depository program is of four types: first, second, third and fourth levels. The first two types are issued on shares already existing on the secondary market., and the third and fourth - due to the new emission.

Sponsored Level 1 Program – the most dynamically developing segment of the depositary receipts market as a whole.

Of more than 1500 depository programs account for more than half of the first level depositary receipts. In addition, due to certain advantages of investing through depositary receipts, it is not unusual that, what 5-15 percentage block of shares of an enterprise, included in the depository program of the first level, purchased through ADR. Such a program allows you not to change, available at the enterprise forms of accounting and reporting. However, ADRs of this level cannot be listed on the leading stock exchanges.. Thus, they are only listed on the OTC market.. In the same time, the company still has the opportunity to increase the level of its receipts in the future, which will lead to an increase in the price of their securities.

To issue sponsored second level ADRs, Listing requires the provision of various forms of accounting reporting in accordance with international GAAP standards (Generally Accepted Accounting Principles), adopted in the USA, where more stringent disclosure requirements are enshrined.

The advantages of such ADRs are significant (listing on the NASDAQ over-the-counter trading system, New York Stock Exchange and American Stock Exchange), although in practice they are rare, since the requirements and costs of the issuer are practically the same for the second and third levels.

Sponsored third-level ADR program, Public Offer, allows you to issue DR only for shares, undergoing initial placement. A distinctive feature is that, that the company, when placing its shares, receives direct investments in hard currency, while the first two levels do not provide an opportunity and only indirectly affect the secondary stock market. The placed ADRs of the third level are quoted on the US stock exchanges (NYSE, AMEX) and in the OTC trading system, and there are no restrictions on their purchase. To register them, you must submit to the Securities Commission (SEC) complete financial statements of the company in accordance with GAAP standards, adopted in the USA.

There are also "limited ADRs", fourth level depositary receipts, Restricted ADR.

The circle of investors with such a "private placement" (private placement) limited to companies, having the status of a Qualified Institutional Buyer (LEVEL, Qualified Institutional Buyer). These, so-called highly qualified investors trade through the PORTAL computer network (PORTAL), created by the National Association of Stock Market Dealers. A distinctive feature of ADR "private placement" is that, that the Commission's requirements for them in accordance with Rule 144A, minimal.

Depositary receipts are issued directly then, when US investors decide to invest in a non-US company. Application process, calculations, clearing and re-registration of ADRs is similar to the process of circulation of securities of American issuers. The custody bank can act as an intermediary in such operations., who is the nominee of foreign shareholders, participates in the transfer of dividends, registration and accounting of shareholders. The main functions of depositary banks, working under the ADR program, include issue, maintenance of the register and cancellation of depositary receipts, re-registration of their owners, as well as assisting a foreign company in the preparation of documents for the Securities Commission and informing a wide range of market participants about the start of the issuance of depositary receipts.

Only one of the companies in the CIS – VimpelCom JSC, Russia, managed to switch to a double standard of accounting and reporting and enter the depository program of the 3rd level. ADR "VimpelCom", as known, entered the listing of the New York Stock Exchange. Many well-known multinational companies, such as: Guinness, Dresdner Bank, CS Holding, Rolls Royce и Volkswagen, starting with the release of the first level ADR, subsequently became participants in the programs of the second (Listing) and third (Offering) levels. At the moment, the SEC is considering about 20 multi-billion dollar depositary receipt programs. Despite the unfavorable investment climate, associated with the global financial crisis, the inflow of foreign investment into the economies of developing countries does not decrease.

In this way, depositary receipts are a tool for international investment. From an investor's point of view, they allow avoiding a significant part of the risks, associated with investing in the economies of different countries, and at the same time receive the same profit, as well as that, which could be obtained when carrying out operations on the local market. The use of sponsored DRs allows you to control the appeal, compliance with the requirements, for their inclusion in the listings of national trading systems and guarantees the possibility of placing capital in the United States. Examining release mechanisms, circulation and description of the basis for regulating the issue of derivative securities when entering stock market USA for foreign issuers showed, that the Securities Act (Securities Act) from 1933 of the year, governing mechanism for public offering (public offering) derivative securities of non-US companies, conducted both by the companies themselves and by their authorized persons (underwriters), and the Stock Exchange Act of 1934 of the year (the Exchange Act), regulating the further circulation of securities of this kind and the rules for registering ownership of them, are of primary interest to a participant in the derivatives market, who wants to place an issue of securities on the US stock market in the same way, as well as the Commission of the United States Securities and Exchange Commission (U.S. Securities and Exchange Commission – the SEC), sole organ, making decisions on registration and circulation of securities of foreign issuers. The above legislative acts impose basic requirements on the issuer and the securities placed by him, if he wants to include them in the listing of such trading systems, like the New York Stock Exchange (NYSE) or the Trading System of the National Association of Dealers (NASDAQ).

In order to list its securities on the stock exchange trading list in accordance with the NYSE Alternative Listing Standards for Non-US Companies, a company must have, at least, 5000 holders 100 or more shares, at least 2.5 thousands of publicly placed and traded shares with a market value of at least 100 million. Doll. USA, net tangible assets not less 100 million. Doll. USA and balance sheet profit not less than 100 million. Doll. in total over the past three years. Moreover, the minimum indicator for any reporting year of these three should not be less than 25 million. Doll. USA. A registered company can always be delisted if the minimum requirements are not met.

At the moment, no Ukrainian company is listed to participate in active trading on the New York Stock Exchange, although the requirements of Ukrainian legislation in relation to such issuers are much lower, and many firms could afford to produce emissions outside Ukraine in accordance with them. Besides, due to the inconsistency of Ukrainian norms, regulating the issue and order of circulation of securities of Ukrainian issuers, as well as individual accounting and reporting standards to international standards, Ukrainian companies are not able to, usually, issue ADR above the first level.

In the same time, we see, that the issue of an issue of shares or bonds by means of American Depositary Receipts, ADR, is a doable task for a serious investor, has already achieved significant success in the national market, the solution of which will allow access to international financial markets and provide access to foreign capital. This fact is especially important for Ukrainian producers in the current situation of lack of investment funds in Ukraine.. Examining release mechanisms, circulation and description of the fundamentals of regulation of derivative securities and inclusion in activities on international financial markets through the placement of securities issues of American Depositary Receipts will significantly contribute to the entry of Ukraine and its enterprises into international capital markets and its inclusion in the integration processes.