In the comments to the previous post, I was asked the question `` do movings work or not ''.

My answer – Yes, Work.

They are worked out very often and it is better to have them on the schedule..

I want to note right away, that this is NOT the MAIN signal.

But only an auxiliary.

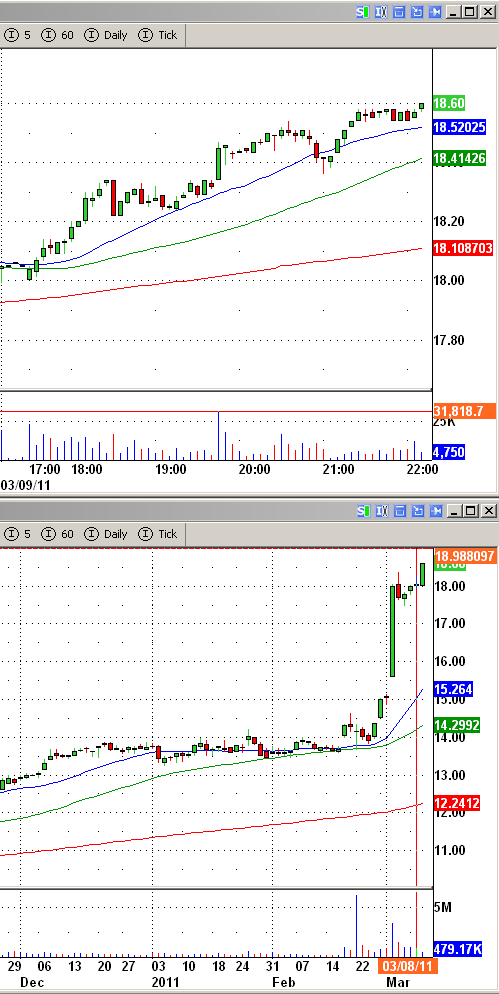

When you see, that the stock went up, then it rolls back and sucks, the presence of movings as support for the base significantly increase the chances of the continuation of the upward movement.

If a stock falls and sucks under movings – good signal to short.

If the stock fell and fell on movings as support – I would wait until she breaks them.

The same is in the situation, if the stock is up, rested and defends under movings.

I hate going against moving averages.

I do not urge anyone to do as I do.

This is my personal opinion.

If you liked it – in no case immediately rush to do the same.

Calmly test, see how it works, and only then add to your vehicle.

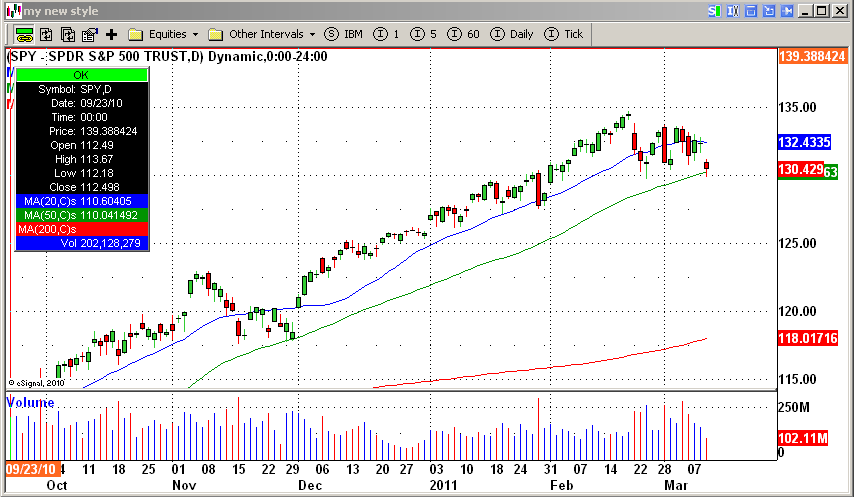

Py.Sy. I use 20-50-200 simple moving averages. They work best on daily and watches.

They also work well at 15 minutes or less., but still work, at 5 minutes.

I also want to notice, that each stock has its own character.

There are stacks, which perform well moving averages, there are also, who don't do it the first time, but then the implementation goes anyway.

But there are also those, who do not care about movings at all.

Be sure to pay attention to this.

It will also increase your chances of success..

Banzai!