After Labor Day, investors return to the S index&P 500, close to record highs. The main cause for concern is the weak data on jobs on Friday., which come out against the background of higher prices, which leads to rumors of terrible stagflation.

Supply Chain Issues, created by the coronavirus and its variants, really increase the likelihood of stagflation, said Matt Maley, Chief Market Strategist Miller Tabak + Co, customers in a weekend note.

"If/when it happens, And stock market, and the bond market will react very negatively (And, probably, very fast)”, – he warns.

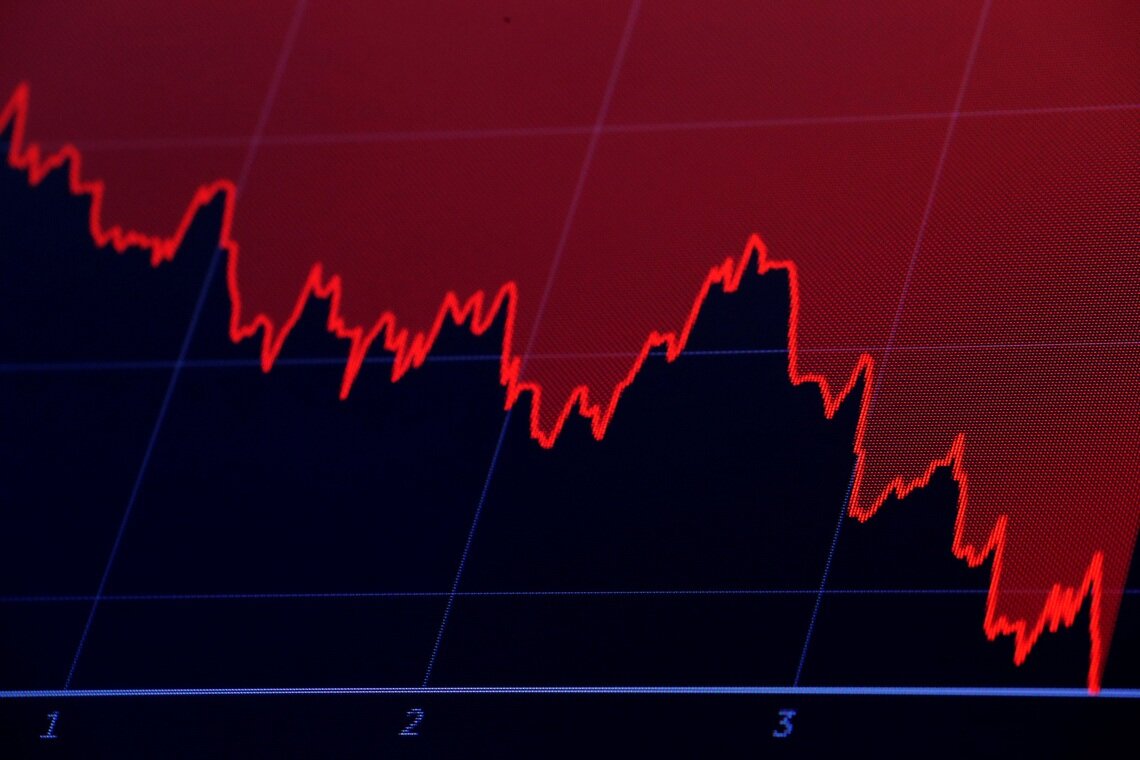

Malley has another warning for investors in our call today., as it notes a list of "strong similarities" between current stocks and turbulent markets. 1999, 2007 And 1929 years. He considers, that an "imminent deep correction" is more likely, what most Wall Street expects.

Here's this list of similarities.

1️. Index S&P 500

Index S&P 00 trades with high forward profits in 22,5 Times, and its price-to-sales ratio in 3,1 much more expensive times, than in 2000 year. QQQ, Tracking NASDAQ-100, traded with a premium 70% to its 200-week moving average, the largest with 1999/2000 of the year.

The stock market has experienced a crisis many times The fund market has experienced a crisis many times

2️. SPAC, in which investors have no idea, what will be the investment.

"For the last time, when SPAC were so big, as it is today? Correct, 1928/1929", – said the strategist.

3️. Leverage peaks.

As in 1920 And 2000 years, marginal debt soared to new highs, and that's okay., until it starts moving the other way.. Recently, it has begun to unwind., and if it continues, markets will have problems.

4. Individual investors make up 20% of the average daily volume of shares, which is twice as large, than two years ago.

Many of the major market peaks of the past — 1929, 1999/2000 — were marked by large jumps in investor activity.

5. With 1998 on 2000 many zero-profit companies have seen, how stocks rose, and investors bought shares, and Maley sees parallels with today's meme actions..

Malley said, that it doesn't predict rollback, like the big years, and the timing of any rollback is obviously tough..

"If/when it's a "rally of everything"" End, almost everything will fall into decay.", – Maley said.