Teladoc Health (NYSE: TDOC) — the largest player in the telemedicine market. Telemedicine is a way of virtual patient care: consultations via messengers and video calls, virtual determination of the diagnosis and issuance of a prescription with sending it to the pharmacy. Previously, Tinkoff magazine has already published materials about this company.

What he earns

The company does not have its own staff of doctors: she enters into an agreement with medical institutions through a partner company. Teladoc receives commission on the sale of access to services and commissions from medical consultations of medical institutions.

Teladoc's main client is employers and insurance companies. They enter into a contract with Teladoc to provide medical care to their employees or customers through the application. All this is paid by the insurance company. One appeal is worth 75 $.

Livongo Sells a Monthly Subscription to Provide Customers with Consumables and Meters. Monthly subscription price - 39 $ for hypertensive patients and 75 $ for people with diabetes. Diabetes program cost - 900 $ in year, for hypertension - 468 $ in year.

The structure of the company

Teladoc Health has many consumer brands.

Teladoc - virtual patient admission platform, main division of the company. Specializes in providing telemedicine services through its application.

Intouch Health - a platform for virtual patient care. The company provides access to medical supervision and patient care anytime, anywhere. Clients of this direction are doctors and hospitals. The platform allows doctors to constantly monitor their patients, wherever they are.

Médecin Direct - European Division, virtual patient reception.

Better Help is the world's largest online mental health platform. Provides professional online advice anytime, anywhere.

Healthiest You is an application for finding medical services not only in your home region, but also on travel.

Livongo - help for patients with diabetes and hypertension. For 75 $ per month the client is provided with a metering device, consumables and consultations with doctors.

Best Doctors - qualified medical care, diagnosis and treatment.

Advance Medical - international division. Operates in over 120 countries, more than 400 doctors in the state, reception is conducted in more than 20 languages.

Company development stages

Teladoc Health is actively developing through the acquisition and absorption of competitors. It was this policy that made it possible to become a leader in the telemedicine market with a capitalization of more than $20 billion and more than 73 million users..

Purchase List:

- 2013 - Consult A Doctor for $16.6 million;

- 2014 - AmeriDa for $17.2 million;

- 2015, January - Better Help for $3.5 million;

- 2015, июнь — Stat Health Services, for 30 million dollars;

- 2016, July - Healthiest You for $45 million;

- 2017 - Best Doctors for $440 million;

- 2018 - Advance Medical for $352 million;

- 2019 — Doctor Direct, the amount of the transaction was not disclosed;

- 2020, January - Intouch Health for 600 million dollars;

- 2020 — Livongo for $13.8 billion;

- 2021, January - Consultant Connect for $56.3 million.

Each acquired division continues to develop in its own direction and generate revenue growth.

Market share and competitors

Due to active acquisition of competitors, Teladoc Health has become the largest representative of the industry in the US and in the world. There are no companies left in the American market, capable of significantly affecting the results of Teladoc.

According to Teladoc Health, in the market, their real competitors are companies:

- MDLive. Fee per visit - up to 82 $. The client gets access to a certified doctor via a secure video link, by phone or through the MDLIVE application. Doctors can diagnose symptoms, prescribe non-narcotic medicines if necessary and send electronic prescriptions to the nearest pharmacy. MDLive was recently acquired by the insurance company Cigna.

- Doctor on Demand. One visit fee - 75 $. The company allows patients to communicate remotely with a team of doctors, psychiatrists and psychologists. All physicians reside in the USA and are certified. Patients can talk to a doctor at any time, seven days a week. IN 2021 merged with Grand Rounds.

- American Well. One visit fee - 79 $. Private American company, specializes in providing telemedicine services. The main principle of work is communication between patients and doctors via secure video communication channels. The company provides emergency teleconference care for patients in 44 states.

Competitors in the global market:

- health vibe, Brazil. The cost of a monthly unlimited subscription is 50-60 reais, about 10 $. Brazil has a low level of insurance of citizens: Only 3 out of 10 people have insurance.. In 2018, Vibe Saúde entered the Brazilian market offering services at affordable prices and the opportunity to receive free consultations.

- Practo, India. Service cost - from 10 $ per month. The company has more than 170 million users, more than 20 million use services monthly.

- Ping An Good Doctor, China. The largest player in the telemedicine market with 192 million users, but due to low tariffs and the low standard of living of the majority of the Chinese population, revenues are comparable to 73 million Teladoc users.

Market share Teladoc Health. The growth potential of the company in the US market is very modest. Of the 320 million people in the country, 73 million are already customers of the company.

Teladoc has a difficult situation with new user acquisition. The company is approaching the ceiling of its capabilities in the field of telemedicine, and attracting a new user has become more and more expensive.

Even in countries with a population of more than 1 billion inhabitants, the business model does not allow achieving high rates. To get past this financial milestone, the industry needs transformation using the example of Advance Medical, a division of Teladoc Health, which has 400 doctors in the state, which allows him to increase the marginality of the business.

Market share of telemedicine services

| Teladoc Health customers | 22,8% |

| Potential market | 20,3% |

| Rest of the market | 56,9% |

22,8%

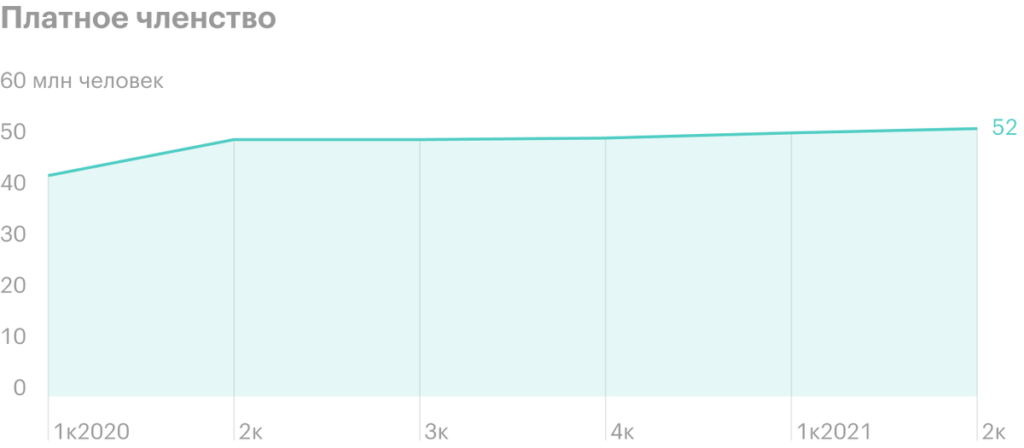

Dynamics of the number of clients, million people

| Paid membership | Visits | |

|---|---|---|

| 2016 | 12,1 | 1 |

| 2017 | 19,6 | 1,5 |

| 2018 | 22,8 | 2,6 |

| 2019 | 36,7 | 4,1 |

| 2020 | 50 | 10,6 |

Financial indicators

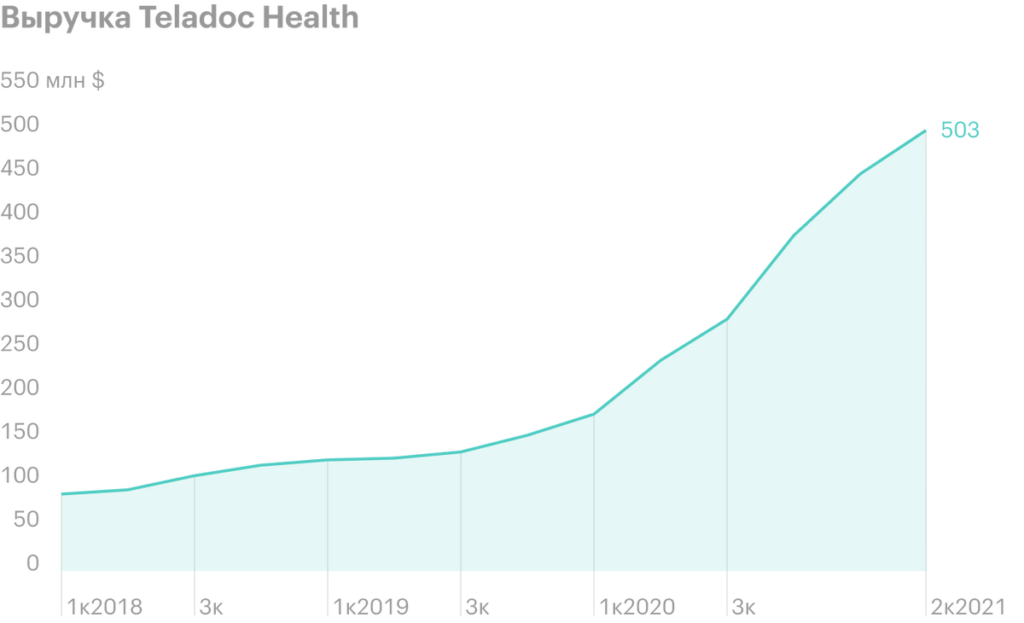

Starting from the second quarter of 2020, the company shows good revenue growth. This is due to the company's recent acquisitions: Intouch Health и Livongo.

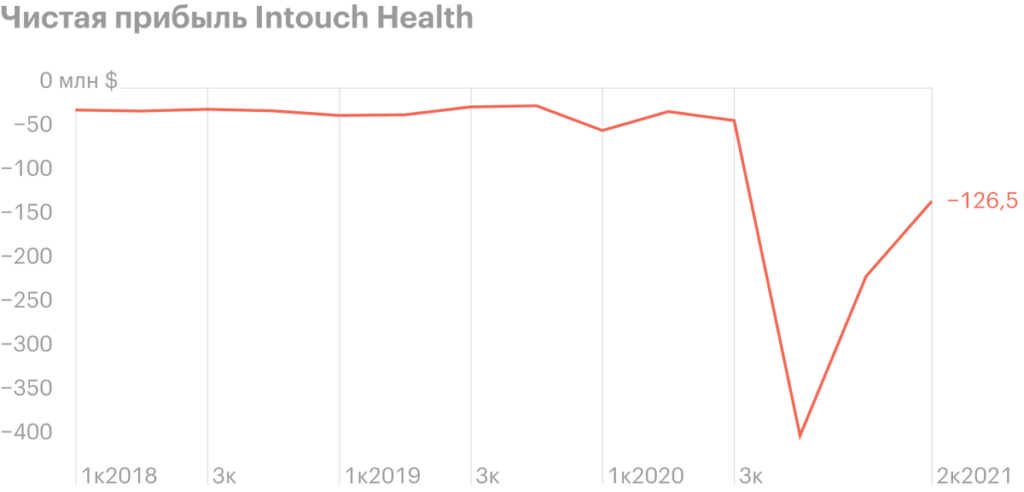

autumn 2020 Teladoc Health announced the purchase of Livongo for a whopping $13.8 billion for the company. And that's about it., that the company has not yet paid off its obligations to the shareholders of Intouch Health, which I purchased in 2019 for the amount, just over a billion dollars. Due to the lack of money, the company announced that it would raise capital through the placement of additional shares..

For obligations to shareholders, Teladoc must pay Livongo 13,9 billion dollars:

- 401 $m net cash;

- 555,4 million dollars, associated with Livongo bond liabilities;

- 60,4 million shares of common stock worth approximately $12.9 billion.

Teladoc must pay $1.069 billion to Intouch Health on obligations to shareholders:

- 4,6 million shares worth $903.3 million;

- 166,5 million dollars in cash.

Negative net income increased significantly after acquisition of Livongo: this is due to cash disbursements and merger costs

From the company's report for the first and second quarter of 2021 and the report for 2020, it can be seen, what expenses in 2020 and 2021 for the acquisition of Livongo and Intouch Health amounted to $ 734 million. Teladoc Health has $567 million in cash commitments, as well as compensation for the costs of association, amortization of intangible assets and expenses for redemption of bonds in 2025.

In the presentation of the report for the second quarter of 2021, the company outlined its debt on bonds maturing in 2022, 2025 and 2027 in the amount of $1.2 billion, the total amount of debt significantly exceeds 2.2 billion.

In a letter from 5 august 2020 of the year on the merger of Livongo and Teladoc Health and the statement of Livongo refers to the amount of the transaction 18,5 billion dollars.

And in the form of F-10 Q for the second quarter 2021 of the year, the $ 13 billion payment is named the initial award. Probably, another tranche of remuneration to shareholders of Livongo is planned in the amount of the missing 5 billion, which can lead to a significant drawdown of TDOC shares due to the exit of Livongo shareholders into the cash.

Teladoc Health's revenue structure for the second quarter of 2020, million dollars

| Revenue | Percentage of total | |

|---|---|---|

| Livongo | 109 | 26,1% |

| Teladoc | 270 | 64,6% |

| Intouch Health | 30 | 7,2% |

| Medical Advance | 9 | 2,2% |

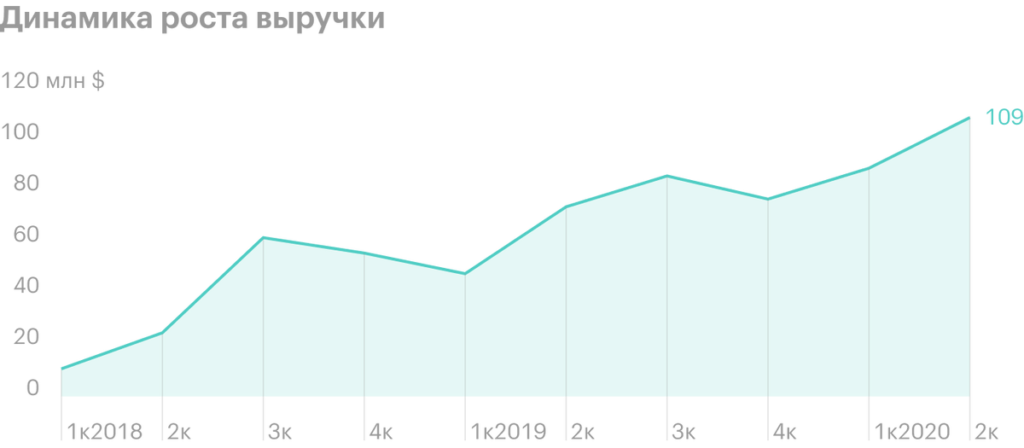

Livongo Business Outlook

Livongo provides consumables and monitoring devices for patients with chronic diseases, such as diabetes and hypertension. Following the merger of Teladoc and Livongo, in a presentation for the second quarter of 2021, Livongo noted an increase in the number of customers by almost 74%.

The essence of Livongo's business model is the sale of highly specialized consumer goods by subscription throughout the country.. Clients – population with chronic diseases, and this is about 15-20% of the US population. The company does not just sell a product, she takes care of supplying patients with the necessary consumables and measuring instruments. Now a person with diabetes does not think about, that he is running out of glucometer strips and that he needs to buy them. Everything will be delivered to him at the appointed time., and now you don't have to think about it and worry

Estimated US market size, according to Livongo, - 147 million people with chronic diseases, out of which: 31,4 million people with diabetes and 39.6 million people with hypertension.

If you calculate the cost of the annual subscription for each patient, that will be about 46.7 billion dollars in revenue per year. In the current state of the market, such revenue corresponds to a capitalization of 200-400 billion dollars. It was for the incredible potential of Livongo that Teladoc Health struck a deal worth 60% on its capitalization.

Dynamics of growth in the number of customers with chronic diseases after the purchase of Livongo, million people

| 3к2020 | 553 |

| 4к2020 | 569 |

| 1к2021 | 658 |

| 2к2021 | 715 |

553

Potential Livongo Market, million people

| Livongo customers | 0,5 |

| Teladoc clients with chronic conditions | 18 |

| The rest of the patients with diabetes and hypertension | 52 |

0,5

Industry Outlook

Many people believe, that the increase in the share price is due to the increase in the number of customers during the pandemic and that with the lifting of restrictions, Teladoc will lose a significant share of customers. Pandemic has accelerated the adoption of telemedicine, but by no means became the main factor in the formation of the client base.

According to market research report Facts and Factors, Expected, that the size and revenue of the global telemedicine market will grow from $ 62.45 billion in 2020 to $ 475.5 billion by 2026, at a CAGR of 26,5%.

Directly Teladoc Health expands its influence not only in the United States, but also in the global market. Beyond the acquisition of UK telemedicine provider Consultant Connect, French Médecin Direct and international operator Advance Medical enter the Brazilian market.

Service called Vida V Powered by Teladoc launches in Brazil with local company Telefónica. Vida V is a digital marketplace for health and wellness products, which will offer telemedicine services to end customers and small and medium-sized businesses.

Every year the revenue in the global market is growing, which indicates good prospects. Despite, that Teladoc and its business model are facing the challenge of restricting users, Teladoc companies appear in all countries of the world, because the product is in demand. The industry is new, in some countries, it is only in its infancy - telemedicine will undergo changes, will adapt to the needs of customers and users.

International revenue, million dollars

| 2017 | 18,3 |

| 2018 | 73,6 |

| 2019 | 106,6 |

| 2020 | 124,3 |

| 2021 | 150,5 |

18,3

Eventually

In Teladoc, you can bet on the Livongo division and on the desire to develop, occupy more and more narrow niches in the healthcare market.

Acquisition and business combination expenses, probably, are temporary: considering the growing revenue, Teladoc will meet its obligations.

In the full year 2021 report, which will be released in January-February 2022, it will be possible to track the dynamics of the revenue of the Livongo division.

What to pay attention to:

- results, revenue and number of new Livongo customers with chronic diseases.

- Slowdown or acceleration of the dynamics of growth of revenue and new customers of Livongo.

- Comparison of 2021 revenue with forecasts in the last report.

- The dynamics of expenses for the merger of Teladoc Health and Livongo.

- Dynamics of changes in net profit.

- Forecast for 2022.

If all of the listed items show a positive trend, this is a sure signal to open a position.