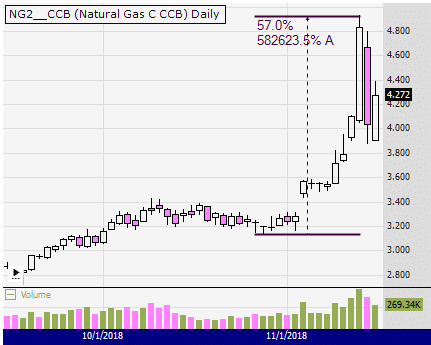

Well it finally happened. The rope twisted for a long time, but it all ends in one pattern. В последнее время появилась такая примета что если видим schedule с необычным отклонением цены, then someone has to get hurt badly. So this time, natural gas futures seemed to be addicted to steroids., making a dash from low to high on 57% in a few days at a rate of more 500 000% per annum.

And then a message appears in the press that he was completely ruined., losing all the investor money, fund them.James Cordier, who made money by selling uncovered options on commodity futures. And, not only broke, but also owes brokers. By the way, our Korovin, too, in theory, should have, once again, let your investors go around the world if you entered the American market a little early, and now, for sure, have not yet recruited new victims, since hardly anyone will risk in the near future to entrust him with their funds. But time goes by, new investors will come to the market, who will not know…. so Korovin will still take his :)

Well, the most interesting thing is, what already, I guess, about ten years among Russian traders a book by the same James Corder is very popular, translated by samizdat into Russian under the title The Complete Guide to Selling Options", where he teaches how to sell long-range options on commodity futures. At one time it was just a bestseller and was presented by read traders as the only guaranteed way to make money on the exchange.. This did not pass me either. remember, in 2012 year, too, under the impression of the book, I decided to start selling long-range options on futures. But, all the same, was smart enough to start it on a demo account, what, By the way, was reflected in . It was lucky that I ran into a period when the sold options quickly went into a big minus on a demo account, disappointment came with the method and interest was lost.

Basically, everyone knows that you can sell uncovered options with exactly the same risk as in the case of the underlying asset. But this, average, gives income comparable to the risk-free rate. That's why, while respecting the risks of investor clients, it is simply not possible to attract. And to earn attractive returns for investors, need to take risk, which rarely destroys the account, but completely and, even, as practice shows, even more than completely. But investor money is not a pity. The main thing here is to receive monthly salaries for management and bonuses for the result during a successful period.. Very advantageous position.

It should also be noted that these rogue managers blame everyone for their failure., just not yourself — the exchange is to blame, Brokers, risk managers, nervous investors, etc., I'm such a genius here, the only one in the village (the city, country, world) who deals with such complex options trading — the end, pancake, I sell with an undisguised intraday" and no one else can do this … etc. and so on. Yes, any bird with five grades of education can do it, if you explain to him what options are and give him time to comprehend….. but there is a possibility that even he will understand that this is not necessary :)