Jack Ma Founder and Executive Chairman of the Board of Directors Alibaba Group born in 1964 year in the Chinese province of Zhejiang, Hangzhou city. As a teenager, he gave tours to all interested tourists for free, thereby improving your knowledge of English.

After graduating from university in 1988 year, Ma became an English teacher. His knowledge was so high., that he opened his own translation agency and started working with American companies, doing business in China. IN 1995, he went to the United States as an interpreter, where he contacted his Chinese friend, who at that time lived in Seattle. There he saw for the first time in his life a personal computer with access to the Internet.. Fascinated by what he saw, Ma asked his friend to help him create a website for a translation agency., after which almost immediately began to receive emails with offers of cooperation.

The Internet was a brand new idea in China, so coming home, Ma on the borrowed money of his friends and parents ($2000) launched one of the first commercial projects in the country — China Pages, online directory of Chinese enterprises. Due to insufficient attendance, the project failed, but Jack Ma is full of strength and energy in a year, in 1999 launched Alibaba.com

"Today is harsh and painful., tomorrow will be even worse, but the day after tomorrow it will be fine". — Jack Ma

Jack Ma in his speech to the company's employees he spoke, that their main competitors are not in the Chinese market, and around the world, and the only way to become successful was to adopt the philosophy of perseverance and perseverance: ‘We will have to pay painful price in next 3 to 5 years, it is the only way we can succeed’

History:

The business began to grow rapidly and very soon Alibaba became larger., than website.

IN 2003 Taobao Marketplace was launched, online platform for buyers and sellers of low-cost goods.

IN 2004 AliPay online payment service created (Chinese PayPal), the purpose of which was to prevent fraud between buyers and sellers.

In the same 2004 launched by Aliwangwang, instant messaging service between Taobao members.

IN 2007 the monetization of Taobao Marketplace began and at the same time the internet marketing platform Alimama was launched.

IN 2008 after studying the Chinese online market and the increased demand for premium things, Tmall was launched – a platform of branded goods.

IN 2009 due to the large volume of traffic, a new hardware complex called Alibaba Cloud Computing was created.

IN 2010 created by AliExpress, online store, selling Chinese goods at retail and small wholesale.

THE MAIN SITES OF ALIBABA GROUP

ALIBABA AND CHINA

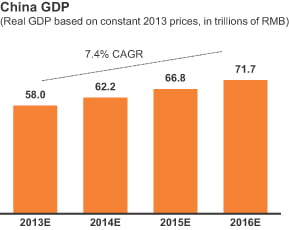

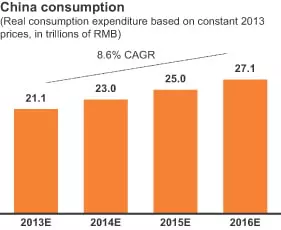

Alibaba Group is one of the largest companies in China, which benefits from the economic growth of the country itself.

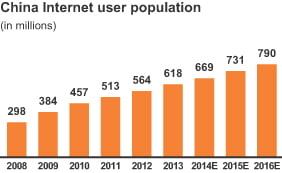

According to CNNIC in 2013 China had the largest number of Internet users (618 million). According to forecasts, their number will grow every year..

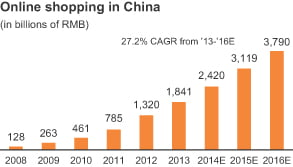

According to iResearch, is expected to increase purchases via the Internet in China from RMB1.841 billion. (US$296 billion) in 2013 up to RMB3.790 billion. (US$610 billion) in 2016.

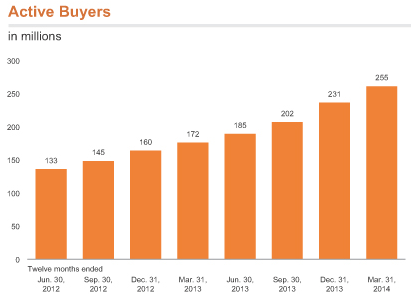

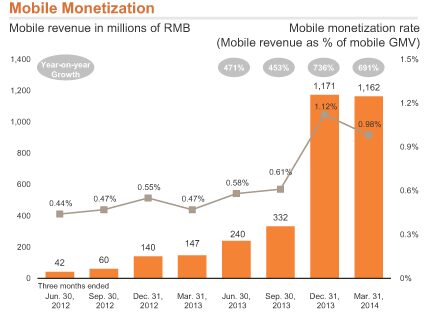

With the growth of the mobile Internet, the number of active users has also increased, which allowed Alibaba Group to get more revenue from the monetization of mobile traffic.

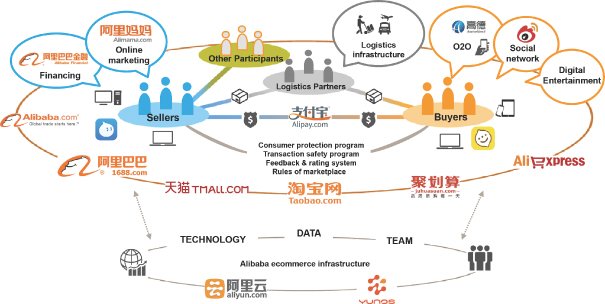

ECOSYSTEM

Alibaba Group is a social commerce ecosystem, including online stores, payment platforms, social networks and applications for mobile phones.

On its sites there are more than a million transactions per day. During one of Alibaba's flash sale shares for a local phone manufacturer, it was sold. 10 000 devices for 10 minutes. Today, China has become the largest ecommerce market in the world, overtaking the United States.

All sites create one large network, where everyone can find that, what is he looking for.

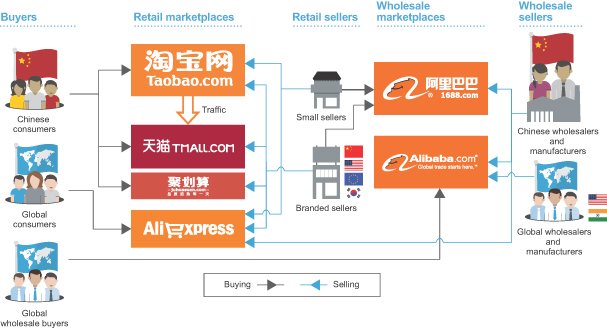

Buyers:

– Chinese consumers buy things on Taobao Marketplace, Tmall and Juhuasuan;

– AliExpress is designed for global consumers;

– Alibaba.com is designed for global wholesalers;

Retail sellers:

– Small business entrepreneurs use Taobao Marketplace and AliExpress to sell their products;

– Chinese brands are sold on the Taobao Marketplace, Tmall, Juhuansuan and AliExpress. Global brands can be found on Taobao Global;

– 1688.com is designed for trade between Chinese buyers-sellers;

Wholesalers:

– Chinese wholesalers and goods manufacturers supply local retailers for 1688.com;

– Chinese wholesalers and manufacturers directly ship their goods to global consumers through AliExpress;

– Global wholesalers and manufacturers supply goods through Alibaba.com

TAOBAO MARKETPLACE

Taobao () is several million Chinese sellers and shops. It's a giant online trading platform.: the largest in Asia and one of the largest in the world. Taobao is like a huge virtual shopping center, which has no end in sight. But unlike a shopping mall., you don't have to go anywhere, and the desired things are very fast, with just a few mouse clicks. On the site you can buy all, what is produced and sold in China.

TMALL

Tmall () is a major division of Taobao and got its name from the abbreviation Taobao mall, which means "Taobao Shopping Center". Tmall combines many stores and distributors in one place, which offer products of Asian production, with quality, corresponding to the European level. It is almost impossible to buy a fake in the store, here is presented exclusively original branded goods on acceptable, and sometimes very low prices.

ALIEXPRESS

Aliexpress () Chinese online trading platform. Each product here is represented by separate unrelated sellers. Appearance and structure of the site resembles eBay. Mainly the site is notable for the goods of Chinese manufacturers at low prices, not much higher than 1 on Taobao.

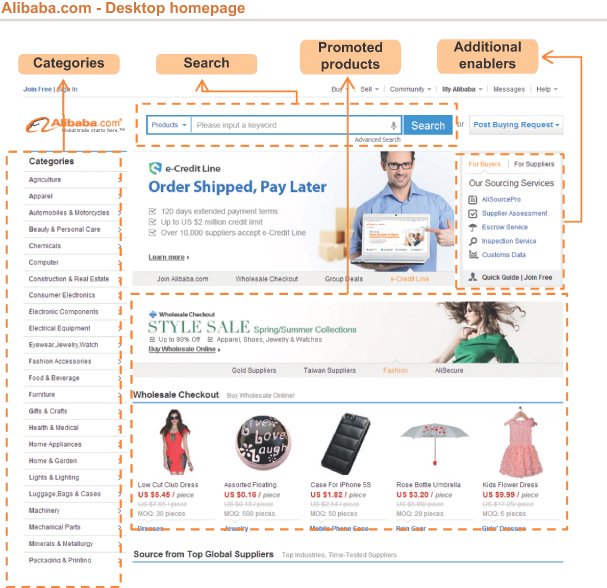

ALIBABA

Alibaba () — the world's largest B2B Internet platform, connecting small and medium-sized businesses around the world – regardless of the location and size of the business. Almost registered on the site 7 millions of participants from more than 240 countries.

While searching for products, you can use filters, that appears on the search results page. Results can be filtered by vendor view and location, Product categories, of the minimum batch and other parameters.

- Golden: suppliers premium members of Alibaba.

- Inspected: Suppliers, which was checked by Alibaba employees or third-party agencies.

- A&V verified: Suppliers, who have been confirmed to have legal status.

- Certified: Suppliers, evaluated by a third party. Evaluation reports are available for download.

LOGISTICS

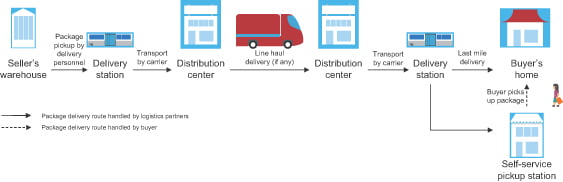

IN 2013 Alibaba Group together with five major Chinese express delivery companies, established a joint venture, which makes it possible to deliver the goods on the day of the order. Alibaba Group owns 48% предприятия. Below is the process of delivery of goods:

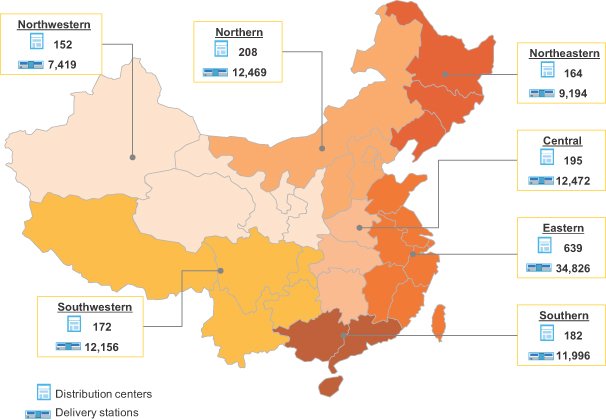

On the map you can see the infrastructure of distribution centers throughout the country:

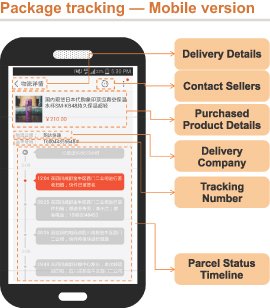

You can track your goods through the mobile application:

COMPETITION

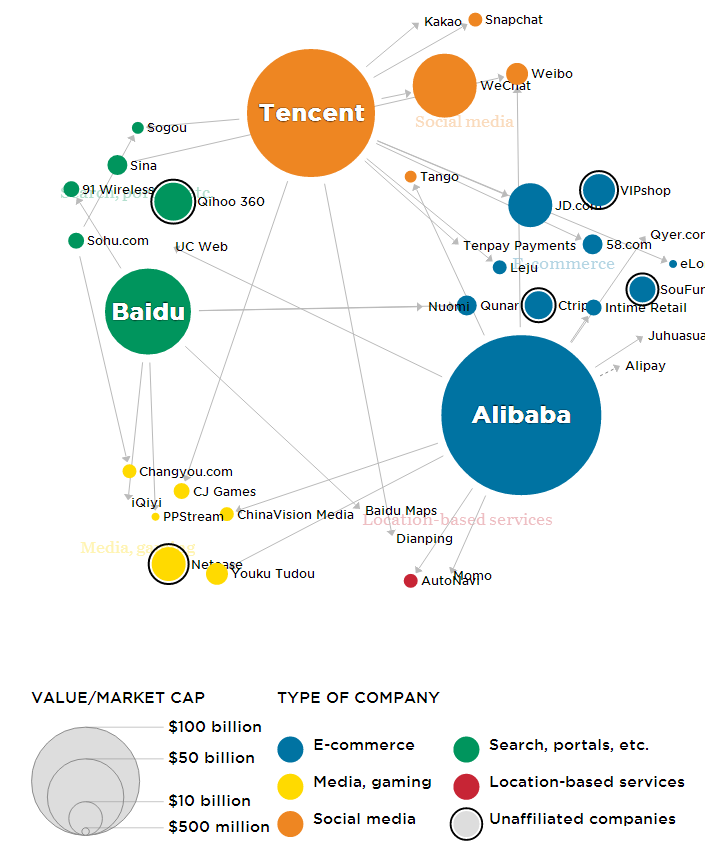

The main Internet competitors of Alibaba Group are Tencent Holdings Ltd. And Baidu Inc.

Baidu Inc. (NASDAQ:START) is the undisputed leader of China's search engines. By the number of requests processed by him, the Baidu site is listed in third place in the world ranking of search engines. The Baidu Index contains more than 740 millions of web pages, 80 millions of images and 10 millions of media files.

Tencent Holdings Ltd. (700:HK) - Chinese telecommunications company, based in 1998 year in g. Shenzhen.

The company is known for, that supports China's most popular fast messaging network called QQ.

INVESTMENTS OF ALIBABA GROUP

In the past two years, Alibaba Group has begun to actively buy US technology startups, to compete with American companies.

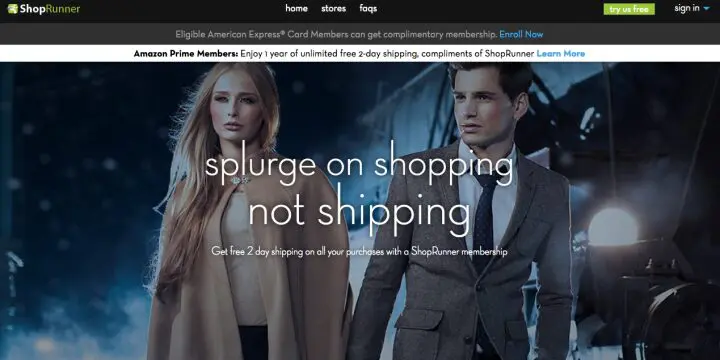

Shoprunner (https://www.shoprunner.com)– service with an annual subscription $79, providing its members with unlimited free two-day delivery of branded items from their stores. Features of the service - no minimum order size and free return delivery. The main competitor is Amazon Prime.

Alibaba Group owns 39% Shoprunner.

Quixey (https://www.quixey.com) - Provides application search results for all existing platforms in response to a query in English, describing the desired action.

Alibaba Group sponsored a startup during the third round of funding in the amount of $50 million.

Tango () – messenger for smartphones with 200 million. registered users. Allows you to forward text messages, Images, video and Audio. The main competitors are WhatsApp And Snapchat.

Alibaba Group invested in Tango $215 million.

Lift () – application for smartphones, which allows you to order a car to travel from one point to another on demand.

Instead of working, how Uber — service for professional taxi drivers, Lyft has a community form, uniting car owners, who want to help others and meet new people.

Alibaba Group invested in Lyft $250 million.

11 Main () - Alibaba's first U.S. marketplace. It features ads for more than 1000 stores, offering clothes, fashion accessories, jewelry and some other product categories. In the future, the range should become larger, stated by the company.

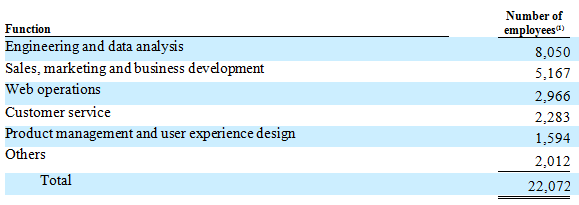

STAFF

On 31 Martha 2014 the company has years 22,072 Full-time employees.

PARTNERS

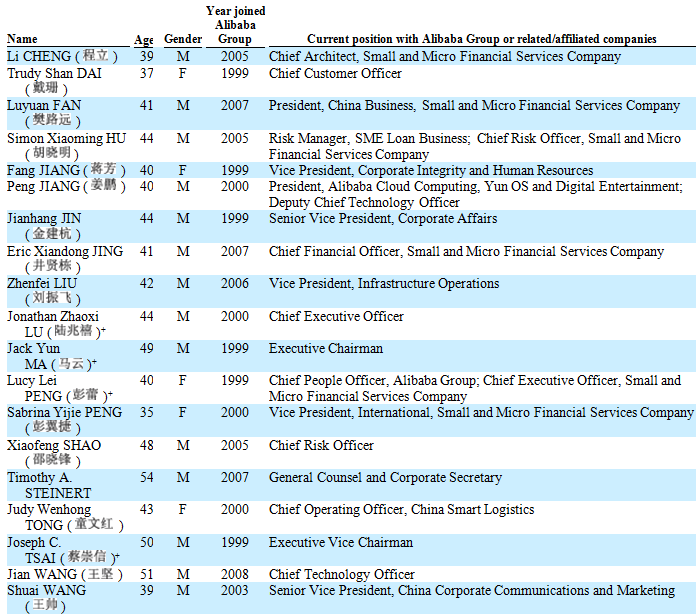

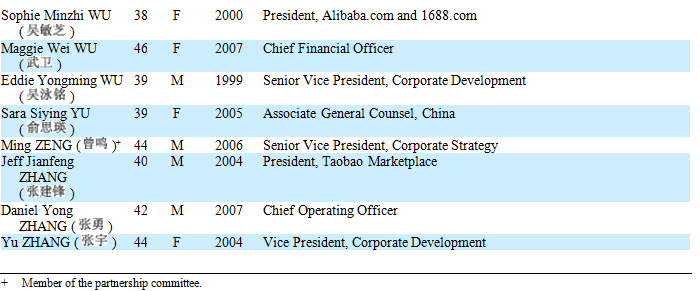

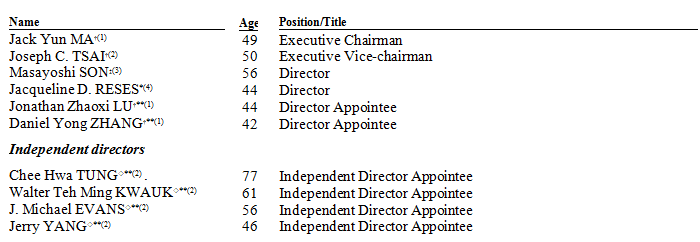

BOARD OF DIRECTORS

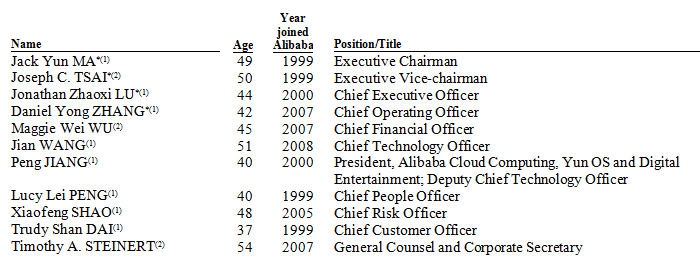

EXECUTIVE DIRECTORS

REPORTING

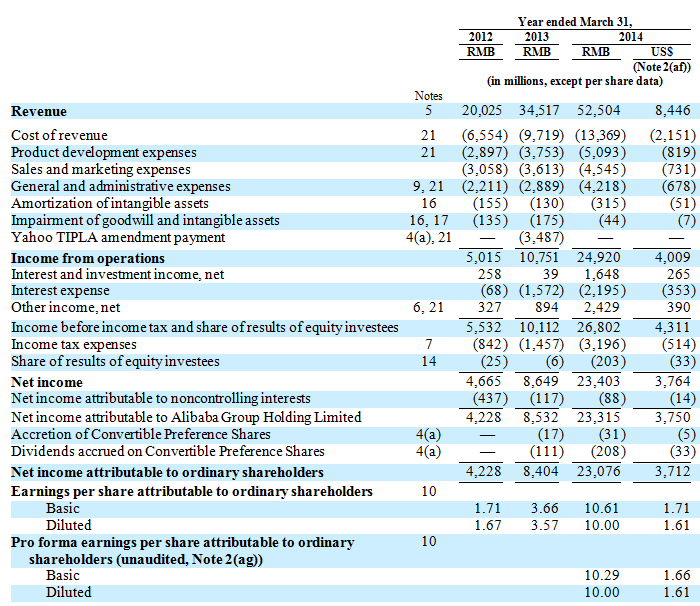

IN 2014 fiscal year income Alibaba Group made up $8,446 billion.

Second quarter revenue 2014 made up $2.54 billion, What's on 46% more than last year. Net profit increased to $1.99 billion. or $0.84 per share.

More financial results .

IPO

Alibaba Group Holding Limited evaluates itself in $130 billion. During the IPO, the company is going to place about 12% shares and attract up to $20 billion, which will be one of the largest in history.

Placement of shares is planned 8 September on the stock exchange NYSE. Shares will be available for trading 18 – 19 Septemberunder ticker 'BABA’

Original article: http://small-cap.ru/news/2441/