Now we have a uniformly speculative thought: take stock of industrial company Eaton (NYSE: ETN), to earn income on the inevitable growth of this business.

Growth potential and duration : thirteen percent for 14 months excluding dividends; nine percent per annum for ten years, including dividends.

Why stocks can go up: the company's products are needed.

How do we act: take shares at the moment 163,7 $.

Where does Eaton make money

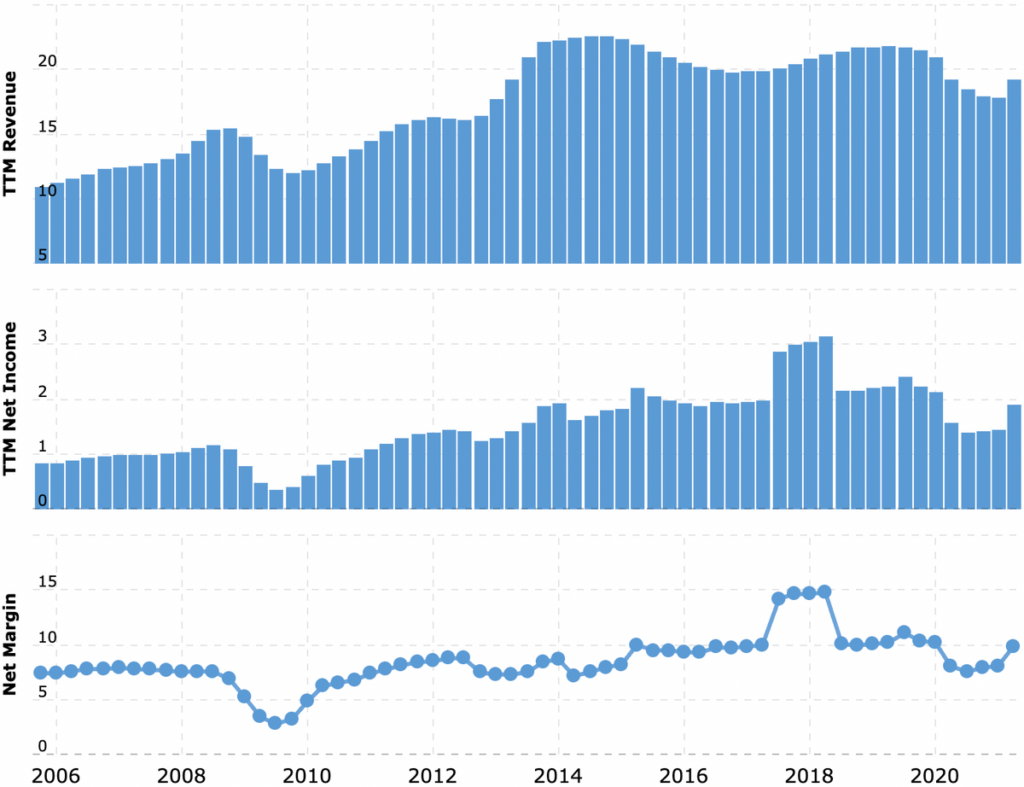

Regardless of title, the company has nothing to do with elitism and English snobbery.. Eaton builds energy management solutions, also provides services in the industry. How the company's products look, can be viewed on her website. In accordance with the annual report, the company's revenue is divided in the following way.

- Electricity in the Americas — 37,4 %. Components for power supply and control, which equipment matches. This sector takes into account implementations in the Western Hemisphere. The sector's operating margin is 20,23 % from its proceeds.

- Electricity in the world — 26,33 %. Components for power supply and control, which corresponds to equipment in other regions. The sector's operating margin is 15,94 % from its proceeds.

- Hydraulics — 10,31 %. Pumps and other such devices for production tasks and transport. The sector's operating margin is 10,09% from its proceeds. Basically, Eaton recently sold this business to Danfoss.

- Aerospace — 12,44%. Pneumatic and hydraulic systems, solutions for air supply. The segment takes into account sales as civilian, and military clients. Segment operating margin — 18,6% from its proceeds.

- Transport — 11,8%. Solutions for both rail, and for road transport. Segment operating margin — 11,5% from its proceeds.

- Electric transport — 1,72%. Inverters, fuses and other components for electrical machines – as commercial vehicles, and conventional electric cars. The segment's sales are roughly halved between these two types of electric vehicles.. This is the only unprofitable segment of the company: operating margin there - 2.73%.

Revenue by country and region of the company:

- USA - 56,24%.

- Canada - 4,23%.

- Latin America — 5,25%.

- Europe - 21,37%.

- Asian-Pacific area - 12,91%.

The case for Eaton

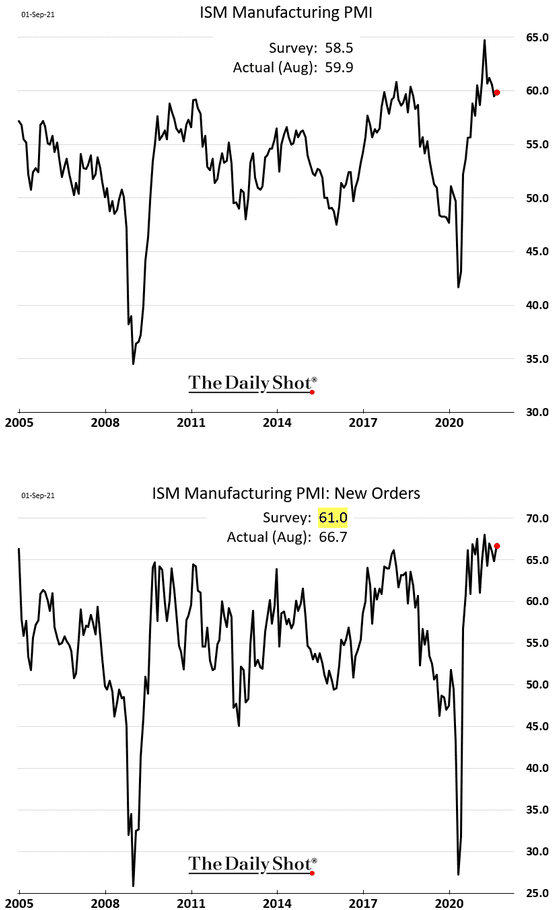

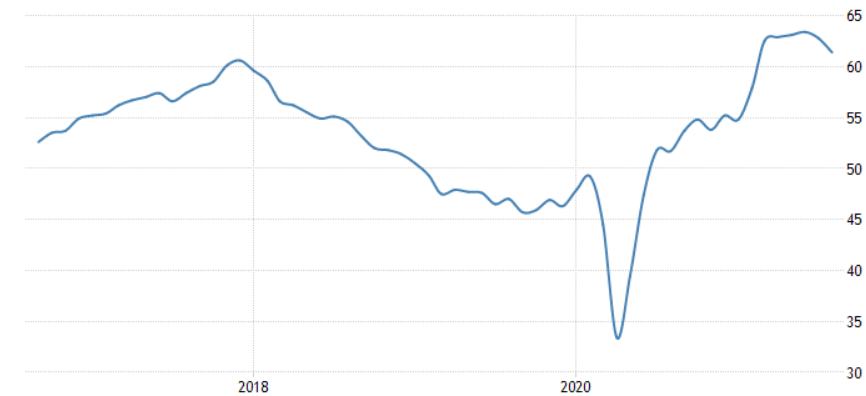

There is growth, so, growing. In the main markets of the company in the short term there is growth - in the US and Europe. Consider long-term prospects. The company has a little bit of everything for everyone: and airplanes, and ground transportation, and electricity supply. From the point of view of diversification, this is a very decent industrial business with good, stable performance. For example, Eaton's long-distance business will be helped by the expected increase in infrastructure spending in the US. The company is also developing the direction of electric cars.

I am generally skeptical about the business prospects of this unit.: in my opinion, it's more advocacy for ESG investors. But I think, that the presence of this subdivision in any case will have a positive effect on the company's quotes.

In general, the specifics of the company are more in line with the trend towards automation., which we are now witnessing. Eaton delivers solutions, which will be in increasing demand as you continue to, how factories will become more technological. So these actions can be taken with an eye to the long term..

Remember Usla. The company pays 3,04 $ dividends per share per year is about 1,85% per annum. It's not very much, but much larger than the average S&P 500 in 1,3% per annum. So with an eye to the long-term development of this business – dividends "above the hospital average" will be a good argument for many investors..

Social justice wars. Eaton invests heavily in environmental and social initiatives at its facility: from reducing energy costs and recycling waste to inclusivity in the workplace. Much more important, that the company trumpets this to the whole world. Considering, that ESG investing is taking over the world, this may contribute to the influx of ethical investors into the company's shares.. Yet again, "There are electric cars here". The effect of ESG is seen even more, than from dividend lovers. Also, given the ethics sticker, can be expected for the company indirect bonuses: easy access to loans and other interesting things.

What can get in the way

Through this fog they come along — dark creatures singing a terrible song. A significant amount of the company's production capacity is located outside the United States, and exports play an important role in its revenue.. In this regard, it is worth fearing the growth of logistics costs and other costs., related to delivery. You should also mentally prepare for the increase in raw materials and labor costs..

Quarantine is not your friend. The company's business has survived the quarantine 2020, but not without loss. If large-scale quarantine repeats, then it will have a bad effect on the business.

Too much growth. Over the past two years, Eaton's shares have surged by almost 2 times - but financial indicators did not grow so much, to justify such growth. Stocks are currently trading near all-time highs and P / E the company has, albeit not the largest, but not the smallest — 34,86. So Eaton shares will be vulnerable to a possible correction.

Payouts. The company pays for dividends 1,219 billion dollars a year - approximately 64,49% from her profits for the past 12 Months. At the same time, it has a very large amount of debt.: about 21,3 billion dollars, out of which 8,9 billion needs to be repaid within a year.

The company doesn't have a lot of money.: 279 million in accounts and 3,341 billion of counterparties' debts. She is also preparing to sell assets for 2,604 billion. Here it is quite possible to fear the reduction of payments and the subsequent fall of shares.. In the long run, big debt is not good either.. Certainly, hopefully, that the ESG agenda will help the company refinance all loans at a sane interest rate even after raising rates, but it is better to take this point into account.

What is the bottom line with ETN

You can take shares now by 163,7 $. And then there are two ways:

- wait, when stocks exceed historic highs and begin to cost 185 $. Think, that we will reach this level in the next 14 Months;

- hold shares 10 years, receiving dividends and looking, how Eaton becomes a beneficiary of the modernization of the American economy.

I also advise you to look at the news section on the company's website - to get rid of the shares before, how the market will react to the reduction or cancellation of dividends, and then pick them up after the fall.